To say that cryptocurrencies are under pressure is increasingly looking like an understatement. This week, even the combination of dovish comments from Fed Chair Jerome Powell and a soft CPI print has largely failed to stem a slide in the cryptoverse. Meanwhile, RIOT’s (NASDAQ:RIOT) continued overtures towards Bitfarms (NASDAQ:BITF) and MicroStrategy’s (NASDAQ:MSTR) 10-for-1 stock split are key developments of the week.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bitcoin’s Meltdown

The soft CPI print resulted in positive price action in precious metals and other commodities such as crude oil. Bitcoin (BTC-USD), on the other hand, is down by 2.5% today and by over 15% over the past month. It is highly likely that this price weakness will continue as crypto trading volumes have been losing momentum over the past few weeks.

Riot’s Move

Meanwhile, Riot Platforms has launched a dedicated website to “educate” Bitfarms’ shareholders about the “broken corporate governance” and the need for urgent board changes at the latter. So far, RIOT has built up a 15% stake in BITF and nominated three candidates to Bitfarms’ board. Earlier, Bitfarms adopted a “Poison Pill” strategy to fend off acquisition attempts by RIOT.

MSTR’s Stock Split

But the biggest development in the crypto space this week is perhaps the 10-for-1 stock split by Michael Saylor’s MicroStrategy. MSTR plans to execute the stock split via a stock dividend and has set August 1 as the record date. The stock is expected to start trading on a split-adjusted basis on August 8. MicroStrategy shares have rallied by nearly 228% over the past year, and the stock could continue to display strength until August 1.

The broader cryptoverse, though, is likely to remain under pressure in the short term as the Bitcoin Fear & Greed Index is now leaning towards an “extreme fear” sentiment, according to CoinTelegraph.

Is BTC Expected to Go Up or Down?

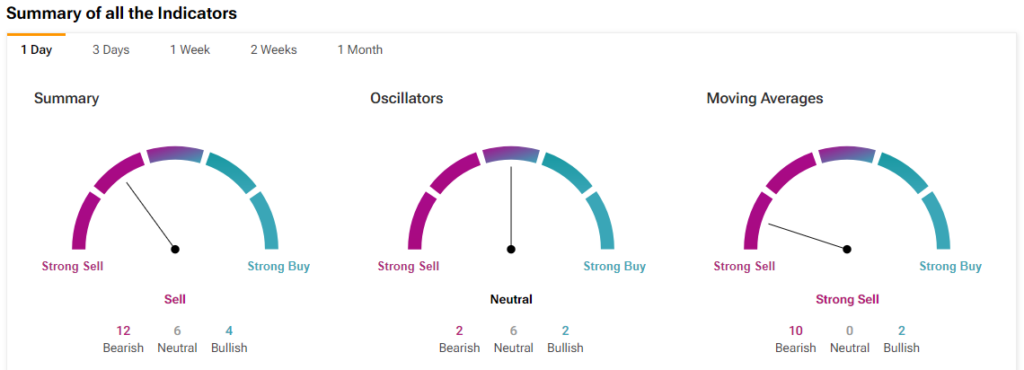

Not surprisingly, the TipRanks Technical Analysis tool is also flashing a Sell signal for Bitcoin on a daily timeframe.

Read full Disclosure