The tide has turned for U.S. megabanks. Today’s banking landscape is being propelled by a reopened deal pipeline, resilient consumer spending, and the possibility of more lenient capital requirements. Meanwhile, the Fed is being slowly drawn into delivering the dovish policy the markets are clamoring for.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

This week’s flood of Q3 earnings—from eight major U.S. banks—offers a revealing snapshot of the sector’s strength. Simply put, the big banks haven’t looked this robust since before the 2008 financial crisis. Some analysts even point to trillion-dollar tailwinds that could give these financial powerhouses even greater room to maneuver.

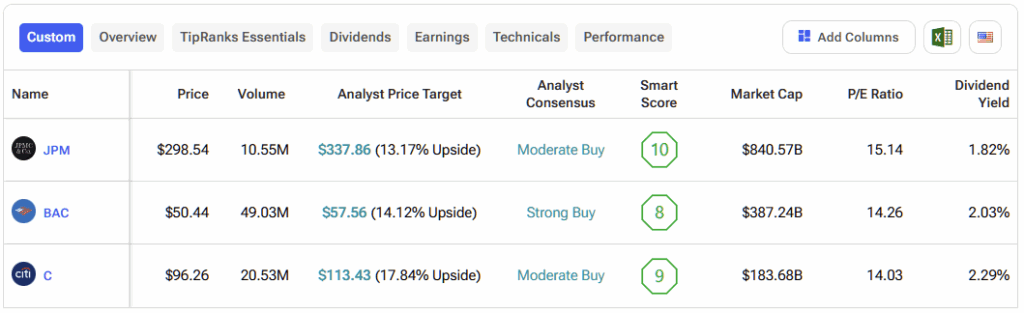

From an investment perspective, my attention turns to JPMorgan (JPM) for its unmatched markets engine and fortress balance sheet, Bank of America (BAC) for its operating leverage as net interest income (NII) accelerates, and Citigroup (C) for its meaningful progress in simplification—and its surprisingly compelling technology story.

JPMorgan Chase (NYSE:JPM)

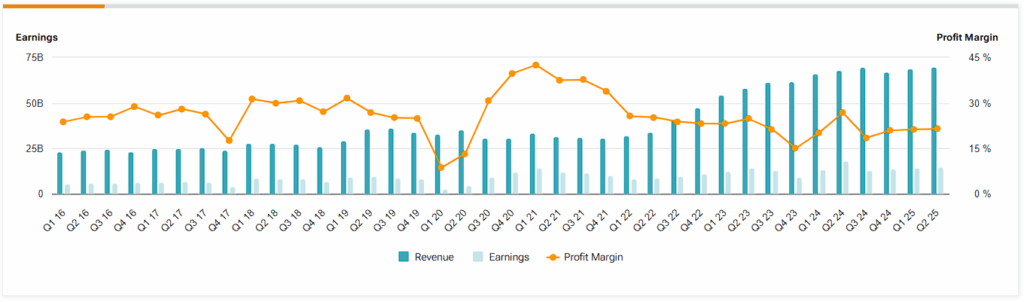

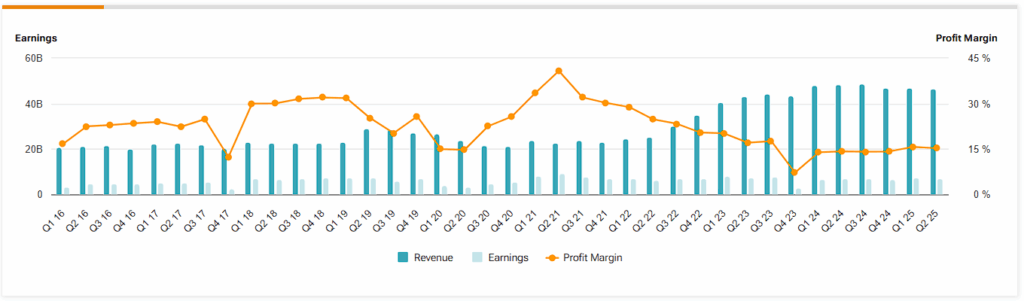

JPM’s third quarter read like a reminder of why scale matters when volatility and deal flow return. Markets revenue hit a third-quarter record (~$8.9 billion), with equities up an eye-catching 33%, while investment-banking fees rose 16%. This is evidence that the pipeline is unclogging across ECM and M&A. The bank boosted full-year NII guidance higher again, a quiet vote of confidence in balances and deposit mix. Add the $8 billion of buyback spending during the period, and it’s hard not to be bullish on the most powerful bank in the world.

Of course, Jamie Dimon once again played designated worrier, as he flagged “elevated asset prices,” took a $170 million hit tied to the Tricolor bankruptcy, and warned of roaches you don’t see yet.

