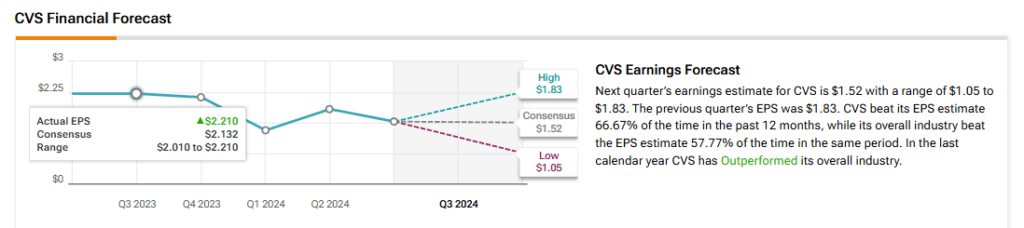

CVS Health (CVS), a healthcare company, will release its fiscal Q3 financials on November 6. Wall Street analysts expect the company to report earnings of $1.52 per share, representing a 31% decrease year-over-year. On the contrary, revenues are expected to grow by 3% from the year-ago quarter to $92.71 billion, according to data from the TipRanks Forecast page.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Interestingly, CVS Health missed EPS estimates only once out of the last nine quarters.

Recent News Ahead of Q3

In a series of developments, CVS Health has experienced leadership changes and revised its earnings guidance ahead of Q3 results.

In October, CVS announced the departure of its CEO, Karen Lynch, and appointed David Joyner as the President and CEO of the company.

In addition, CVS Health announced preliminary earnings guidance for the third quarter. It now expects earnings to be in the range of $1.05 to $1.10 per share, lower than analysts’ expectations due to rising costs impacting its health insurance business.

In August, CVS announced a $2 billion cost-cutting initiative to boost profitability and streamline its operations. These savings are expected to support margin recovery and boost CVS’s financial position.

Insights from the TipRanks Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts believe that CVS Health’s $2 billion in cost-saving initiatives should help boost its margin recovery. They see David Joyner’s appointment as CEO as a positive development. Furthermore, CVS has optimized its Medicare Advantage plans by reducing OTC and dental benefits, which supports a strong EPS growth outlook.

Here, OTC means “over-the-counter” benefits, covering non-prescription items like vitamins and pain relievers under Medicare Advantage plans.

At the same time, bears highlight challenges confronting CVS Health, including recent media speculation regarding a potential company break-up. They also emphasize that the company’s preliminary adjusted EPS guidance for Q3 is considerably below the consensus estimate of $1.71. Additionally, they point out that CVS is dealing with operational issues, particularly within its Health Care Benefits segment, which is affecting the company’s overall performance.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 7.56% move in either direction.

What Is the Price Target for CVS?

Turning to Wall Street, CVS Health stock has a Moderate Buy consensus rating. Out of the 14 analysts covering the stock, nine have a Buy recommendation and five recommend holding the stock. Furthermore, at $69.17, the average CVS price target implies 23.94% downside potential.