Deere (DE) stock fell on Wednesday after the farm equipment manufacturing company posted its earnings report for its Fiscal fourth quarter of 2025. The company reported diluted earnings per share of $3.93, which was above Wall Street’s estimate of $3.84 for the quarter. However, it also represented a 13.6% drop year-over-year from $4.55 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue reported by Deere in Fiscal Q4 came in at $12.39 billion, which was better than analysts’ estimate of $9.83 billion. The company’s revenue also grew 11% year-over-year from $11.14 billion. Deere Chairman and CEO John May said this was possible thanks to the company’s structural improvements and the diverse customer segments and geographies that it serves despite “challenges and uncertainty” over the past year.

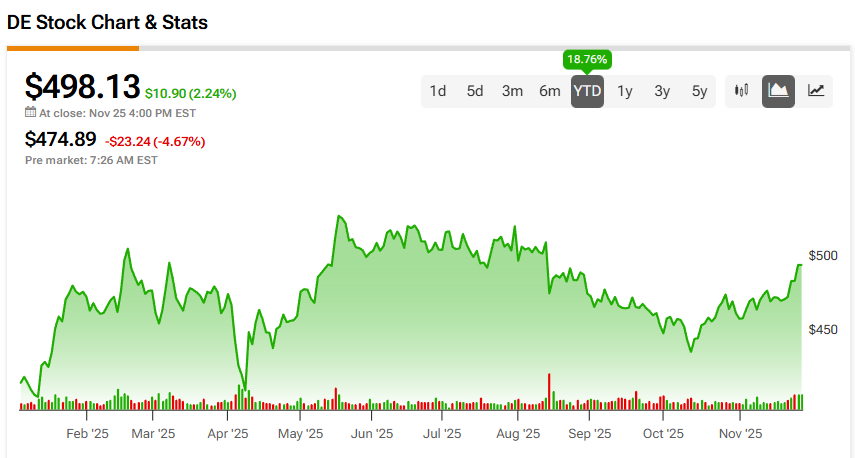

DE stock was down 4.67% in pre-market trading on Wednesday, following a 2.24% rally yesterday. The stock has increased 18.76% year-to-date and 6.89% over the past 12 months.

Deere Outlook Disappoints Investors

Even with its strong Fiscal Q4 results, Deere still cautioned investors that the worst for the agriculture industry isn’t over yet. May noted, “We believe 2026 will mark the bottom of the large ag cycle,” and that the company will face “ongoing margin pressures from tariffs and persistent challenges in the large ag sector.”

Deere expects net income in 2026 to range from $5 billion to $4.75 billion, compared to the $5.027 billion reported in 2025. It also estimates that Production & Precision Ag revenue will fall 5% to 10%, while Small Ag & Turf and Construction & Forestry revenues will increase about 10%.

Is Deere Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Deere is Moderate Buy, based on seven Buy and five Hold ratings over the past three months. With that comes an average DE stock price target of $515.58, representing a potential 3.5% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after the company’s earnings report.