There’s an old saying: Strike while the iron is hot. For investors, this can mean ignoring the frightened crowd and considering beaten-down stocks, such as CrowdStrike (CRWD) stock. There’s absolutely no room for fear when you’re buying stocks on weakness, and I am bullish on CRWD stock because the negative news will certainly be temporary.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CrowdStrike provides cybersecurity and cloud-computing services with artificial intelligence (AI) enhancements. This is a great field for CrowdStrike to be involved with in the 2020s, as digital threat detection is of the utmost importance for many businesses nowadays.

Lately, however, investors seem to be ignoring CrowdStrike’s vast opportunities in the cybersecurity market. They’re running for the hills when they ought to consider striking first and fast, especially if they’re contrarians. So, get your galoshes ready, as there’s no shortage of blood in the streets, and CrowdStrike is hated today but might be celebrated later on.

CrowdStrike Causes Chaos with Tech Outage

The financial press is great at spreading fear and promoting panic among investors. I almost want to praise Bloomberg for its dramatic headline about CrowdStrike’s “IT crash” leaving a “trail of chaos.” I’ll also give CNN some credit for colorfully describing CrowdStrike’s tech outage as wreaking “havoc on businesses, 911 systems and government agencies.”

I’ll let CrowdStrike President and CEO George Kurtz explain what actually happened. He stated in an X (formerly known as Twitter) posting, “CrowdStrike is actively working with customers impacted by a defect found in a single content update for Windows hosts. Mac and Linux hosts are not impacted.”

So, it’s not as if all computers in the world are affected. Besides, there’s no need to worry about hackers being involved in this. Kurtz clarified, “This is not a security incident or cyberattack. The issue has been identified, isolated and a fix has been deployed.”

Still, the reputational damage can’t simply be overlooked. Wedbush analyst Daniel Ives declared, “This is clearly a major black eye for CrowdStrike,” and he’s not wrong about that.

Yet, black eyes heal eventually. It’s difficult to maintain a “This, too, shall pass” attitude when The Telegraph is bellowing about a “global IT meltdown.” However, stock prices don’t go down (and dip-buying opportunities don’t arise) when everything in the world is running smoothly.

Yes, flights will be delayed, and some computers might display the dreaded “blue screen of death” for a little while. The fear and loathing surrounding CrowdStrike right now seems overdone, though. It reminds me of the widespread worry 15 years ago that the BP (BP) oil spill would ruin the energy giant. These issues come and go, and level-headed investors can take advantage of these types of situations.

CrowdStrike Stock Continues to Tumble

After collapsing on Friday, CrowdStrike stock continued to decline sharply today. What you need to know, however, is that there weren’t any new cybersecurity failure incidents related to CrowdStrike.

Granted, there were continuations of delays and frustrations, especially among airlines. Still, the market should have expected that the unfortunate effects wouldn’t be completely cleared up over the weekend.

Yet, when a company is in Wall Street’s doghouse, it can be stuck there for a while. As Ives put it, the tech-failure incident made CrowdStrike “a household name, but not in a good way.”

What mainly caused CrowdStrike stock to continue declining on Monday, I believe, was analysts’ downgrades. For example, Guggenheim analyst John DiFucci downgraded CrowdStrike shares from Buy to Neutral on Sunday. BTIG analysts also announced a similar downgrade of the stock.

As we’ll discuss in a moment, the majority of analysts published a Buy or equivalent rating on CRWD stock. However, it probably won’t be long before some of those analysts lower their ratings and price targets on the stock. So, be ready for that to potentially happen in the near future.

None of this negates CrowdStrike’s stellar track record of quarterly EPS beats. If anything, this incident highlights CrowdStrike’s wide variety of big-league, well-capitalized clients. Clearly, there are large companies that rely on CrowdStrike for cybersecurity services. Hence, if and when this dark cloud passes, CrowdStrike will likely remain a major player in a lucrative market.

Is CrowdStrike Stock a Buy, According to Analysts?

On TipRanks, CRWD comes in as a Strong Buy based on 31 Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average CrowdStrike stock price target is $383.93, implying 44.9% upside potential.

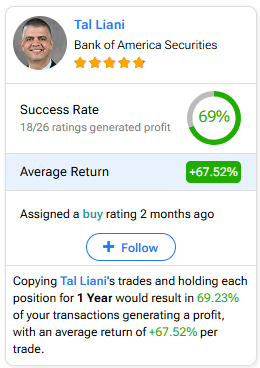

If you’re wondering which analyst you should follow if you want to buy and sell CRWD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Tal Liani of Bank of America (BAC) Securities, with an average return of 67.52% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider CrowdStrike Stock?

Before there can be a rainbow, there must be rain. Suffice it to say, it’s raining hard on CrowdStrike right now. This is good news if you wanted to invest in CrowdStrike but didn’t pull the trigger yet. This share-price crash will lower CrowdStrike’s P/E ratio and make the reward-to-risk balance more favorable.

Most importantly, CrowdStrike has a broad, well-capitalized client base, and the company won’t be in the market’s doghouse forever. Therefore, in anticipation of an eventual change in the crowd’s negative sentiment toward CrowdStrike, I would definitely consider CRWD stock today.