Danaher (DHR) is an American global conglomerate with a strong presence in the life sciences and diagnostics industries. It’s an under-the-radar compounder that has consistently grown over the past four decades and has a significant runway ahead.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company is among the best-run industrial businesses in the world and is applauded for its Danaher Business System of continuous improvement. I am bullish on Danaher for its superior M&A philosophy, compounding capabilities, and the runway it has, given that its pure-play growth story is just getting started.

The Danaher Business System

The Danaher Business System (DBS) is the lifeblood of Danaher and has helped it become a success story over the past four decades. Taking away the abstraction you’ll see online, the DBS is just a set of instructions for employees backed by the “Kaizen” philosophy. Kaizen is a Japanese term that means “continuous improvement,” and that’s exactly what Danaher practices throughout its business.

In a dynamic world, being nimble is an important quality to have. The DBS encourages all Danaher employees to work toward common goals and deliver quality products fast. The company’s consumer-centric strategy has helped it develop a loyal client base and attain a large amount of recurring revenue. Over 50% of Danaher’s revenue is recurring across all three segments: Life Sciences, Diagnostics, and Biotechnology.

But What Does Danaher Do Exactly?

As I alluded to above, Danaher has three segments. The Life Sciences segment provides tools and technologies for drug discovery and biological research. The Diagnostics segment provides tools and software for point-of-care testing and molecular diagnostics. Finally, the biotechnology segment (which many investors are bullish on) deals with the development and commercialization of biopharmaceuticals and advanced therapies.

Danaher wasn’t always this lean and had exposure to industrials, dental services, and environmental services not long ago. This is where the DBS kicked in and management showed its capital allocation skills.

Capital Allocation at Its Finest

Over the past couple of years, Danaher has focused on becoming a pure-play company in niche markets with synergies. It spun off its industrial and dental services businesses into separate listed entities in 2016 and 2019, respectively. Later in 2023, the company spun off its Environmental & Applied Solutions segment into a separate listed entity Veralto (VLTO).

Danaher is applauded for its capital allocation skills and has successfully executed hundreds of deals over the past 40 years. One of its most high-profile acquisitions was back in 2011 when it acquired biomedical testing equipment maker Beckman Coulter for $6.8 billion. The company expanded its presence in the life sciences market and created a lot of value for shareholders.

Fast forward to 2015, and Danaher paid $13.8 billion for Pall Corporation, a leading manufacturer of filtration, separation, and purification tools. Another move that solidified the company’s position in life sciences.

Five years later, in 2020, Danaher bought the Biopharma business of General Electric Life Sciences (now called Cytiva) for $21.4 billion. Cytiva is a leader in bioprocessing products and services and enables the development of vaccines. In May 2023, Danaher merged the life sciences business of Pall Corporation with Cytiva to streamline its offerings.

In December 2023, Danaher closed the acquisition of Abcam for $5.7 billion. Abcam is a UK-based biotechnology company that supplies protein research tools for applications in the life sciences industry.

Reading about these sizable deals makes one wonder whether they were worth it, and I’ll tell you that they were. Today, Danaher is a pure-play kingpin in synergistic end markets. Management knows when to enter, when to exit, and most importantly, how much to pay. These skills aren’t taught; they’re learned with years of experience, which this compounder has.

A Compounding Machine with Unrealized Potential

Investors love to find compounders and often have different definitions for them. My definition is quite simple compared to elite institutions. For me, a compounder is any company that has consistently grown over a long period of time and has the potential for future growth due to secular trends.

Danaher meets my definition. Over the past 10 years, the company has grown its revenue, net income, and free cash flow by about 6%. Danaher has strong cash generation capabilities and has been turning all its profits into cash for the past 30 years. In 2023, Danaher reported net income of $4.7 billion, and its free cash flow was $5.8 billion. That gives it an FCF-to-net income ratio of 1.2x.

Mid-single-digits may not be all that impressive to some, but it’s important to note that Danaher is in the early innings of its story as a pure-play life sciences and biotechnology company. It’s investing in AI and integrating it to speed up drug discovery, diagnostics, and cancer research.

