Datadog (NASDAQ:DDOG) shares jumped nearly 25% in the pre-market session today after the cloud application monitoring and security platform’s third-quarter EPS of $0.45 landed past expectations by $0.11. Additionally, revenue increased by a healthy 25.4% year-over-year to $547.54 million, outpacing estimates by $22.8 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s number of large customers with annualized recurring revenue (ARR) of $100,000 or more increased to 3,130 from 2,600 in the year-ago period. Impressively, operating cash flow during the quarter rose to $152.8 million and its total cash pile ballooned to $2.3 billion at the end of September.

Looking ahead to Fiscal year 2023, Datadog expects EPS to be in the range of $1.52 to $1.54 on an anticipated revenue range from $2.103 billion to $2.107 billion. For the upcoming quarter, the company expects revenue to hover between $564 million and $568 million. EPS for the quarter is seen landing between $0.42 and $0.44.

Is Datadog a Buy, Sell, or a Hold?

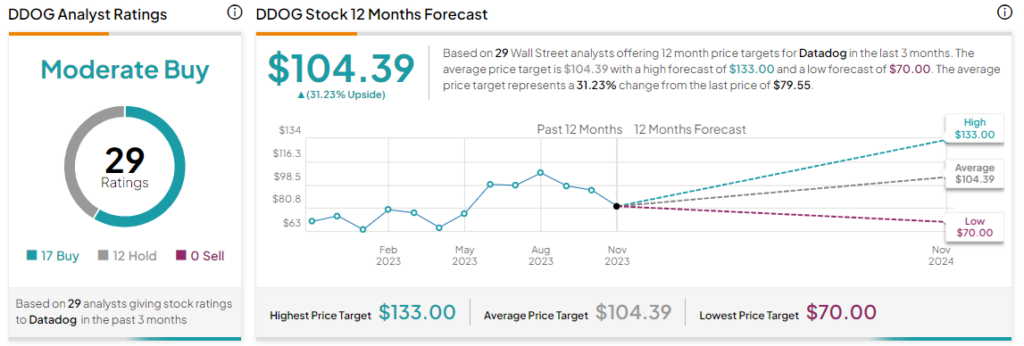

Overall, the Street has a Moderate Buy consensus rating on Datadog. After a nearly 14.5% rise in the company’s shares over the past year, the average DDOG price target of $104.39 implies a substantial 31.2% potential upside in the stock.

Read full Disclosure