Seagate Technology (STX), one of the world’s leading data storage companies, has emerged as a major beneficiary of the AI boom, driven by accelerating enterprise demand for hard disk drives (HDDs). While the consumer storage market is now largely dominated by solid-state drives (SSDs), HDDs have reasserted their relevance in data centers due to their superior cost efficiency at scale.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

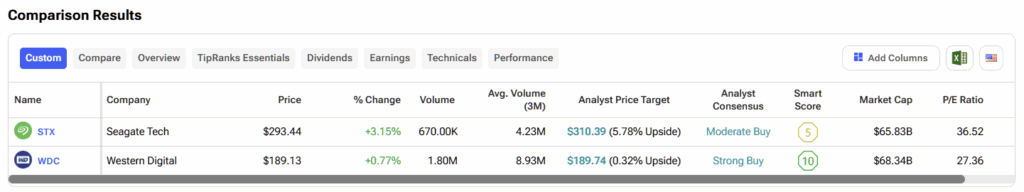

Seagate represents a pure-play investment in the growth of HDD usage in enterprise and hyperscale environments, as the company remains almost entirely focused on HDDs. In contrast, its closest competitor, Western Digital Corporation (WDC), maintains a hybrid strategy across both HDDs and SSDs. I am bullish on Seagate’s outlook and believe the company is attractively positioned at a forward P/E multiple of approximately 28x, particularly as its earnings growth is expected to accelerate meaningfully.

Seagate Benefits From Favorable Industry Trends

A key pillar of my bullish stance is Seagate’s positioning within several favorable long-term industry trends. According to Mordor Intelligence, the global HDD market was valued at approximately $52.8 billion by the end of 2025 and is expected to grow at a compound annual growth rate (CAGR) of 6.12% through 2031, reaching roughly $70 billion. While this growth rate may appear modest, it represents a notable inflection point for an industry that had experienced years of stagnation due to the rapid adoption of SSDs.

Importantly, the enterprise segment is driving this resurgence. Mordor Intelligence estimates that enterprise HDD demand will grow at a CAGR of 9.52% through 2031, driven by hyperscalers’ aggressive data center investments. AI workloads—particularly image and video generation—are dramatically increasing storage requirements. Industry estimates suggest that a single minute of AI-generated video may require nearly 20,000 times as much data as a comparable text output. As leading AI platforms expand deeper into video generation, data center operators are racing to secure large-scale, cost-effective storage capacity.

With an estimated 40% share of the global HDD market, Seagate is well-positioned to be a primary beneficiary of this expanding demand.

Seagate’s Revival Represents Structural Improvements

The bullish contingent is also hailing STX’s recent progress. Seagate’s financial revival appears to be driven by structural and fundamental improvements rather than a purely cyclical rebound. The enterprise storage market is increasingly focused on minimizing cost per terabyte, a critical metric for hyperscalers operating at enormous scale. Based on industry data, enterprise SSDs currently cost roughly five to six times more per terabyte than enterprise HDDs, reinforcing HDDs’ economic advantage.

Seagate’s Heat-Assisted Magnetic Recording (HAMR) technology has been instrumental in lowering the total cost of ownership for customers. The company’s Mozaic 3+ drives have already been qualified by five global cloud service providers, validating both the technology and its commercial readiness. Seagate is now ramping production of its Mozaic 4+ drives, which are expected to exceed 40 TB in capacity. These drives allow hyperscalers to nearly double storage density without investing in additional physical infrastructure.

This technological leadership is translating into tangible financial results. Following sharp revenue declines of 37% and 11% year over year in fiscal 2023 and 2024, respectively, Seagate delivered a strong fiscal 2025, with revenue rising 39% to $9.09 billion. Margin performance has been equally impressive. In fiscal Q1 2026 (ended October 2025), gross margins reached a record 40.1%, while operating margins climbed to 29%, the highest level since 2012. Reflecting tight industry supply and strong pricing power, management disclosed that Seagate has secured build-to-order contracts covering the majority of its production capacity through the end of 2026.

