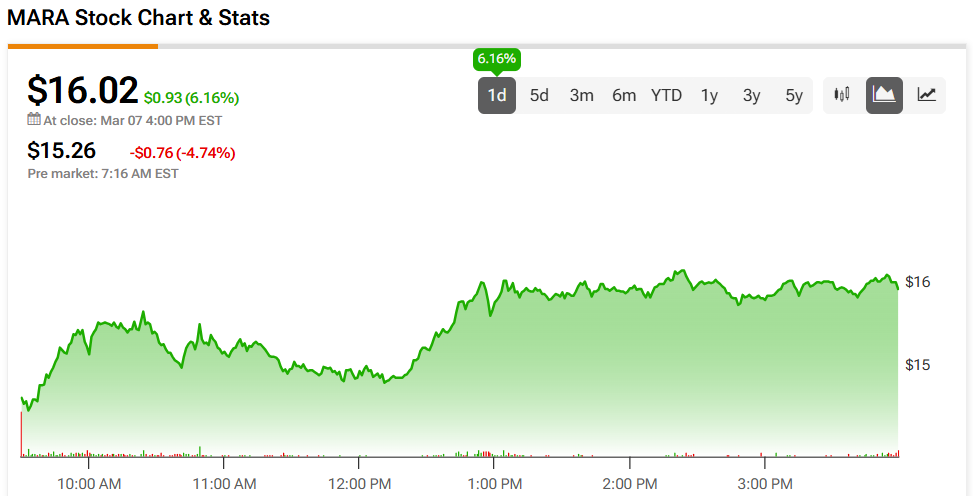

Traditional banks and Wall Street are adjusting as cryptocurrencies continue to draw increased attention. Crypto miners like MARA Holdings (MARA), which currently holds 46,374 BTC, have displayed volatility following President Trump’s recently signed an executive order establishing a strategic bitcoin reserve and a U.S. digital asset stockpile fueled by bitcoins owned by the Department of Treasury and forfeited through legal proceedings. After shedding over 30% of its value in the past three months, MARA has seen its stock price rebound by over 6% late last week, attributed to changing investor sentiment spurred by the news.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Crypto Gets a Boost

President Donald Trump has signed an executive order to establish a strategic Bitcoin reserve and a U.S. digital asset stockpile. This reserve will capitalize on Bitcoin owned by the Department of Treasury, obtained through forfeiture proceedings, and will be treated as a reserve asset. No sales will be made from this reserve. Instead, it will be maintained as a reservoir of reserve assets.

The Secretaries of Treasury and Commerce will develop further strategies for acquiring more Bitcoin. Additionally, a U.S. digital asset stockpile will be set up to house digital assets other than Bitcoin, also seized during forfeiture proceedings.

MARA Holdings is a digital asset technology company specializing primarily in mining Bitcoin. Most recently, the company reported a 4% month-over-month increase in its Bitcoin production for February 2025. Although an overall 6% decrease in blocks won during the same period due to greater network difficulty and fewer operational days, the company’s energized hash rate remained slightly above the previous month.

Furthermore, MARA is nearing the completion of a 40-megawatt data center in Ohio to house more than ten thousand S21 Pro immersion miners. As part of its long-term strategy, the company aims to establish its presence in the AI and related markets while focusing on cost efficiency and low-cost energy.

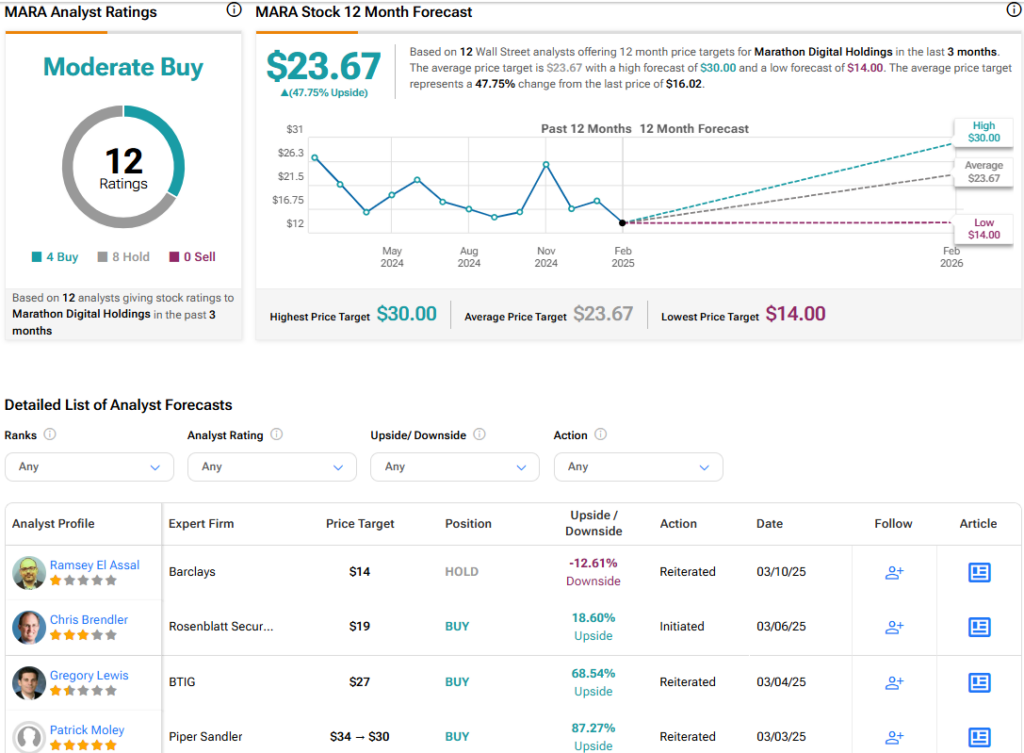

Analysts Cautiously Optimistic

Analysts following the company have continued to be cautiously optimistic about the stock. For example, BTIG’s Gregory Lewis reiterated a Buy rating on the shares with a $27 price target over the next 12 months. He notes anticipating substantial revenue growth in the coming years, stemming from the expectations of escalating Bitcoin prices, increasing exahash capacity, and enhancements in operational efficiencies.

MARA Holdings is rated a Moderate Buy overall, based on the recent recommendations of 12 analysts. The average price target for MARA stock is $23.67, which represents a potential upside of 47.75% from current levels.