Shares of Deckers Outdoor (DECK) dropped over 16% in after-hours trading as the company’s weak annual guidance failed to impress investors. The footwear giant, known for brands like UGG and HOKA, increased its full-year revenue projection to $4.9 billion, below the consensus estimate of $4.93 billion. Drake MacFarlane, an analyst at MScience, stated that the guidance seems overly cautious considering Deckers’ strong Q3 performance, hinting at a slightly bearish outlook for the upcoming quarter.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Deckers owns famous brands like UGG, HOKA, and Teva.

Deckers Beat Q3 Estimates on Strong Holiday Sales

Deckers Outdoor’s third-quarter revenue grew 17% year-over-year to $1.83 billion, beating analysts’ average estimate of $1.73 billion, according to LSEG data. Meanwhile, operating income increased to $567.3 million compared to $487.9 million a year ago.

The Q3 performance was mainly driven by strong holiday demand for its popular HOKA running shoes. Notably, HOKA brand net sales rose 23.7% to $530.9 million in Q3, compared to $429.3 million in the same quarter last year. Moreover, UGG brand sales grew by 16.1%.

Overall, the growing popularity of HOKA shoes, along with the success of its UGG boots and sandals, has contributed to double-digit revenue growth for the company for nearly seven consecutive quarters. Interestingly, the company’s HOKA shoes, known for oversized soles, have been capturing market share from competitors like Nike (NKE) in the sportswear sector. Despite their bulky and heavy appearance, HOKA sneakers have gained a devoted fan base, contributing to its brand value.

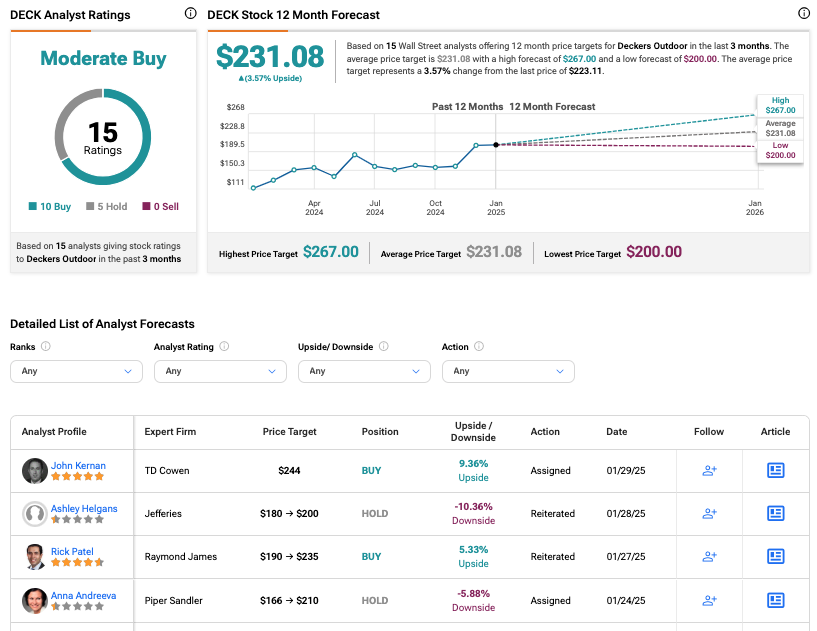

Is Deckers Outdoor a Good Stock to Buy?

As per the consensus rating on TipRanks, DECK stock has received a Moderate Buy rating, based on 10 Buy and five Hold recommendations. The Deckers Outdoor share price forecast is $231.08, which is 3.6% above the current trading level. These ratings could change after the company’s Q3 results.