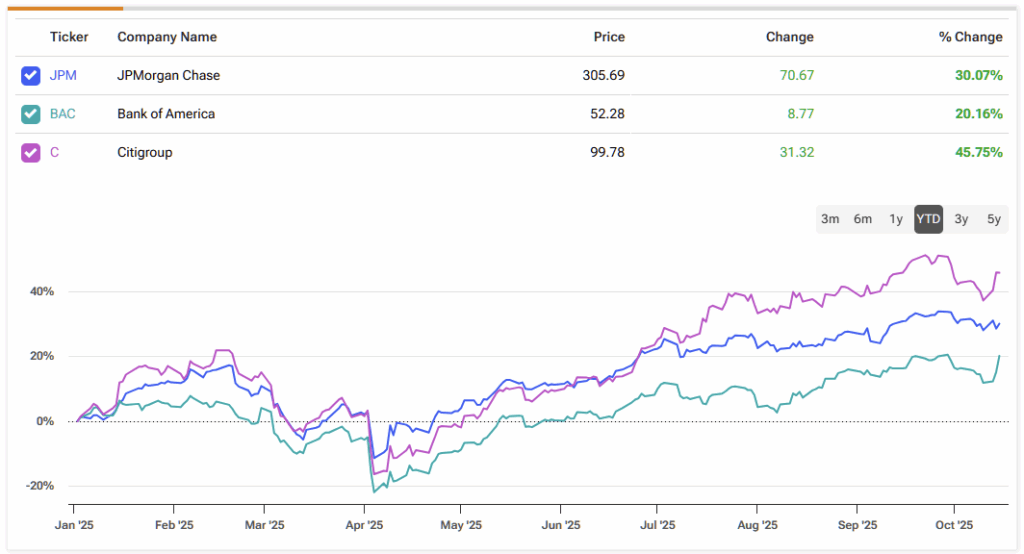

But this is the sort of risk management muscle I want to see from such a large institution. In the meantime, at 15x this year’s expected EPS, I don’t see how JPM is “expensive” even following its 40% YoY share price rally. With increased deal activity, a robust payments/wealth mix, and ample capital to deploy if regulators continue to ease the Basel “endgame” regulations, JPM remains an attractive investment opportunity and a bellwether for the U.S banking system.

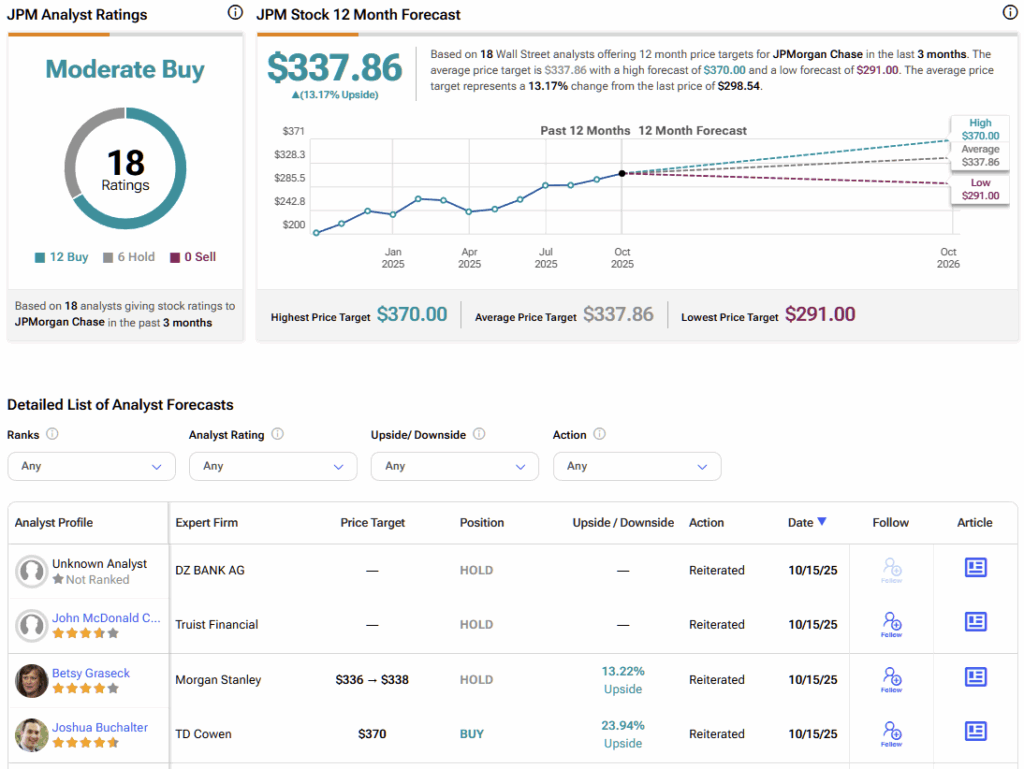

Is JPMorgan Chase Stock a Buy, Hold, or Sell?

