Dollar Tree (DLTR) stock has dropped significantly after its Q2 FY24 results and further declines are possible in the near term. Even though the company’s CEO Rick Dreiling reassured investors, I’m bearish on DLTR stock due to its disappointing quarterly results and a bleak full-year outlook.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Dollar Tree operates a chain of retail stores specializing in low-priced items, often priced at just $1.25. While this might suggest the company benefits from inflation by attracting budget-conscious shoppers, that’s not necessarily the case. Despite Dreiling’s optimistic spin on the quarterly performance, investors should carefully review the facts and examine Dollar Tree’s less-than-encouraging earnings outlook.

DLTR Struggles Despite CEO’s Cheerful Chatter

Dreiling served up some glass-half-full commentary in the wake of the company’s second-quarter report for Fiscal year 2024. However, a closer look at the facts indicates that Dollar Tree’s financial health is far from ideal. Analyzing the company’s financials supports the thesis that DLTR stock may have further room to decline in the near term.

Following Q2 results, Dreiling stated that he is “encouraged by the continuous progress in the transformation at Dollar Tree and Family Dollar.” He also highlighted that Dollar Tree’s customers are reacting favorably to the introduction of its expanded multi-price offerings.

Peeking into results, Dollar Tree Segment saw a 1.3% year-over-year increase in net same-store sales in the second quarter of FY24. But, the average ticket (i.e., purchase size per transaction) for this segment actually dropped by 0.1%. The key takeaway is that while Dollar Tree stores attracted a good amount of foot traffic, shoppers spent less during their visits.

Having said that, it’s worth noting that the Family Dollar Segment experienced a 0.1% decline in net same-store sales, indicating that not all segments of the company showed improvement. Moreover, highlighting only the same-store sales growth in one segment could present a misleading view of the overall performance.

Why Did Dollar Tree Stock Plummet?

After Q2 results, Dollar Tree stock plunged over 20% on Wednesday, falling under $65 from a high point of $150 earlier this year. Clearly, the company’s sub-par quarterly results and disappointing full-year guidance triggered a market sell-off. These results and guidance reinforce my belief that DLTR stock is vulnerable to further declines.

Dollar Tree’s modest growth in same-store sales for its Dollar Tree Segment wasn’t enough to prevent a tough earnings event. Investors sold off their shares after the company reported just 0.7% year-over-year sales growth and $7.37 billion in revenue, falling short of the analysts’ consensus estimate of $7.49 billion. Moreover, Dollar Tree’s adjusted operating income slumped 24.2% year-over-year to $218.1 million. Meanwhile, the company’s adjusted earnings crashed 26.4% to $0.67 per share, falling short of Wall Street’s consensus earnings prediction of $1.04 per share.

Dollar Tree Cuts FY24 Outlook

Next, we need to consider Dollar Tree’s revised guidance, which also contributed to the sharp drop in DLTR stock on Wednesday. This update should make potential investors reconsider before buying the stock.

Dollar Tree has significantly reduced its full Fiscal year 2024 earnings guidance to $5.20-$5.60 per share, down from the previous range of $6.50-$7 per share. This substantial cut undermines Dreiling’s optimistic view of the company.

Additionally, the company lowered its net sales forecast to between $30.6 billion and $30.9 billion for FY24, down from the prior range of $31 billion to $32 billion. The company also anticipates low-single-digit comparable net sales growth across both the Dollar Tree and Family Dollar segments.

Is Dollar Tree Stock a Buy, According to Analysts?

On TipRanks, DLTR stock comes in as a Moderate Buy based on 10 Buys, 10 Holds, and one Sell rating assigned by analysts in the past three months. The average Dollar Tree stock price target is $120.95, implying an upside potential of 90.3%.

Year-to-date, DLTR stock has lost 55.4%.

See more DLTR analyst ratings.

TipRanks Highlights Best Analysts for Dollar Tree Stock

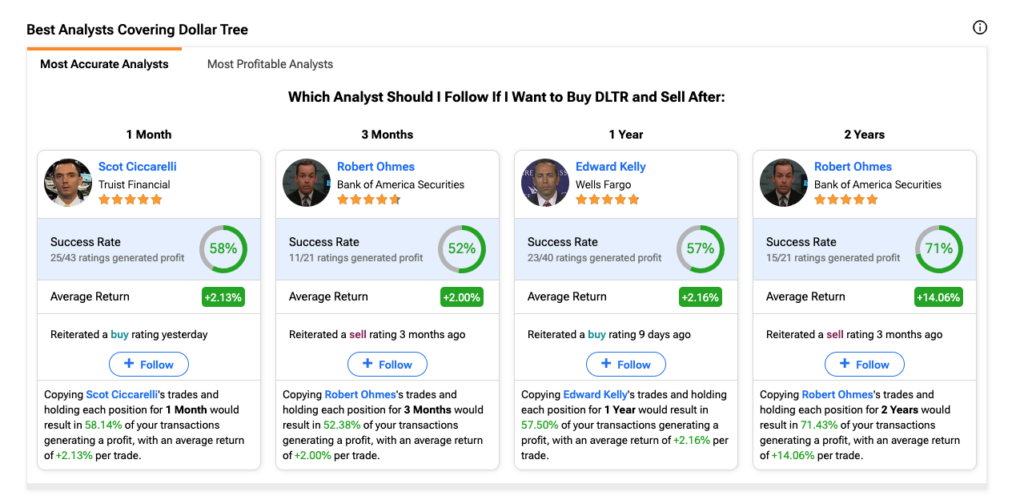

If you’re looking for guidance on buying and selling DLTR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Edward Kelly of Wells Fargo. He has an average return of 2.16% per rating and a 57% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Dollar Tree Stock?

Dreiling sought to assuage investors, but he couldn’t prevent a share-price sell-off as Dollar Tree’s top-line and bottom-line misses were hard to ignore. While it’s typical for a CEO to cast financial results in a favorable light, investors should do their own research and make independent judgments.

In addition, Dollar Tree’s significant reduction in earnings guidance appears to contradict the CEO’s optimistic comments. As a result, it’s not surprising that short-term traders might continue to penalize the stock, and at this point, I wouldn’t consider buying DLTR shares.