Chinese AI firm DeepSeek could be facing major setbacks in developing and releasing its next large language model, known as R2, due to tightening U.S. export controls on Nvidia’s (NVDA) most advanced chips. Indeed, according to The Information, the company’s current models are heavily optimized for Nvidia’s hardware, especially the H20 chip, which was previously the most powerful AI chip legally available to China. However, a new U.S. ban on the H20 has created a supply crunch that is leaving DeepSeek and its partners scrambling for alternatives. As a result, this shortage is expected to slow the adoption of R2, particularly within China, where demand for AI models is growing rapidly.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is worth noting that DeepSeek has not yet set a launch date for R2, as CEO Liang Wenfeng is reportedly unsatisfied with the model’s current performance, and engineers are still refining it before release. Internally, the company has been working closely with major Chinese cloud providers by sharing technical specifications to help them prepare for R2 deployment. But the ability of these cloud platforms to meet demand is uncertain, as most customers using DeepSeek’s previous model, R1, rely on the now-restricted H20 chips.

While companies like Huawei offer domestic alternatives to Nvidia chips, DeepSeek’s models are so closely tied to Nvidia’s hardware and software ecosystem that switching would significantly reduce performance and efficiency. In fact, R1’s success earlier this year led to a surge in orders for H20 chips from tech giants like ByteDance, Alibaba (BABA), and Tencent (TCEHY), who spent $16 billion on 1.2 million chips in early 2025. With no further H20s available, Chinese firms have resorted to using gaming GPUs like the RTX 4090, which are also restricted but more easily accessible on the black market. For now, R2’s success may depend on how long China’s current H20 supply can hold out.

What Is a Good Price for NVDA?

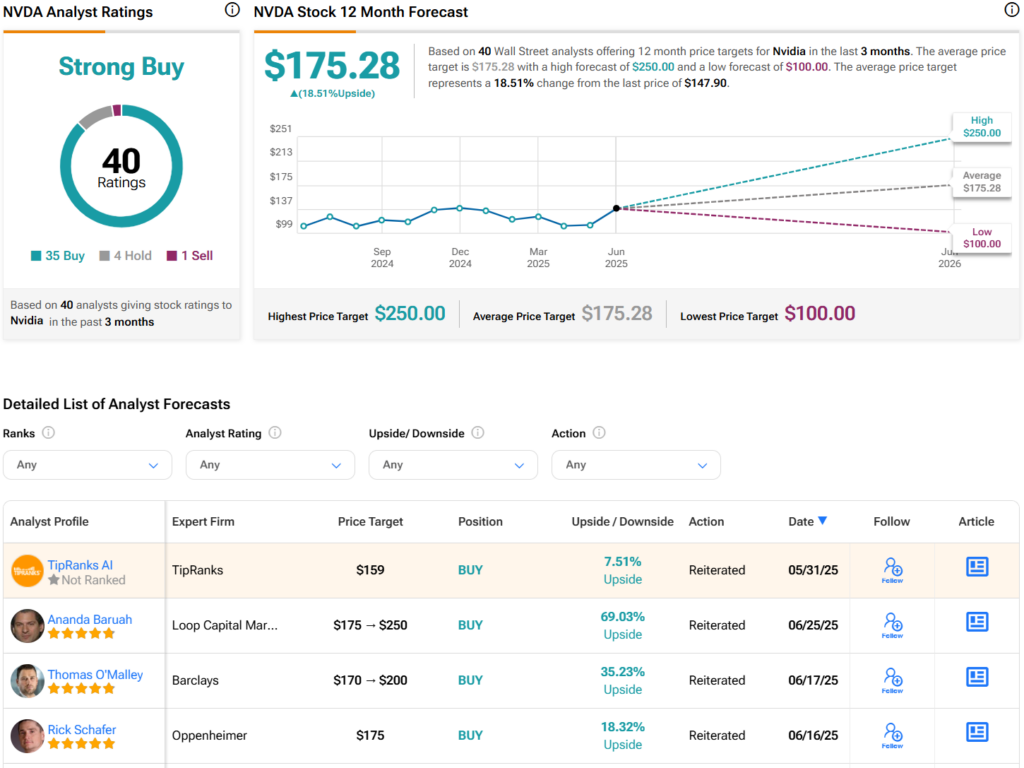

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 35 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $175.28 per share implies 18.5% upside potential.