Analyst sentiment seems bullish on JPMorgan, with the stock carrying a Moderate Buy consensus rating, based on 12 Buy and six Hold ratings assigned over the past three months. No analyst rates the stock a Sell. Further, JPM’s average stock price target of $337.86 implies ~13% upside potential over the next twelve months.

Bank of America (NYSE:BAC)

BAC finally got a quarter that changes the conversation. Management lifted Q4 NII guidance to ~$15.6–$15.7 billion (8% YoY), and investment-banking fees leaped 43% to $2 billion as corporates rediscovered their appetite for mergers and financings.

The consumer pulse showed steady employment and solid wage growth, which helped card volumes and deposits perform well. This is classic BAC: a broad, steady banking machine that thrives when the economic cycle stops working against it.

The stock has trailed peers this year, which is why sentiment can run up if execution holds. I see two near-term props following the earnings release. First, the self-help from balance-sheet positioning (that NII guide) and an Investor Day on November 5, where capital returns and expense discipline should take center stage. If markets keep underwriting windows open, I feel that BAC’s earnings power is under-appreciated relative to the narrative.

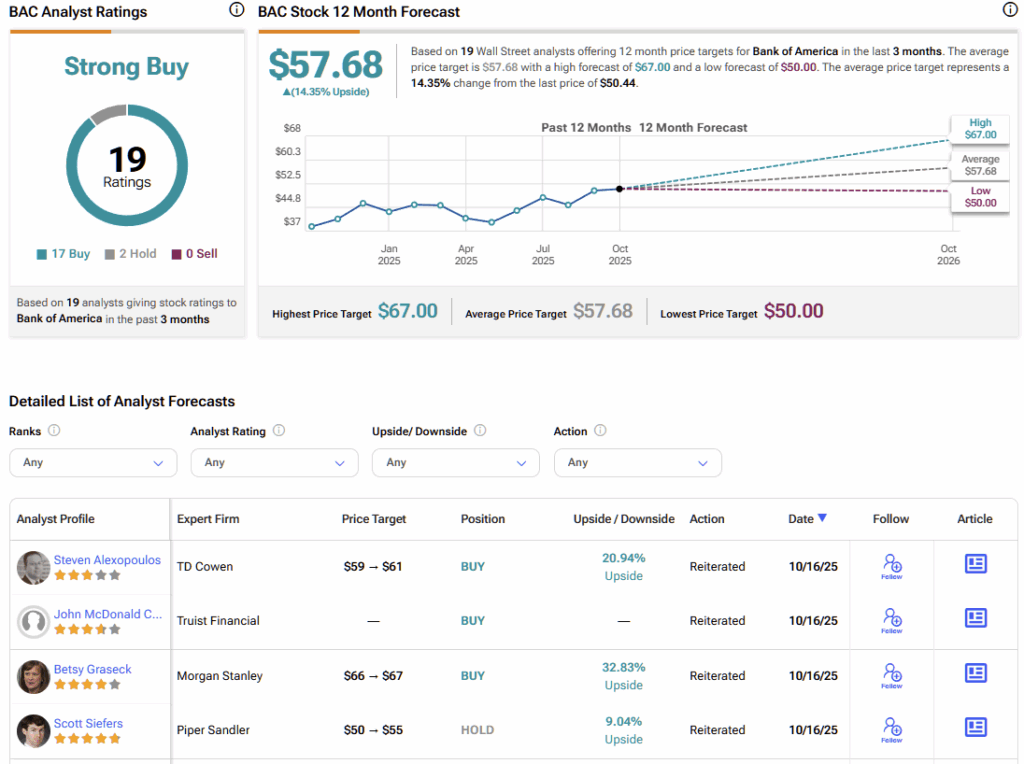

Is Bank of America Stock a Good Buy?

On Wall Street, BAC stock features a Strong Buy consensus rating, based on 17 Buy and two Hold ratings. As with JPM, not a single analyst rates BAC stock a Sell. Moreover, BAC’s average stock price target of $57.68 implies 14% upside potential over the next 12 months.

