Cybersecurity company CrowdStrike Holdings (CRWD) is scheduled to announce its results for the second quarter of Fiscal 2026 after the market closes on Wednesday, August 27. The stock has climbed about 23% year-to-date and 58% over the past year, driven by strong momentum in AI‑powered security and the continued expansion of its cloud-native Falcon platform. However, a few analysts remain concerned about the stock’s high valuation and the potential for softer sales growth in the second half of the year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

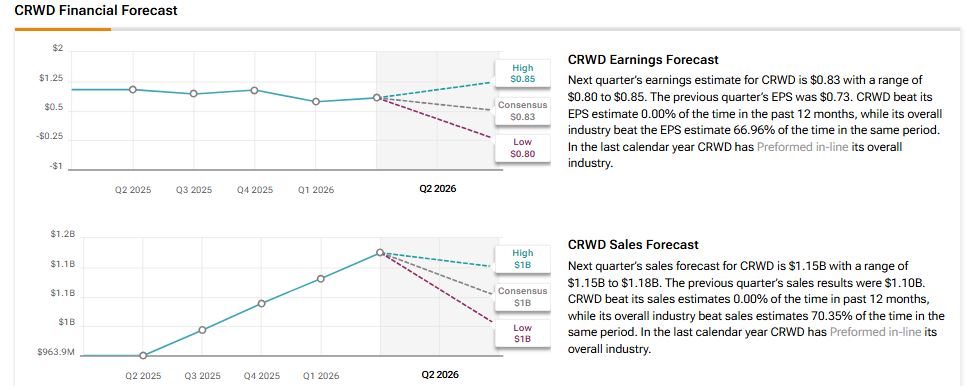

Wall Street analysts expect CrowdStrike to report earnings of $0.83 per share for the second quarter of Fiscal 2026, down 20% from the year-ago quarter. However, analysts expect Q2 revenues to increase 19% year-over-year to $1.15 billion, according to the TipRanks Analyst Forecasts Page. It’s important to note that CrowdStrike has an impressive track record with earnings, having exceeded EPS estimates in each of the past nine consecutive quarters.

Analysts’ Views on CRWD Ahead of Q2 Results

Heading into the Q2 results, BMO Capital analyst Keith Bachman lowered his price target on the stock to $460 from $500, but kept an Outperform rating. He noted good partner feedback in the July quarter and steady demand for the company’s security tools. However, he is cautious about the stock’s performance in the second half of FY26. Bachman also said CrowdStrike would need to grow its annual recurring revenue (ARR) and sales by more than 22% in FY27 to push the stock higher.

Meanwhile, Guggenheim analyst John DiFucci kept a Neutral rating on the stock. The 5-star analyst expects the company to meet revenue and annual recurring revenue (ARR) targets in the second quarter. He pointed out that in Q1, CrowdStrike closed two very large deals—each over $23 million—showing that customers are committing to big contracts. He also sees plenty of room for long-term growth in the U.S. federal government market, which could lift revenue over time.

However, he believes there is limited upside from current levels. With the stock still trading at a high valuation, he prefers to remain on the sidelines for now.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 8.54% move in either direction.

Is CRWD Stock a Good Buy?

With 26 Buys and 13 Hold recommendations, CrowdStrike scores a Moderate Buy consensus rating on TipRanks. The average CRWD stock price target of $496.00 implies an upside potential of about 18.43% from current levels.