Shares of CrowdStrike (CRWD) jumped in after-hours trading after the cybersecurity firm reported earnings for its second quarter of Fiscal Year 2025. Earnings per share came in at $1.04, which beat analysts’ consensus estimate of $0.97 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased by 31.7% year-over-year, with revenue hitting $963.87 million. This beat analysts’ expectations of $958.3 million.

Looking forward, management now expects revenue and adjusted earnings per share for FY 2025 to be in the ranges of $3,890.0 – $3,902.2 million and $3.61 – $3.65, respectively. For reference, analysts were expecting $3,958 million in revenue along with an adjusted EPS of $3.91.

Investor Sentiment for CRWD Stock Is Currently Very Positive

The sentiment among TipRanks investors is currently Very Positive. Out of the 753,382 portfolios tracked by TipRanks, 3.1% hold CRWD stock. In addition, the average portfolio weighting allocated towards CRWD among those who do have a position is 5.34%. This suggests that investors of the company are fairly confident about its future. However, the more interesting part is that the number of portfolios holding CRWD stock has increased from 2.4% during the last earnings report.

This is worth noting because Crowdstrike has since been at the center of controversy after a faulty update by the firm led to a global IT outage that caused its shares to crumble. This shows that investors believe the company will overcome any damage to its operations or reputation and see the fall in share price as an opportunity.

Is CrowdStrike a Buy or Sell?

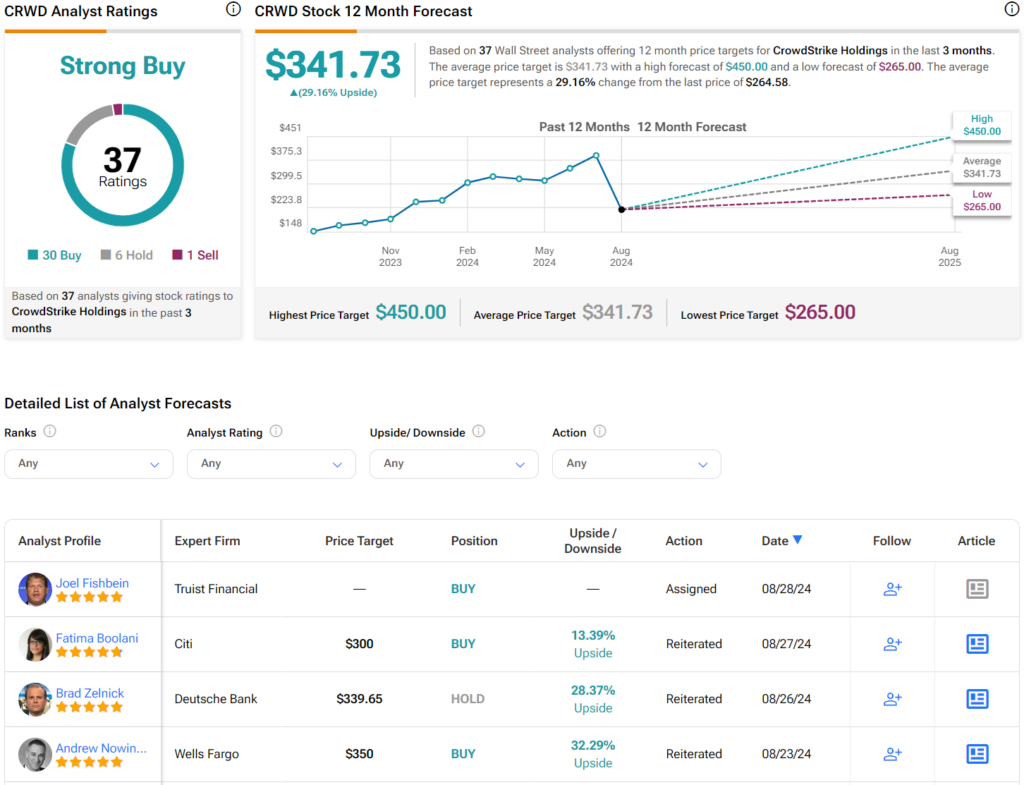

Turning to Wall Street, analysts have a Strong Buy consensus rating on CRWD stock based on 30 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After an 80% rally in its share price over the past year, the average CRWD price target of $341.73 per share implies 29.16% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.