Citigroup (NYSE:C)

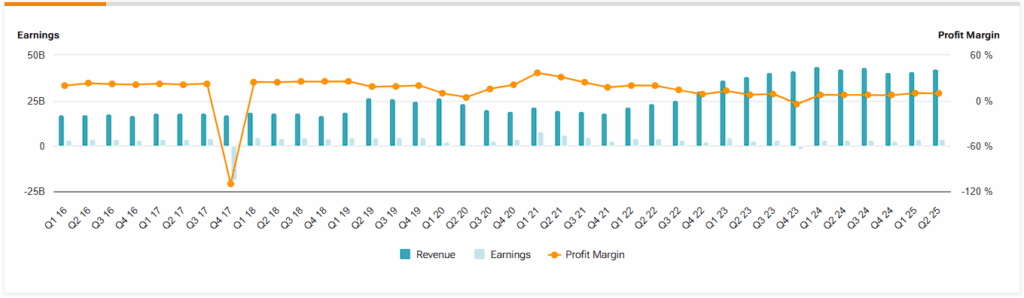

Citi’s quarterly results told a clear story of strength, with every operating segment posting record Q3 revenue. Banking surged 34%, Markets climbed 15%, and Services delivered its best quarter ever. Capital returns were equally impressive, totaling about $6.1 billion through buybacks and dividends, while progress on the Banamex strategy continued with an agreement to sell a 25% stake. The strong momentum has fueled investor optimism, pushing shares up 60% year over year.

A more intriguing angle lies in technology. CEO Jane Fraser noted that Citi’s internal AI tools are freeing up roughly 100,000 developer hours each week—capacity that can now be redirected toward controls, onboarding, or speeding up product development. Combined with a rebound in deal activity, that efficiency boost suggests the results could keep gaining momentum over the next few quarters. While management did caution about pockets of “froth,” their strong execution continues to earn them the benefit of the doubt.

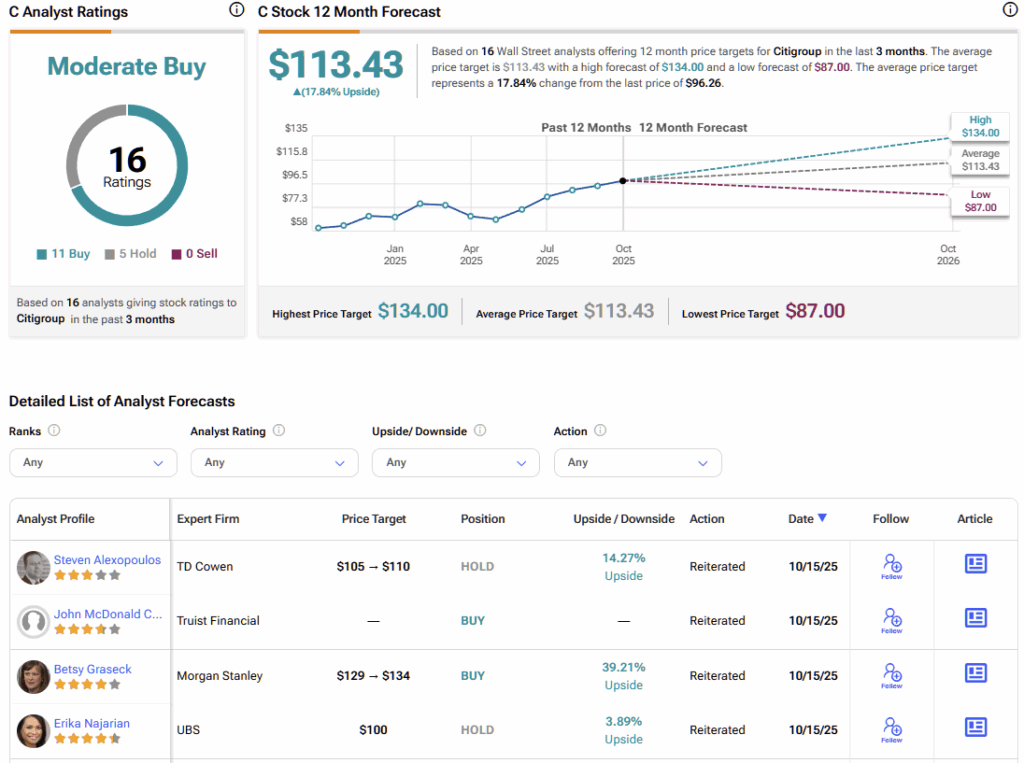

Is Citigroup a Buy, Hold, or Sell?

Citigroup is now covered by 16 Wall Street analysts, and sentiment is somewhat bullish. The stock carries a Moderate Buy consensus driven by 11 Buy and five Hold ratings. And again, no analyst rates the stock a Sell. In the meantime, Citigroup’s average stock price target of $113.43 indicates ~18% upside potential over the next twelve months.

Big Banks Back in Form

I’m firmly Bullish on the big banks. And while I’m keeping my seat belt fastened—given that several of these names have already enjoyed extended rallies—further upside doesn’t look out of reach.

JPMorgan remains the clear leader, Bank of America could be the quiet outperformer if net interest income trends higher, and Citi finally resembles a sharper, more focused institution with a genuine tech advantage. Sure, margins can compress, regulations can shift, and credit can weaken—but for now, these banks look stronger than they have in years.