Ace hedge fund manager Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made notable portfolio adjustments on Monday, October 6, according to the firm’s daily disclosures. The trades highlight ARK’s strategy of doubling down on key growth names in e-commerce, automation, and defense technology while trimming positions in biotech and aerospace plays.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Wood Boosts Bets on DoorDash, Deere, and Alibaba

ARK’s biggest move of the day was a $6.9 million purchase of DoorDash (DASH) through the ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Space Exploration & Innovation ETF (ARKX). The food-delivery company has been a key beneficiary of rising demand for online ordering, and Wood’s latest buy signals growing confidence in its growth outlook and expanding logistics network.

In another notable trade, ARK increased its stake in Deere & Co (DE), buying 7,274 shares worth about $3.37 million through ARKQ. The agricultural machinery maker has been a recurring addition to ARK’s funds in recent weeks, aligning with the firm’s conviction in automation and precision farming.

ARK also bought 4,449 shares of Alibaba Group (BABA) for about $836,545 through the ARK Innovation ETF (ARKK), taking another step in building its stake in the Chinese online retail giant. Additionally, the firm expanded positions in L3Harris Technologies (LHX) and MercadoLibre (MELI), investing roughly $5.8 million and $3.8 million, respectively. In genomics, ARKG purchased 19,875 shares of GeneDx Holdings (WGS) valued at $2.35 million, reinforcing its interest in next-generation health innovation.

ARK Reduces Exposure to Adaptive and AeroVironment

On the sell side, ARK cut its stake in Adaptive Biotechnologies (ADPT), selling 180,169 shares from the ARK Genomic Revolution ETF (ARKG) worth $2.59 million. The move may show caution toward short-term swings in the biotech space.

ARK also reduced its holding in AeroVironment (AVAV), a drone maker, selling 13,969 shares through ARKQ and ARKX ETFs for $5.23 million. Smaller cuts were made in Kratos Defense (KTOS), Rocket Lab (RKLB), and Brera Holdings (SLMT), with total proceeds of more than $11 million.

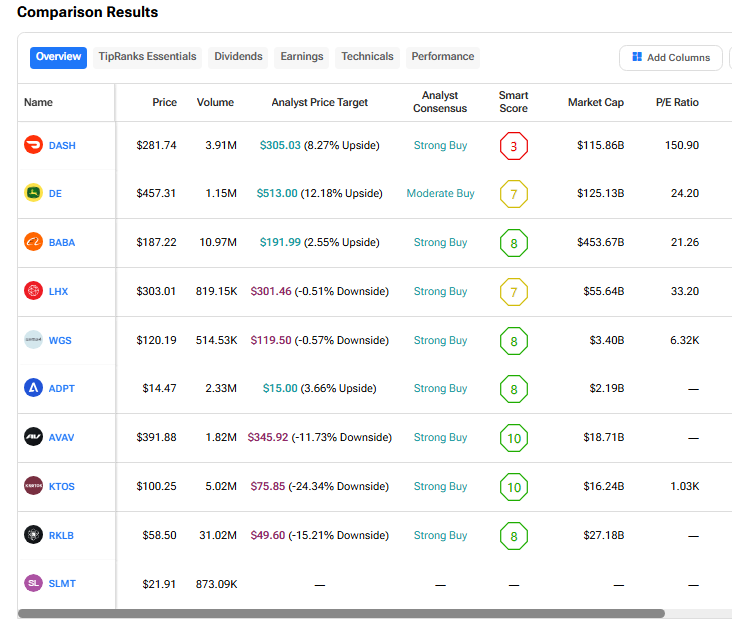

Here’s how all of the above stocks perform on TipRanks’ Stock Comparison Tool: