D-Wave Quantum Inc. (QBTS) is getting ready to share its Q1 2025 earnings on May 8, and a lot is riding on this moment. Investors and analysts are watching closely, not just to see if D-Wave can hit its numbers, but also to understand where it actually stands in the race toward quantum computing dominance. For now, it seems that QBTS rides the crest of positivity, with its stock on the rise, but no doubt, the scheduled earnings call will shed much light on the company’s short-term and long-term prospects. So, where does D-Wave stand today ahead of earnings? Let’s break it down.

Strong Cash, But Burning Through It

First, the good news: D-Wave is sitting on a hefty cash pile. After raising over $300 million in recent months, it has enough money to support its operations for a few years. That gives it breathing room to keep developing its tech and signing up customers. However, it’s not yet profitable – far from it. In Q4 2024, D-Wave reported a loss of over $86 million, including a big hit from changes in the value of its financial instruments. Operational losses were about $20 million. So, while the bank account looks strong, the company is still burning cash quickly.

Technology: A Unique Path in Quantum

Unlike competitors like IonQ (IONQ) and Rigetti (RGTI), which focus on gate-based quantum computing (the more widely known kind), D-Wave specializes in quantum annealing. This approach is great for solving specific optimization problems—think scheduling, logistics, and planning—but it’s not as flexible as gate-model quantum computers. Still, D-Wave is the clear leader in this niche, with a working system that already boasts 4,400 qubits.

The company is also entering the gate-based arena, though it’s years behind others. Its long-term plan is to build a scalable, error-corrected gate-model system, but that’s likely at least a decade away.

Real-World Customers and Use Cases

One area where D-Wave shines is real-world adoption. It has over 135 customers, including big names like Ford (F) and Japan Tobacco (JAPAF). These companies have used D-Wave’s systems to optimize manufacturing and drug discovery, which proves that quantum computing isn’t just a lab experiment—it’s starting to make a difference in the real world.

Analyst Expectations and Sentiment

Analysts are cautiously optimistic. Some call the stock a “speculative buy,” while others warn it’s still very risky. That’s fair. D-Wave’s stock is trading at a high valuation compared to its revenues, which were flat in 2023 and 2024. However, analysts expect a big jump in Q1 2025 revenue of over $10 million, more than the company made in all of last year. If D-Wave hits that target, it could be a turning point.

How It Compares to Rivals

In other comparisons to its competitors, IonQ and Rigetti, D-Wave leads in commercial applications and customer wins. IonQ, with its trapped-ion tech, is ahead in pure gate-based performance. Rigetti is more focused on research and has struggled to scale. So, while D-Wave’s technology is more limited, it’s also more widely used, which counts for more than something.

The Bottom Line

D-Wave heads into its earnings call with momentum, money, and a growing customer list. But it’s still an underdog in a game dominated by tech giants and deep-pocketed rivals. This week’s results could boost investor confidence or highlight just how far D-Wave still has to go. Either way, May 8 will be a quantum-sized day for QBTS.

Is D-Wave Quantum Stock a Good Buy?

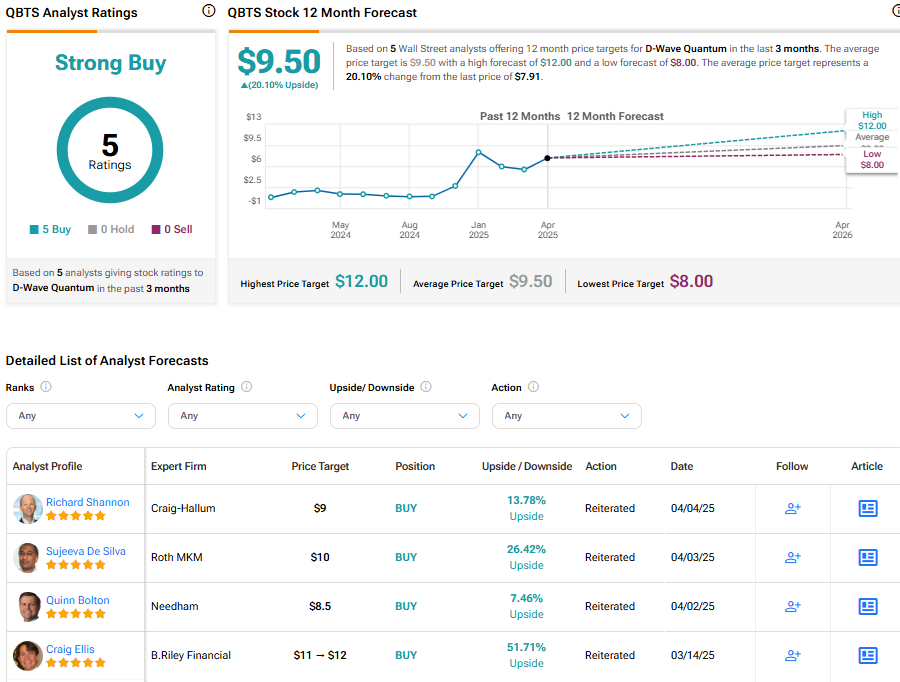

Wall Street analysts clearly believe in D-Wave, with five Buy ratings issued in 2025. The average price target for QBTS stock is $9.50, implying a 20.10% upside potential.