Shares of Chevron (CVX) slipped slightly in the pre-market trading following the oil giant’s earnings report for the first quarter of 2025. The oil giant reported adjusted earnings of $2.18 per share in the first quarter, compared to earnings of $2.93 per share in the same period last year. Analysts were expecting earnings of $2.16 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company generated Q1 revenues of $47.6 billion, which increased 2.3% year-over-year but missed consensus estimates of $48.25 billion.

Q1 2025 Performance Breakdown

Chevron’s first-quarter performance was a mixed bag, with a recovery in the downstream (refining) segment, offset by weaker profits from the upstream segment. In the refining sector, Chevron posted an improvement in profitability, earning $325 million during the quarter, though this was still down from $783 million a year ago.

At the same time, Chevron’s oil and gas production earnings were $3.76 billion, down from $5.24 billion in the year-ago quarter, as lower crude prices and ongoing market volatility took their toll.

Meanwhile, global oil production remained steady at 3.35 million barrels of oil equivalent per day, flat from the same period last year. The company achieved a 12% increase in production from the Permian Basin, the largest U.S. oilfield, and saw a successful expansion at the Tengiz oilfield in Kazakhstan. However, these gains were offset by the loss of production from asset sales.

Share Repurchases and Dividend Plans

Chevron continued its strategy of returning capital to shareholders. The company repurchased $3.9 billion worth of shares in Q1 and paid $3 billion in dividends. This continues the firm’s trend of consistent growth, as demonstrated by the image below from Main Street Data.

Looking ahead, Chevron expects to repurchase between $2 billion and $3.5 billion in shares in Q2 2025.

Chevron’s Outlook for 2025

Chevron’s outlook remains cautious, with the company flagging the impact of falling crude prices and the recent geopolitical developments. In particular, the Trump administration’s order to wind down operations in Venezuela is expected to affect Chevron’s second-quarter shipments from the country.

Is CVX Stock a Buy?

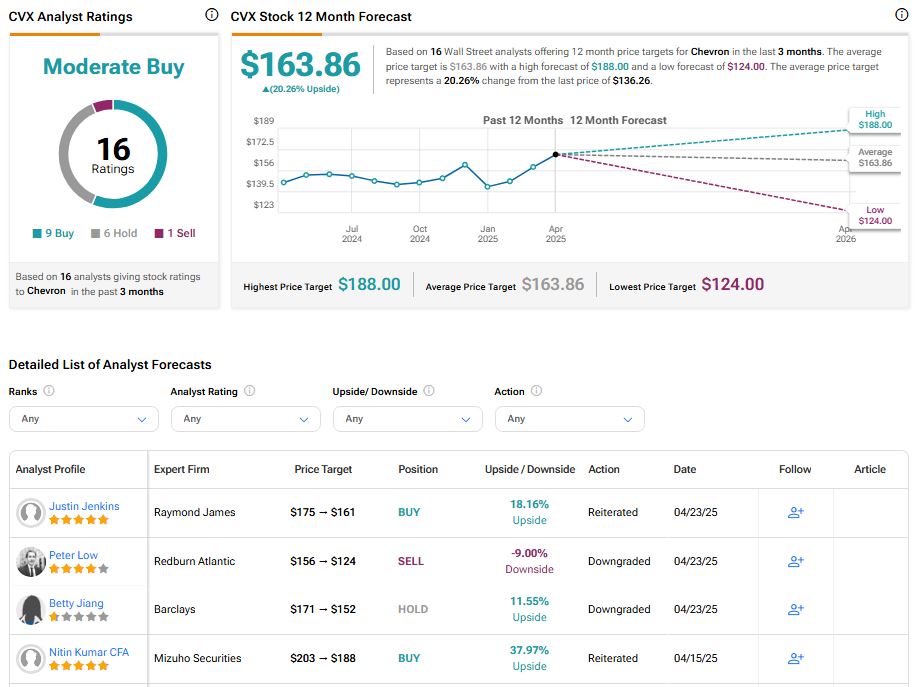

The stock of Chevron has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on nine Buy, six Hold, and one Sell recommendations assigned in the past three months. The average CVX price target of $163.86 implies 20.26% upside from current levels.