Seagate is Investing Aggressively to Capture Market Share

Beyond favorable market conditions, Seagate’s capital allocation strategy further supports the bull case. Rather than expanding its manufacturing footprint, the company is prioritizing efficiency gains by retrofitting existing production lines to support HAMR technology. This approach aligns well with the industry’s shift toward higher-capacity drives rather than higher unit volumes.

Management has also outlined plans to introduce Mozaic 5+ drives with capacities exceeding 50 TB by 2028. If successfully executed, this roadmap should reinforce Seagate’s competitive moat and strengthen its market share in the enterprise HDD market.

Is Seagate Technology a Buy, Hold, or Sell?

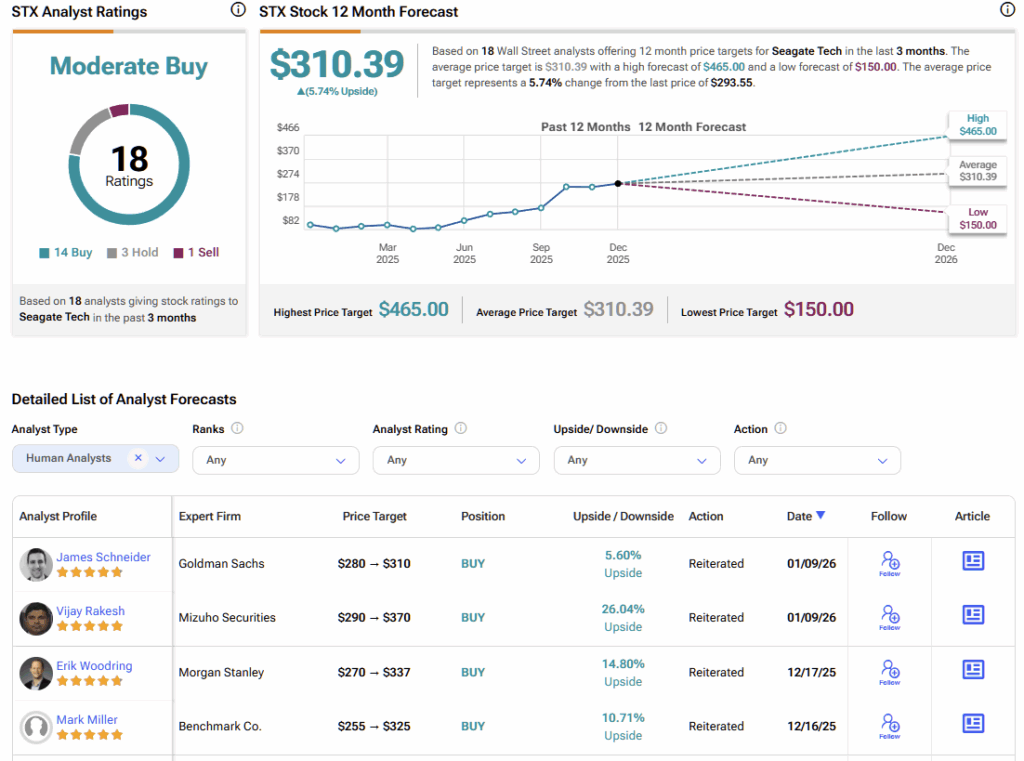

On Wall Street, STX stock carries a Moderate Buy consensus rating based on 14 Buy, three Hold, and one Sell ratings over the past three months. STX’s average stock price target of $310.39 implies approximately 5% upside potential over the next twelve months.

However, given Seagate’s strong positioning, accelerating earnings growth, and exposure to secular demand for data center and AI infrastructure, I believe initiating or maintaining a position at current valuation levels remains an attractive way to gain long-term exposure to this theme.

Seagate’s Enterprise HDD Strategy Set to Shine

Seagate Technology is exceptionally well positioned to benefit from the growing demand for enterprise HDD solutions. As one of the clear market leaders alongside Western Digital, the company has emerged from the cyclical downturn of fiscal 2023 and 2024 with stronger margins, improved pricing power, and a compelling technology roadmap. While analyst consensus points to fair valuation today, I believe Seagate’s structural advantages and earnings growth potential offer investors the opportunity for attractive long-term returns.