Crocs stocks (CROX) dipped nearly 3% after earnings (and kept falling in the following two trading sessions), which, in my view, signals a massive buying opportunity. The footwear company’s second quarter was quite strong, with continuous top-line gains and double-digit earnings growth. While some missteps were present, including somewhat disappointing HEYDUDE sales, management continues to execute well, including repaying debt swiftly and repurchasing shares.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

With the stock now trading at incredibly low multiples, I remain extremely bullish on CROX stock.

Breaking Down Crocs’ Q2-2024 Results — Enduring Growth, Margin Expansion

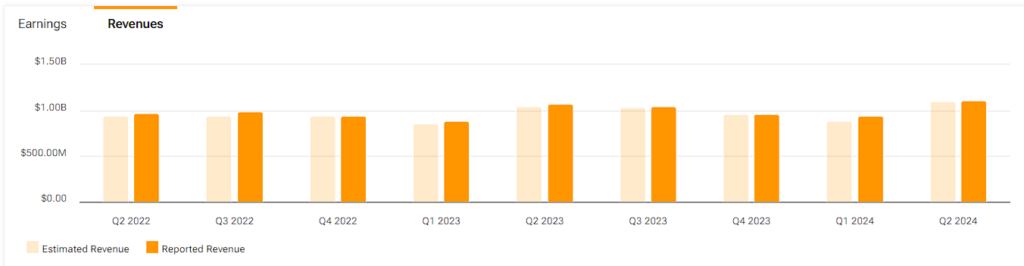

Crocs’ Q2 results exhibited enduring growth and, most importantly, a substantial margin expansion that boosted earnings growth. Let’s start by looking at the company’s revenues, which hit $1.1 billion, up 5% compared to last year. This result beat the company’s prior guidance and was primarily driven by robust performance in the Crocs brand, which more than offset the challenges witnessed in the HEYDUDE brand. Let’s take a look at each brand.

The Crocs Brand

Once again, the Crocs brand continued to drive the company’s results, with its revenues growing by 11% to $914 million. This growth was driven by multiple factors. To begin with, the brand’s direct-to-consumer (DTC) segment saw a 14% gain, backed by strong online sales and physical retail location openings. Improvements in digital marketing and online shopping experience also boosted the brands’ DTC sales.

On the wholesale front, the brand saw strong momentum, too, with revenues growing by 9%, reflecting robust demand from retailers. Iconic products like the Classic Clog and high-profile partnerships with franchises such as SpongeBob, Pringles, and K-pop band Treasure notably boosted sales.

Geography-wise, the international market played a crucial role in driving growth, with a remarkable 22% revenue surge led mainly by China and Australia. Finally, product diversification contributed to Crocs’ growth, as new offerings in the sandal category and innovative styles like the Jibbitable Classic Brooklyn supported repeat purchases and customer growth.

The HEYDUDE Brand

The HEYDUDE brand, in contrast, saw a 17.5% drop in revenue, totaling $198 million. Some upbeat factors were in play here, like the fact that the average selling price of HEYDUDE shoes rose 7% to $30.76. Also, the decline in Wholesale revenues, down 24%, was technically due to the company’s deliberate decision to reduce its account base and right-size channel inventories, aiming for long-term brand health.

The brand’s overall weakness was clear, regardless. The DTC channel recorded an 8% decline in sales. This is despite HEYDUDE’s progress in retail expansion, including opening 13 new outlet locations in the quarter, totaling 19 for the year.

Margin Expansion and Earnings Growth

Moving to the bottom line, things look way brighter. Notably, the company’s overall adjusted gross margin rose by 330 basis points to 61.4%, with both brands contributing positively. The Crocs brand posted a gross margin of 64.1%, up 210 basis points from the previous year, benefiting from favorable product and freight costs and higher international pricing.

Meanwhile, the HEYDUDE brand recorded a 200 basis point improvement in its gross margin to 49.1%, attributed to, again, lower freight costs, channel mix, and higher average selling prices.

The combination of revenue growth and improved margins led to a notable increase in adjusted earnings per share (EPS), which rose by 12% to $4.01.

Capital Allocation & Valuation

In line with Crocs’ strong profitability, the company posted record quarterly free cash flow of $384.2 million. This cash flow was used rather effectively, as management repaid $200 million in debt and repurchased $175 million worth of stock. I believe this is a nice mix, with the company both retiring debt in a high-rate territory while also taking advantage of the stock’s cheap valuation, which should end up being accretive to earnings.