In June 2024, Danaher appointed former Google (GOOGL) engineer Martin Stumpe as its Chief Data & AI officer. Stumpe led the pathology team at Google Brain back in 2016 and later served as the Chief of AI at Tempus Labs, Inc., a Chicago-based health-tech company.

The biopharmaceutical industry has been slow to adopt artificial intelligence due to regulatory constraints, unpredictable behaviors of algorithms, and data limitations. It’s all early-stage, and Danaher is moving with caution, too, but it is pioneering.

Notably, the global bioprocessing market is expected to grow from $27.2 billion in 2024 to $104.5 billion by 2034, exhibiting a compound annual growth rate of 14.4%, according to industry data by Precedence Research. The bioprocessing market is one of Danaher’s primary markets and deals with the production of pharmaceuticals, vaccines, and gene therapies.

I believe Danaher is a best-positioned enabler of global structural changes in drug discovery. The company has the potential to outpace its historic growth rates as AI disrupts the bioprocessing and life sciences industries. With governments and organizations spending heftily on research and development of next-generation therapies, Danaher is set to compound at higher rates for years to come.

Is Danaher Stock a Buy, According to Analysts?

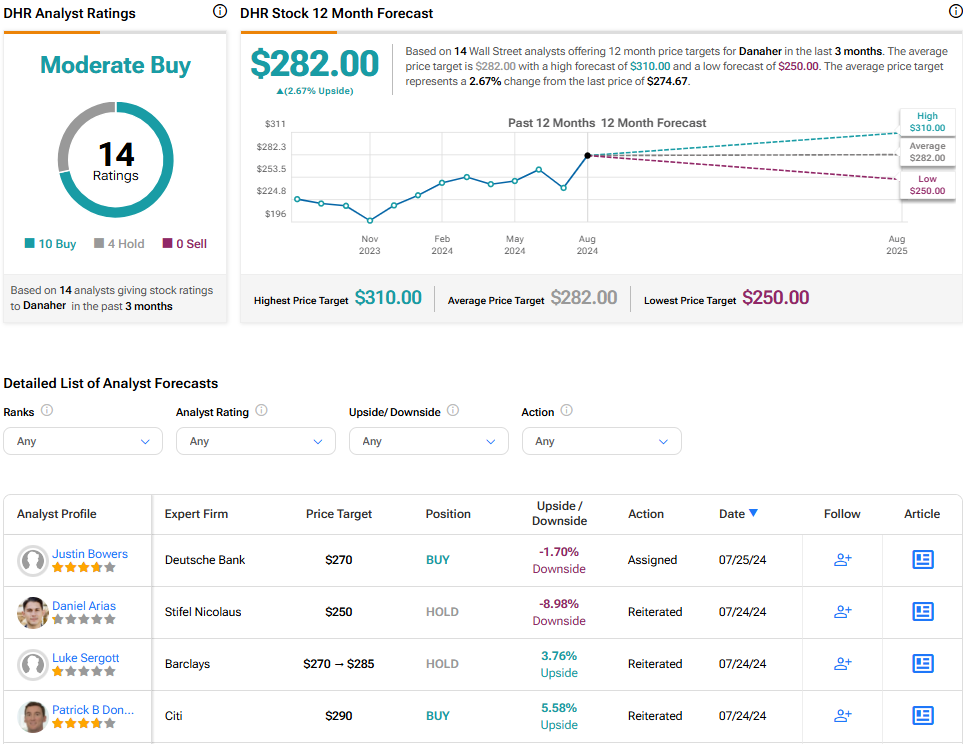

On the Street, DHR stock sports a consensus Moderate Buy rating based on 10 Buy recommendations and four Hold recommendations. The average DHR stock price target of $282 implies little upside potential of 2.7% from current levels. However, the Street-high of $310 points to an upside of 12.9%.

The Bottom Line on DHR Stock

Most of the time, compounders trade at a premium, and investors think they’re overvalued. However, if you find a true compounder that is an enabler of global structural changes, the premium you pay for it might be justified.

Danaher isn’t cheap, trading at 36.5 times its forward earnings, but you can’t always pick up high-quality compounders at a discount. I would keep it on my watchlist and wait for a pullback.