Shares of networking titan Cisco Systems (CSCO) were little changed in after-hours trading despite reporting solid first-quarter results. The company beat analyst expectations of $0.87 with adjusted earnings per share of $0.91. In addition, revenue came in at $13.8 billion, which surpassed the expected $13.78 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, CEO Chuck Robbins noted that the company is off to a strong start in the first quarter as customers invest in critical infrastructure to prepare for AI.

Nevertheless, total revenue was still down 6% from the previous year and down 14% when excluding the contribution from its Splunk acquisition. It is also worth noting that product revenue fell by 9% while services revenue grew by 6%.

Cisco’s Guidance

Looking forward, management has provided the following guidance:

- Q2 revenue between $13.75 billion and $13.95 billion versus estimates of $13.76 billion

- Q2 adjusted earnings of $0.89 to $0.91 per share compared to expectations of $0.87

- FY25 revenue between $55.3 billion and $56.3 billion versus estimates of $55.95 billion

- FY25 adjusted earnings of $3.60 to $3.66 per share compared to expectations of $3.57

As you can see, guidance was mostly better than expected except for full-year revenue figures, which slightly missed due to a midpoint of $55.8 billion. This is likely what contributed to the stock’s small after-hours move at the time of writing.

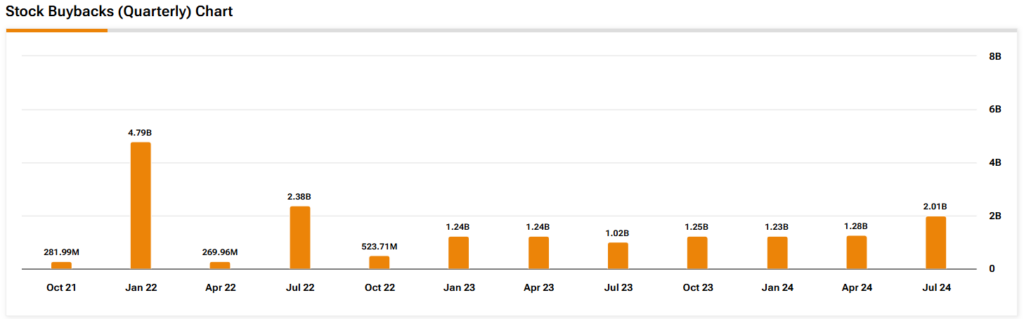

Cisco Returns $3.6B to Shareholders

During the first quarter, Cisco returned over $3.6 billion to shareholders. Dividends made up $1.6 billion, or $0.40 per share, while buybacks made up the remaining $2 billion. The firm regularly repurchases its shares each quarter (as demonstrated in the image below) and has $3.2 billion remaining under its buyback plan.

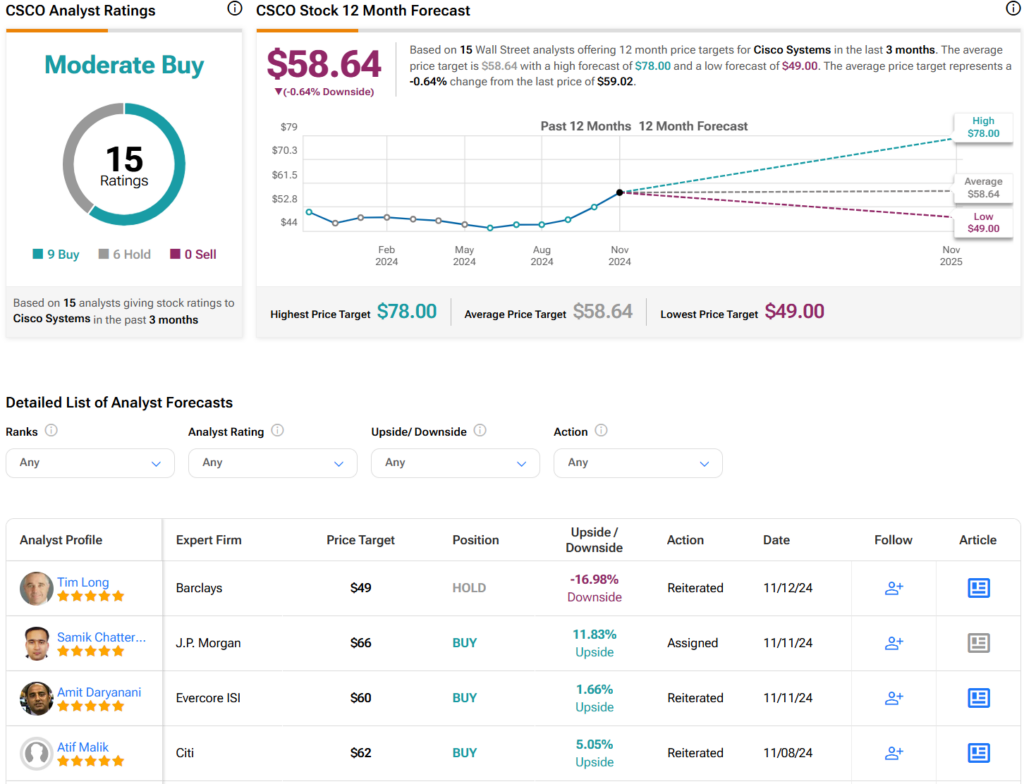

Is CSCO a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CSCO stock based on nine Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 15% increase in its share price over the past year, the average CSCO price target of $58.64 per share implies that shares are trading near fair value. However, it’s worth noting that estimates will likely change following today’s earnings report.