The Campbell’s Company (CPB) announced a major change in its leadership late on Tuesday. The company, known for its iconic chicken noodle soup, announced the retirement of its President and CEO, Mark Clouse, after leading the company since 2019. Clouse will retire effective January 31, 2025.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following his retirement from Campbell’s, Clouse will assume the role of president of the National Football League’s (NFL) team, Washington Commanders.

Clouse’s tenure has been marked by pivotal changes, including the company’s rebranding from Campbell Soup to Campbell’s Company, reflecting its diversified product portfolio. Beyond soups, Campbell’s offerings include Snyder’s-Lance pretzels, Goldfish crackers, and Rao’s sauces.

Beekhuizen Will Step into Clouse’s Shoes

Mick Beekhuizen, a key member of Clouse’s leadership team since September 2019, will replace Clouse as the new CEO. Beekhuizen initially joined CPB as CFO in 2019 and later oversaw the meals and beverage division as president in 2022. He will officially assume the CEO role on February 1, 2025.

CPB Reports Fiscal Q1 Results

In another development, CPB reported its Fiscal Q1 results, showing adjusted earnings of $0.89 per share, a 2% year-over-year decline but above analysts’ expectations of $0.82 per share. The company recorded sales of $2.8 billion, a 10% year-over-year increase, surpassing consensus estimates of $2.75 billion.

Additionally, the company reiterated its FY25 guidance, expecting net sales growth of 9% to 11% and adjusted earnings between $3.12 and $3.22 per share.

CPB Announces Quarterly Dividend

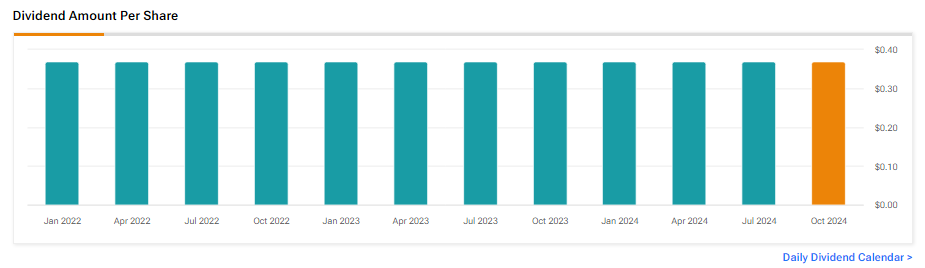

Moving over to dividends, CPB announced a 5% increase in its quarterly dividend to $0.39 per share, payable on January 27 to shareholders of record at the close of business on January 2, 2025.

Is CPB Stock a Good Buy?

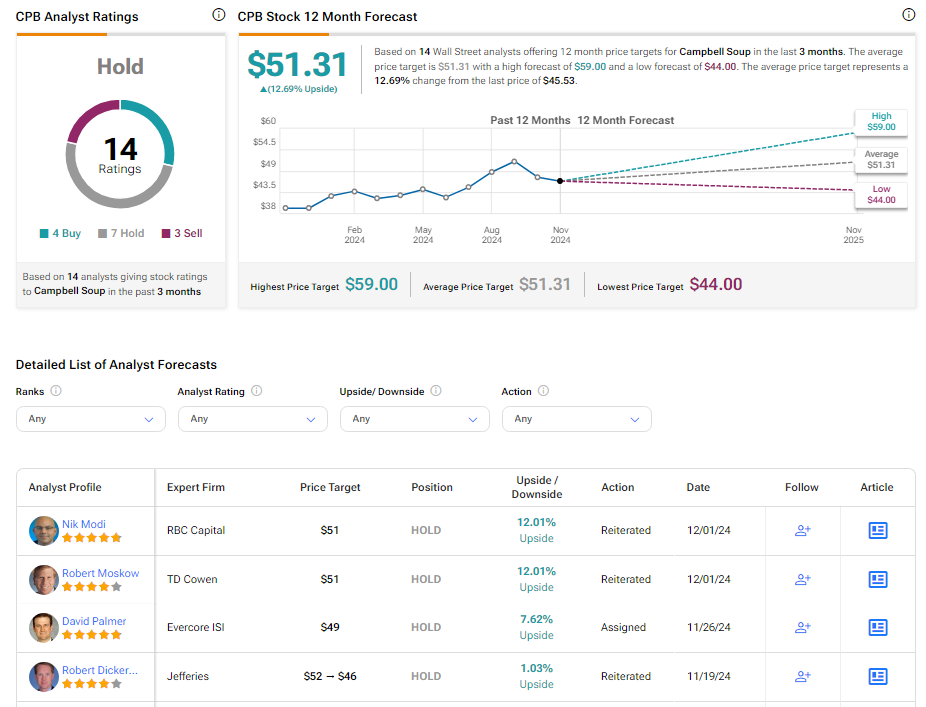

Analysts remain sidelined about CPB stock, with a Hold consensus rating based on four Buys, seven Holds, and three Sells. Over the past year, CPB has increased by more than 10%, and the average CPB price target of $51.31 implies an upside potential of 12.7% from current levels.