Shares of footwear company, Crocs (NASDAQ: CROX) plunged in morning trading on Thursday even as the company raised its FY23 forecast and now expects its revenues to grow in the range of 11% to 14% year-over-year to be in the range of $3.95 billion to $4.05 billion at current currency rates while analysts have projected revenues of $4.01 billion. Adjusted diluted earnings for FY23 is projected to be between $11.17 and $11.73 per share versus consensus estimates of $11.23 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In the fiscal second quarter, CROX anticipates adjusted diluted earnings between $2.83 and $2.98 per share on revenues in the range of $1.03 billion to $1.049 billion at current currency rates. Analysts were projecting adjusted earnings of $3.29 per share on revenues of $1.07 billion.

In Q1, CROX generated revenues of $884.2 million, up by 33.9% year-over-year and surpassing consensus estimates of $856.81 million. Adjusted diluted earnings increased 27.3% year-over-year to $2.61 per share in Q1 and beat Street expectations of $2.16 per share.

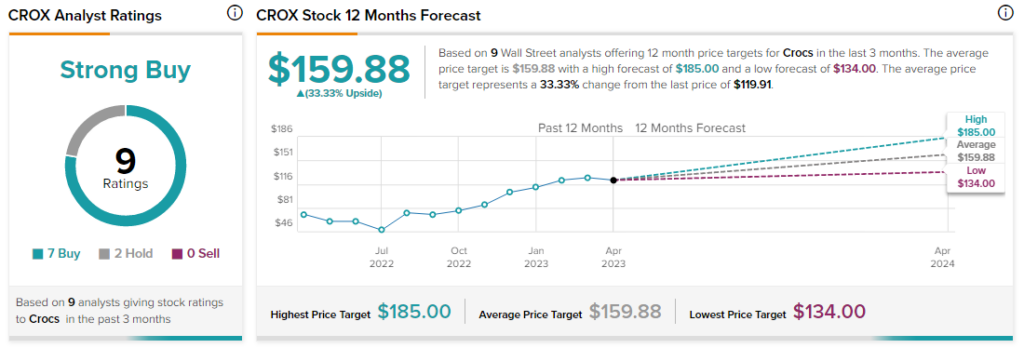

Analysts are bullish about CROX stock with a Strong Buy consensus rating based on seven Buys and two Holds.