The January Consumer Price Index (CPI) report is out and the stock market isn’t reacting well to the latest inflation measurement. The bad news is inflation increased by 0.5% in January compared to December while rising 3% annually. Both of these metrics were above estimates of 0.3% month-to-month and 2.9% year-over-year increases.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

A major contributor to increased inflation was shelter costs, which ballooned 0.4% in January, representing almost 30% of all items inflation data. The energy index increased 1.1% while the gasoline index was up 1.8%. Food at home jumped 0.5% while food away was up 0.2%, resulting in the food index rising 0.4%.

Excluding volatile food and energy sectors from the CPI data, inflation was 0.4% in January and 3.3% over the past year. Yet again, this data hit markets hard today as experts predicted inflation of 0.3% and 3.1%.

What This Means for the Stock Market

Inflation coming in higher than expected is bad news for the stock market. Investors have been hoping for interest rate cuts but increased inflation supports the Federal Reserve’s stance of delaying them. This backs up comments made by Fed Chairman Jerome Powell yesterday during his meeting with the Senate Banking Committee about the central bank being in no rush to cut rates.

How to Play the Stock Market Going Forward

Traders must accept that elevated interest rates are here to stay when making investment decisions. This may deter them from seeking growth stocks as high interest rates weigh on them more than others. Instead, they should seek out stocks that perform well when interest rates are up.

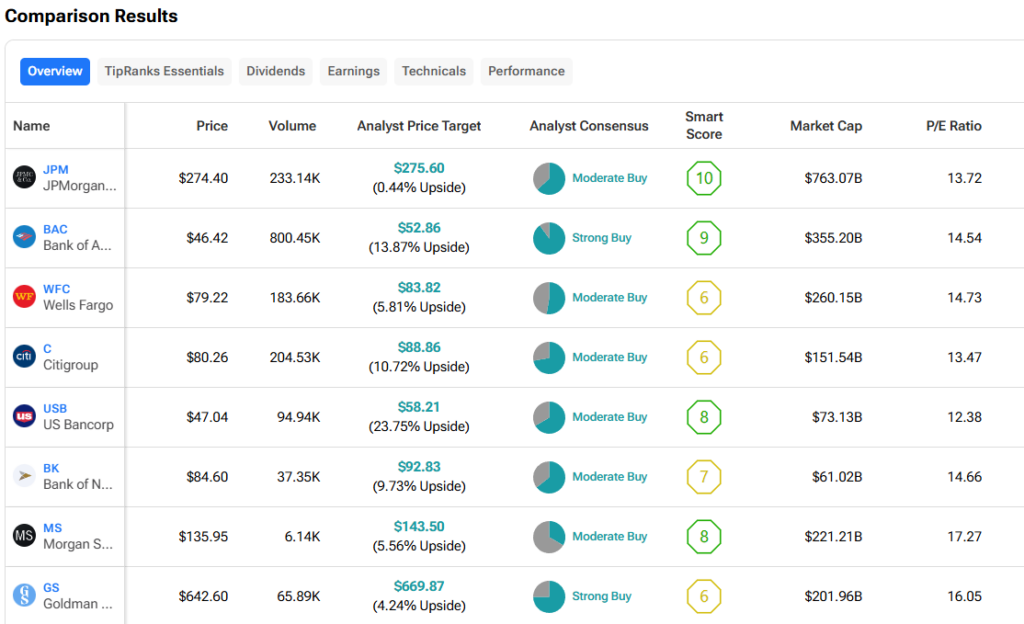

The banking sector is one that typically does well when inflation rates are increased. While many of the top bank stocks are falling alongside the latest CPI data, this could mark an attractive entry point for potential gains. Two bank stocks that stick out are Bank of America (BAC) and Goldman Sachs (GS) with Strong Buy ratings.