The online food ordering and delivery company DoorDash (NASDAQ:DASH) discussed acquiring Deliveroo (GB:ROO) last month, Reuters reported. However, the talks ended without an agreement due to valuation concerns. Nevertheless, it highlights the company’s intent to bolster its market position through acquisitions.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Deliveroo is a British food delivery company. It has seen a decline in its stock value over the past three years. This has driven its valuation lower. Moreover, its revenue take rate is stabilizing, and gross transaction value is increasing. These attributes make Deliveroo an attractive target for acquisition.

DoorDash Eyes International Expansion

DoorDash is leveraging its strong financial position to expand globally. DoorDash had cash and cash equivalents of $3.12 billion as of March 31. Moreover, on a trailing 12-month basis, it generated a free cash flow of $1.52 billion.

With a substantial cash reserve, DoorDash is well-positioned to expand itself in international markets. The company currently has a presence in 25 countries. In 2022, the company acquired Wolt Enterprise, expanding its international footprint.

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on DASH stock expect it to benefit from its growing market share in the international market. With this backdrop, let’s look at the Street’s average price target and consensus rating for DASH stock.

Is DoorDash Stock a Buy?

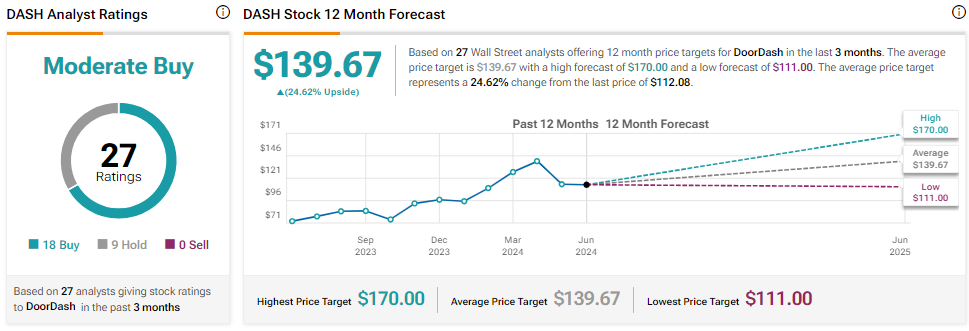

DoorDash stock is up about 52.3% over the past year, reflecting increased users on its platform and growing order frequency. DASH stock has received 18 Buys and nine Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average DASH stock price target of $139.67 implies 24.62% upside potential.