Tesla (NASDAQ:TSLA) shares jumped 5% on Wednesday, but don’t let the green fool you, the Q1 2025 earnings report was anything but pretty.

Investors had already braced for bad news after Tesla revealed a record-breaking plunge in deliveries earlier this month. Still, the EV giant underwhelmed, falling short of expectations that had already been dragged down.

Revenue fell 9.2% year-over-year (including a 20% drop in auto revenue) to $19.34 billion, missing the Street’s call by $2.07 billion. Adjusted income fell by 39%, resulting in adjusted EPS of $0.27 – $0.15 below consensus. Net income, the most stringent measure of profitability, plunged 71% compared to the same period last year. Tesla’s bottom line was buoyed by $595 million in zero-emission tax credit sales; without that boost, the company would have reported a loss.

Tesla’s CFO attributed the weak Q1 deliveries to factory retooling, which limited the availability of the refreshed Model Y in most markets and forced the company to sell the older version instead. He also cited growing political hostility toward the brand as a contributing factor.

But the market’s initial reaction to what can only be described as a disaster quarter was a positive one. And that is purely down to the fact CEO Elon Musk said that he’ll be spending less time at DOGE, assuaging investor fears he has lost interest in running Tesla since taking on his controversial role in the Trump administration. Musk also said the affordable model launch remains on schedule despite contrary media reports. The company also stated that the Robotaxi rollout in Austin is still set for June.

Still, not everyone’s buying the optimism. Wells Fargo’s Colin Langan sees the bounce as short-lived.

“We expect the stock to fade with poor results, cut delivery guide, tariffs headwinds (high on Energy Gen) & disappointment the affordable model is largely a cheaper Model Y,” the analyst opined.

Langan also believes the demand issues aren’t abating, noting: “While factory ramp-up hurt Q1, the post-ramp data isn’t encouraging. The new Model Y is already piling up in inventory, delivery times are short, and prices are falling. In California, Q1 registrations were down 15%. In China, Tesla’s leaning hard into aggressive financing promos.”

In addition, given the tight timeline, limited testing, and potential constraints of a vision-only system, Langan thinks there is a risk that the June Robotaxi launch in Austin could “underwhelm.” When he raised concerns with Musk about handling glare – a “top vision-only concern” – the CEO explained that the camera system uses direct photon counting, effectively bypassing the traditional image sensor.

“We’ll see how AV experts respond to his first technical answer on the matter,” Langan said. “We are skeptical given reports some FSD owners are told to take control due to front cameras glare.”

Langan’s stance on Tesla stock is even more cautious. The analyst rates TSLA an Underweight (i.e., Sell), while lowering his price target from $130 to $120, implying a potential downside of 52% in the coming months. (To watch Langan’s track record, click here)

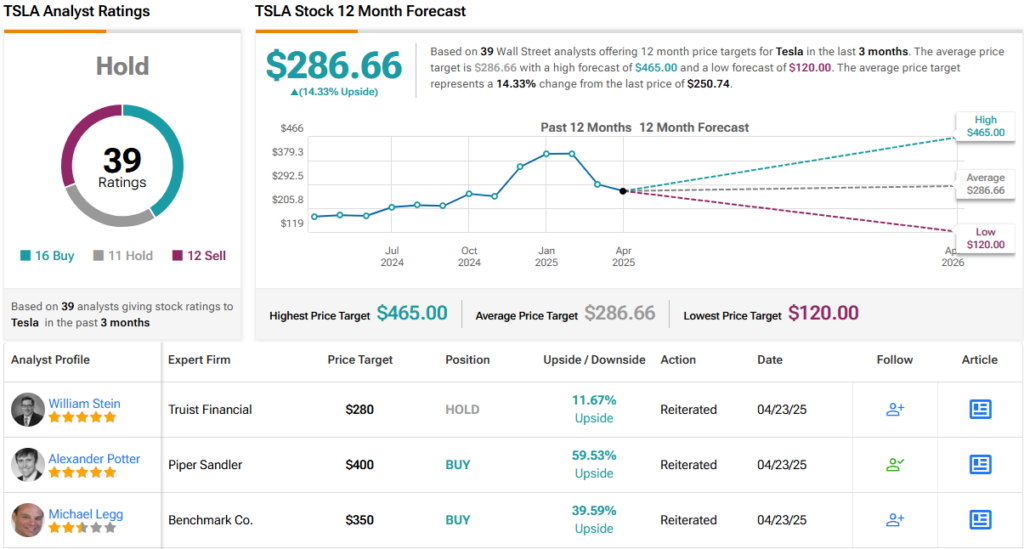

He’s not the only bear in the room. 11 other analysts also carry a Sell rating on TSLA. Add to that 16 Buys and 11 Holds, and the broader consensus lands at Hold (i.e., Neutral). However, the average price target stands at $286.66, suggesting a potential 14% gain over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.