It was a long, strange year for aerospace stock Boeing (BA), with labor troubles and production caps marking much of the year’s progress. But 2026 is looking a lot brighter, particularly for some analysts. Dan Niles is one of those analysts, and he believes Boeing is a “top pick” for 2026. Investors, however, were less certain, sending share prices slipping fractionally in Wednesday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Founder and portfolio manager at Niles Investment Management Dan Niles believes that Boeing can be a winner in 2026. Several factors fed into Niles’ assessment, and interestingly enough, these are actually familiar trends that we have heard previously from other analysts.

Niles pointed out that Boeing has a massive backlog of orders, somewhere around $600 billion worth of product ready to be sold just as soon as it can be assembled and shipped. There is the very real possibility that Boeing could hit $10 billion in free cash flow by the end of the decade, and then, there might be the greatest point of all. Defense spending is only likely to increase worldwide, and that in turn will serve as a “long-term tailwind” for Boeing.

Not All Good News

Some points, however, are less positive for Boeing, and deserve due consideration. One point is that Boeing is likely to post a loss for its fourth quarter. The loss will come in around $0.37 per share, if projections hold up. That does represent a year-over-year change of 93.7%, however.

Worse, some believe that Boeing stock is overpriced at its current level. One report noted that Boeing trades “at a premium to its peers.” Some might believe that is the case, but others may not. Individual investors will need to do their own due diligence on that point, certainly.

Is Boeing a Good Stock to Buy Right Now?

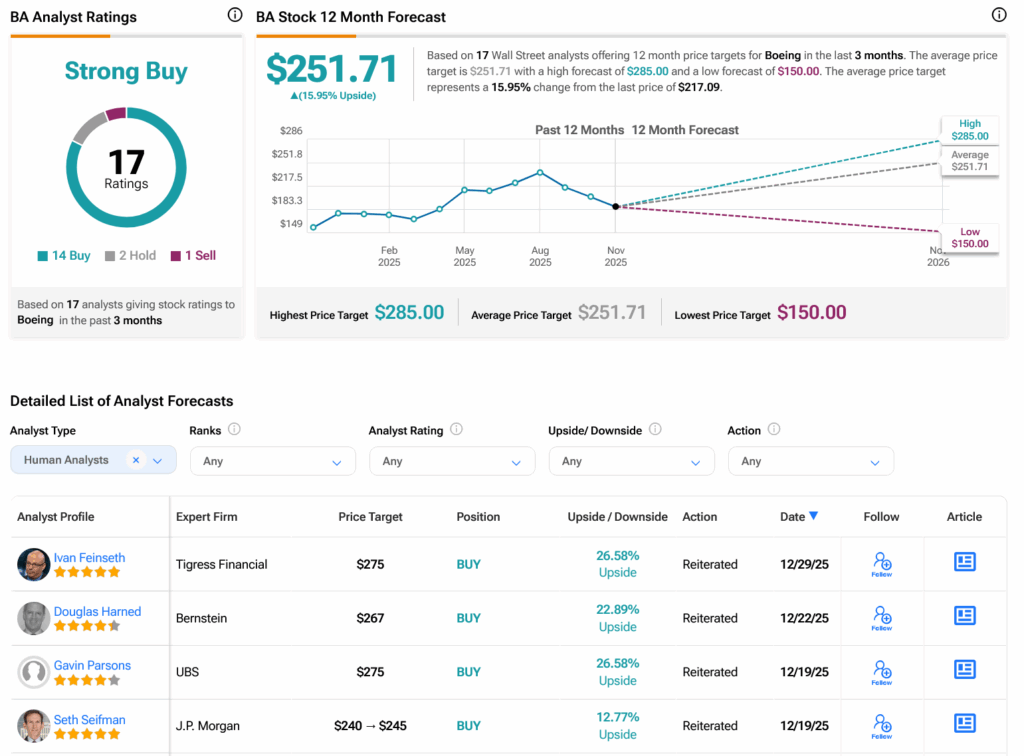

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 14 Buys, two Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 27.13% rally in its share price over the past year, the average BA price target of $251.71 per share implies 15.95% upside potential.