Shares of American oil giants Chevron (CVX), ExxonMobil (XOM), and ConocoPhillips (COP) rallied in pre-market trading today after the U.S. attacked Venezuela over the weekend. President Donald Trump stated the U.S. will run the country for the foreseeable future, following the capture of Venezuelan President Nicolás Maduro and his wife, Cilia Flores, charging them with narco-terrorism conspiracy and other crimes.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Trump stated that U.S. oil companies, “the biggest anywhere in the world,” will go and invest billions to fix the “badly broken” oil infrastructure of Venezuela. He clarified that securing U.S. access to the country’s oil and energy sector is a key goal of removing Maduro. Despite vast reserves, Venezuela produces under 1% of global supply because of corruption, poor management, and U.S. sanctions that have slashed output from 3.5 million barrels per day in 1999 to current lows.

Why Venezuela Is the Oil Epicenter

An OPEC founding member, Venezuela commands the world’s largest proven oil reserves at 303 billion barrels, 17% of global totals, according to U.S. Energy Information Administration (EIA) data. This positions it as a strategic asset amid global supply dynamics, though production has fallen below 1 million b/d due to sanctions, underinvestment, and political instability.

Oil prices dropped sharply in 2025, the biggest annual fall in 5 years. Brent crude fell 19% and U.S. crude declined nearly 20%. This was because OPEC+ increased output after years of cuts, and U.S. production hit records, overwhelming supply.

What Are Trump’s Plans for Venezuela?

Trump noted that the U.S. will temporarily run Venezuela “with a group” until a safe handover to new leaders, without giving further details. Trump outlined a model where oil majors will bear the costs to rebuild Venezuela’s oil infrastructure, with direct reimbursement from future production revenues. This aims to rapidly ramp output for exports, expanding sales to current and new buyers by leveraging the country’s vast reserves to fund reconstruction while securing U.S.-aligned supply flows.

Notably, Chevron remains the sole major U.S. operator in the South American country, exporting roughly 140,000 b/d in Q4 2025 (as per Kpler data), underscoring limited Western access and potential uplift from regime change scenarios targeting energy sector liberalization. Chevron stated in a CNBC interview that it prioritizes employee safety, asset security, and full compliance with all laws while continuing operations amid this geopolitical shift.

Which Oil Stock Is Preferred by Analysts?

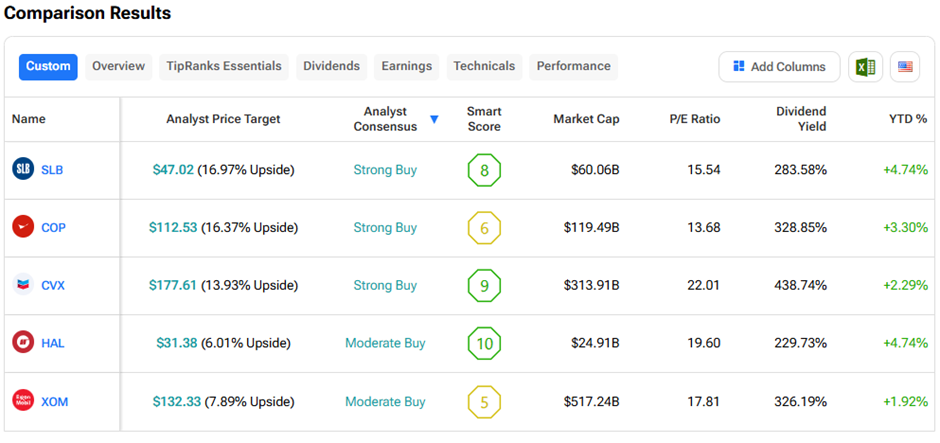

We used the TipRanks tool to Compare Venezuela Oil Recovery Stocks. Currently, analysts have a “Strong Buy” consensus rating on Schlumberger (SLB), ConocoPhillips, and Chevron stocks, with SLB offering the highest upside potential over the next twelve months.