Regarding the stock’s valuation, Crocs is trading at a forward P/E of 8.9x, which is an attractive multiple no matter from what angle you assess the company, especially given that earnings keep growing in the double digits. Sure, you can attribute the humble multiple to market worries regarding the performance of HEYDUDE, but looking at the bigger picture, the stock’s recent dip seems like an overreaction when you consider the overall report, including the fact that free cash flow hit a new record.

Is CROX Stock a Buy, According to Analysts?

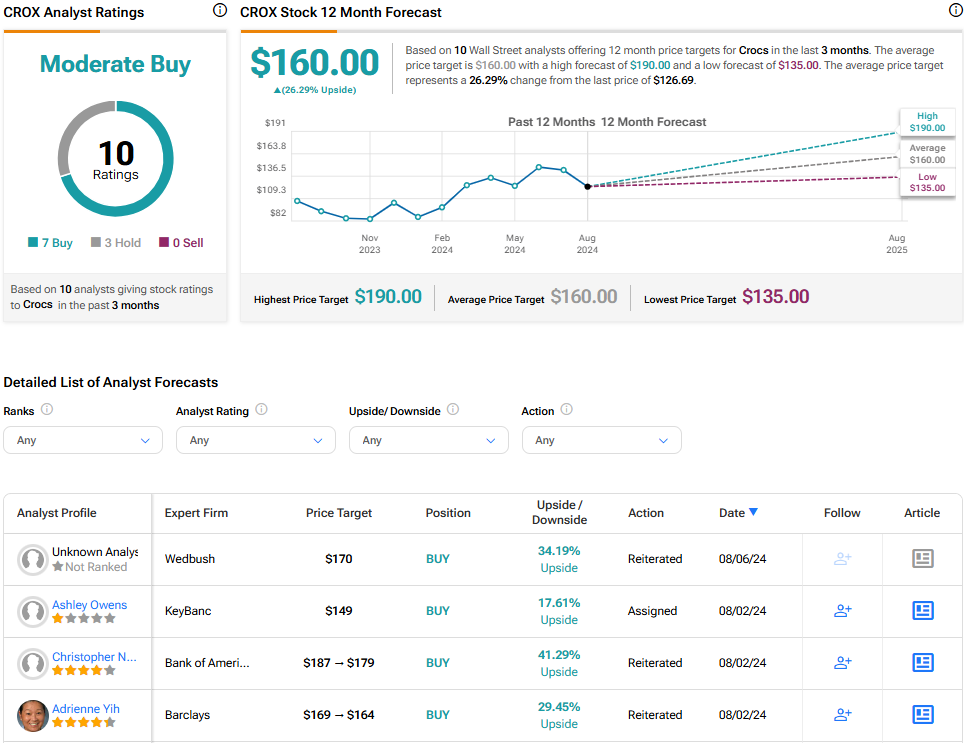

Taking a look at Wall Street’s sentiment on the stock, Crocs currently has a Moderate Buy consensus rating based on seven Buys and three Holds assigned in the past three months. At $160, the average Crocs stock forecast implies 26.3% upside potential.

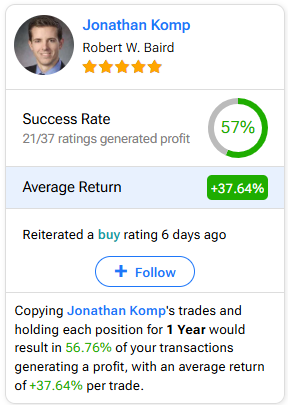

If you’re wondering which analyst you should listen to if you want to buy and sell CROX stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jonathan Komp from Robert W. Baird. His track record is incredible, with an average return of 37.64% per rating and a 57% success rate. Click on the image below to learn more.

The Takeaway

Overall, Crocs’ post-earnings plunge presents a compelling buying opportunity. Despite some setbacks with HEYDUDE sales, the company achieved robust growth, record revenues, and a significant margin expansion. In the meantime, the debt paydown and share repurchases seem like great capital allocation moves. With the stock now trading at an attractive multiple while retaining strong momentum, I remain highly optimistic about Crocs’ overall investment case.