Truist Securities has launched analyst coverage on two AI stocks with different calls. Analyst Arvind Ramnani started CoreWeave (CRWV) at Hold, pointing to strong growth but balanced risk. At the same time, he initiated Palantir Technologies (PLTR) at Buy, calling it a “best-in-class AI asset.”

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Truist Sees Balanced Risk-Reward at CoreWeave

Ramnani said CoreWeave is a leading AI-focused cloud provider with a strong customer base that includes major AI labs and large tech firms. He also pointed to the company’s close ties with NVIDIA (NVDA) as a key strength, since access to GPUs is critical for its business. Based on this mix, he set an $84 price target, implying about 11% upside from current levels.

At the same time, Ramnani highlighted the sharp rise in demand for CoreWeave’s services. Revenue jumped more than 14 times in 2023, grew more than 8 times in 2024, and is expected to more than double again in 2025. Even with that growth, he said the stock’s risk-reward looks balanced at current prices.

That balance reflects ongoing risks. Ramnani flagged CoreWeave’s high debt and heavy capital spending needs as key concerns. Running large AI data centers requires steady investment, which can limit flexibility in the near term.

Truist Calls Palantir a Best-in-Class AI Asset

Ramnani acknowledged Palantir’s high valuation but said the company is well placed to drive wider use of generative AI across governments and businesses. He noted that momentum has picked up sharply since the launch of Palantir’s AI Platform (AIP), with revenue growth rising to 63% year over year, from 13% in mid-2023. The analyst assigned a $223 price target, which implies about 26% upside from current levels.

Just as important, a larger share of that growth is flowing through to profits. Operating margins have climbed above 50%, showing better cost control as revenue grows. While recent strength has mainly come from the U.S., Ramnani sees international markets as a key source of future growth.

Which Is the Better AI Stock?

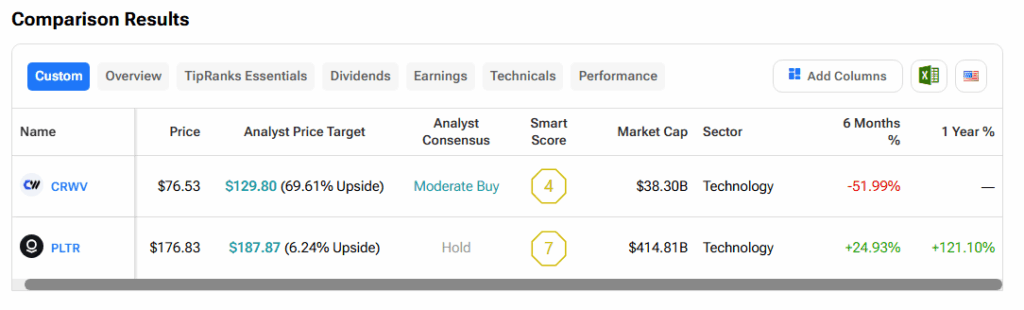

Using TipRanks’ Stock Comparison Tool, we found that CoreWeave holds a Moderate Buy consensus rating, while Palantir carries a Hold rating from Wall Street analysts.

Meanwhile, CoreWeave shares are down about 52% over the past six months, while Palantir is up nearly 25% over the same period and has gained more than 120% over the past year.