Aerospace stock Boeing (BA) is a name to conjure with in the industry. It is one of the biggest names around in aircraft, but that primacy might be threatened by one of its biggest competitors in the space. Airbus (EADSY) just made a move that is about to shut down a record that Boeing has held for decades, and investors did not take the news well at all. In fact, Boeing shares lost over 2% in Monday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reports note that Airbus A320 deliveries are about to outpace Boeing 737 deliveries, which would make the Airbus A320 the “…world’s most-delivered commercial jet.” Airbus has been routinely outpacing Boeing in deliveries, especially with the Federal Aviation Administration’s (FAA) production cap still in place on Boeing’s operations. And that gradual outpacing has built into a cumulative result that might make the former plucky competitor a major name in its own right.

It certainly did not help matters for Boeing that the A320neo delivered on an exciting new proposition: an aircraft that was 20% more fuel efficient while also offering reduced fuel emissions against its Boeing counterpart. Throw in the lack of any large-scale disruption at Airbus, and the ability to quietly produce over a long period, and that was all Airbus needed to make a serious play for first place.

A New Harpoon

Thankfully, Boeing has more than just 737 aircraft going on, and Boeing made that point explosively clear recently with new tests on the redesigned Harpoon Block II Update anti-ship missile. This line of missiles has been in operation since 1977, reports note, and is still in use in aircraft, submarines, and surface-launched applications.

New reports suggest that the improved Harpoon will offer “…a near-total redesign…” which includes “…new hardware, software, and fuel to improve performance and lethality.” Getting the Block II Update model up and running required multiple divisions—Boeing Test & Evaluation, Cruise Missile Systems, and more—to work together with the United States military to produce a new and powerful weapon that could be the cornerstone of Boeing’s military operations.

Is Boeing a Good Stock to Buy Right Now?

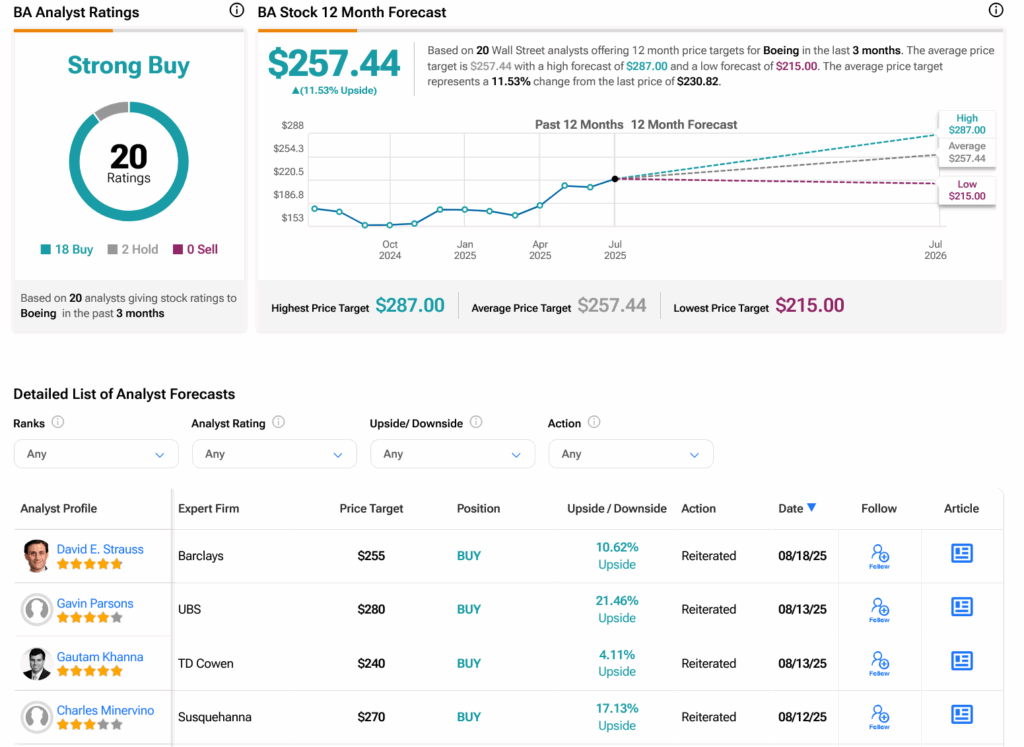

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 19 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 29.56% rally in its share price over the past year, the average BA price target of $257.05 per share implies 9.14% upside potential.