News of Elon Musk’s latest move broke on Monday, and it didn’t take long for Wall Street to react. A regulatory filing showed that the Tesla (NASDAQ:TSLA) chief had snapped up about 2.57 million shares, spending nearly $1 billion in the process. The disclosure triggered an immediate rally, with Tesla stock jumping about 6% as of this writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That sense of commitment is exactly what Tesla’s board has been trying to secure. For better or for worse, Tesla has taken a bold move to keep CEO Elon Musk onboard and fully engaged. The company’s Board of Directors has crafted an exceptionally large incentive package, one that could be worth $1 trillion if Musk can successfully achieve numerous benchmarks in the years ahead.

While shareholders will still need to approve this new arrangement, it is clear that the board is keen to ensure that Musk is all-in on the autonomous opportunities that are beckoning – chiefly full self-driving and autonomous robots.

After falling for the first few months of 2025, Tesla stock is now up 6% year-to-date. Slipping EV sales and deliveries marred the company’s performance in the early going, as Musk’s political affiliations turned off many a would-be Tesla consumer. However, the share price has waged a comeback during the spring and summer months, lifted by Musk’s shrinking government responsibilities, the launch of driverless cars in Austin, and now the hopes that the famously distracted CEO will remain firmly in the driver’s seat of Tesla for the foreseeable future.

Wedbush analyst Daniel Ives agrees wholeheartedly with the board’s decision as the company arrives at this critical juncture.

“We believe Tesla and Musk are heading into a very important chapter of their growth story as the AI Revolution takes hold and the Robotaxi opportunity is now a reality on the doorstep,” the 5-star analyst opined.

Ives further details that Tesla is in a “pole position” to lead the way in autonomous driving, especially as it gears up to deploy Robotaxis in 30 to 35 cities around the country in the coming year. The analyst assesses the AI and autonomous opportunity to be worth around $1 trillion for Tesla, justifying the imminent need to ensure that Musk remains laser focused on the task at hand.

“Musk is driving this vision and is now in a ‘wartime CEO’ mode which is music to the ears of Tesla bulls with this AI Arms Race happening across the tech world,” adds Ives.

That includes the regulatory angle as well. While there have been some tensions of late between Musk and President Trump, the analyst is not so worried about this kerfuffle. Ives points out that Trump is clearly interested in promoting U.S. primacy with AI, and is therefore likely to help grease the wheels by easing the federal framework for autonomous technologies.

“We believe Tesla could reach a $2 trillion market cap by the middle of 2026 in a bull case scenario,” sums up Ives, who assigns TSLA an Outperform (i.e. Buy) rating and a $500 price target. (To watch Daniel Ives’ track record, click here)

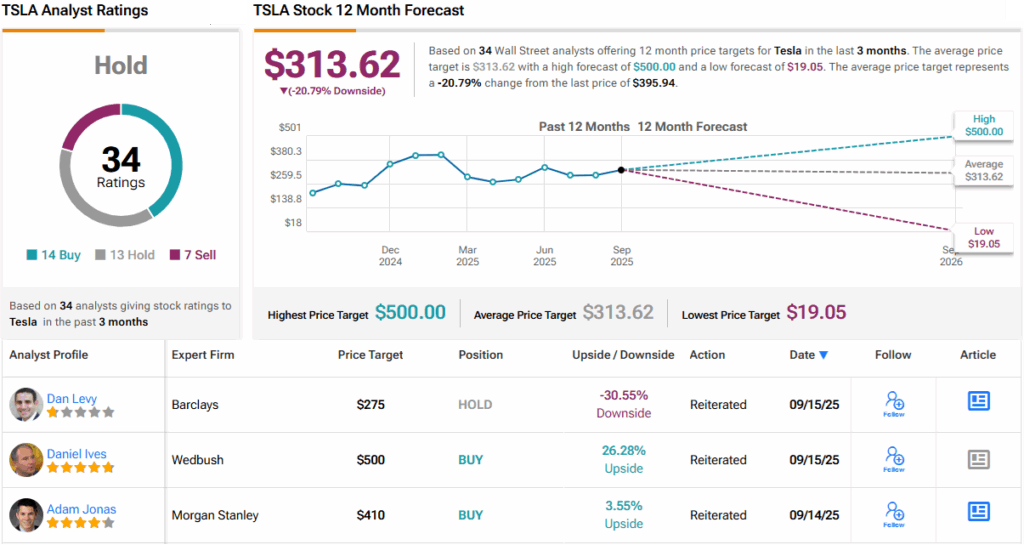

Wall Street, on the other hand, has a fairly divided opinion on TSLA. With 14 Buys, 13 Holds, and 7 Sells, the stock carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $313.62 implies a 21% downside from Friday’s closing price. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.