Oil stocks are trending lower on reports that the OPEC+ cartel is planning to increase crude production yet again.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Multiple media reports claim that the Organization of the Petroleum Exporting Countries and its allies are likely to increase its oil production by 411,000 barrels per day beginning in November of this year. The cartel will finalize its plans at its next meeting scheduled for Oct. 5.

OPEC+ has already raised its quota by more than 2.5 million barrels per day this year, or about 2.4% of world demand. The cartel has been increasing production in an effort to capture more market share and to appease U.S. President Donald Trump, who has called for lower oil prices.

Industry Impacts

The ongoing production increases, which are exerting downward pressure on crude oil prices, are hurting the stocks of companies such as Chevron (CVX), Occidental Petroleum (OXY), and Diamondback Energy (FANG). News of the latest OPEC+ production increase comes on the same day that ExxonMobil (XOM) announced that it’s cutting 2,000 jobs worldwide in an effort to save money.

Many oil producers are in cost-cutting mode with crude prices languishing below $70 a barrel. French oil major TotalEnergies (TTE) recently announced a plan to save $7.5 billion in the next five years, and Chevron earlier this year laid off 20% of its global workforce. OPEC+ produces about half of the world’s oil and is key to setting prices.

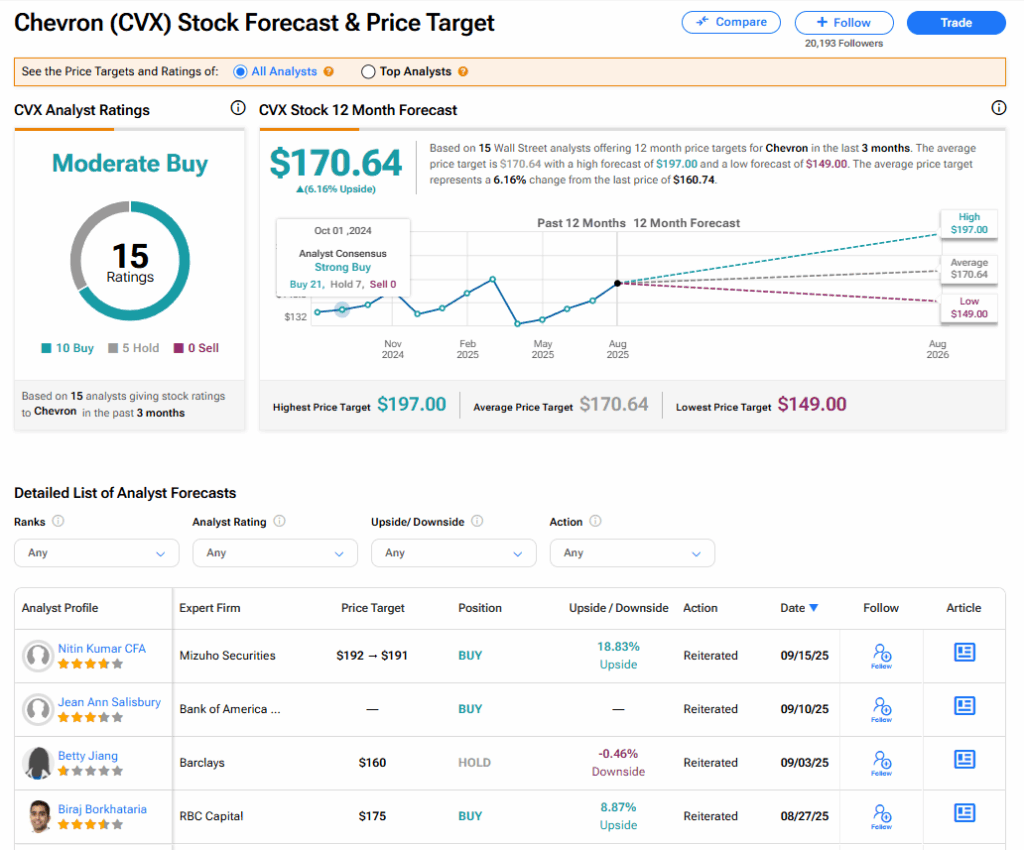

Is CVX Stock a Buy?

The stock of Chevron has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on 10 Buy and five Hold recommendations issued in the last three months. The average CVX price target of $170.64 implies 6.16% upside from current levels.