U.S. President Donald Trump added lumber and forest products to a list of goods that are likely to be hit with 25% tariffs in the coming weeks, in a move that could dent profit margins of homebuilder stocks such as Tolls Brothers (TOL) and DR Horton (DHI).

“I’m going to be announcing tariffs on cars and semiconductors and chips and pharmaceuticals, drugs and pharmaceuticals and lumber, probably, and some other things over the next month or sooner,” Trump said in Miami on Wednesday.

Companies are Mindful of Risks

Lumber prices soared during the pandemic amid a major supply chain crisis, while spiking once more as Russia invaded Ukraine in February 2022. Since then prices have retreated considerably but the threat of tariffs means companies are watchful once more.

Commenting yesterday after its Fiscal Q1 earnings, the CEO of luxury homes maker Toll Brothers said there had been no impact yet from tariffs.

“We have not seen any immediate supply chain impacts from tariffs or labor shortages due to changes in immigration policies,” said chief executive Douglas Yearley.

He went on say that the firm is “monitoring developments closely and will pivot as necessary to deal with any issues that arise,” adding: “We have all learned valuable lessons from the supply chain shocks we navigated through a few years ago with the pandemic.”

DR Horton said last month it was keeping a close eye on events. Mike Murray, the homebuilder’s chief operating officer, said it was “hard to foresee what the impact would be” from tariffs.

Builder Sentiment Plunges on Tariffs

However, Trump’s comments on lumber may change the outlook. Although Trump maintains that the U.S. has “all the trees you need,” America sources about 30% of its lumber needs from the likes of Canada and China.

The U.S. last raised duties on softwood lumber from Canada in August 2024 from 8.05% to 14.54%. The excising of countervailing and anti-dumping duties of this level already suggests that the White House might not stop at 25% on lumber.

Approximately 7% of all goods used in new residential construction, worth around $13 billion, originate from abroad, according to the National Association of Home Builders (NAHB). Of this lumber accounts for about $8.5 billion of the $13 billion.

Faced with the threat of tariffs and a muddier economic outlook, companies are feeling the heat. Homebuilder sentiment fell sharply in February over concerns on tariffs, elevated mortgage rates and high housing costs, according to the NAHB/Wells Fargo Housing Market Index (HMI) released earlier this week.

Builder confidence in the market for newly built single-family homes was 42 in February, down five points from January and the lowest level in five months.

“While builders hold out hope for pro-development policies, particularly for regulatory reform, policy uncertainty and cost factors created a reset for 2025 expectations in the most recent HMI,” said NAHB Chairman Carl Harris. “Uncertainty on the tariff front helped push builders’ expectations for future sales volume down to the lowest level since December 2023.”

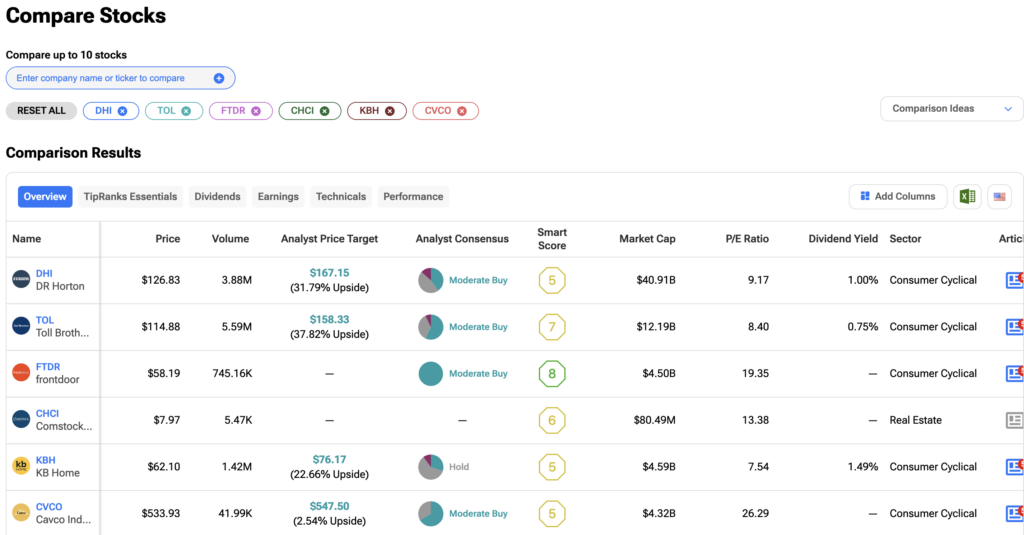

What Are the Best Homebuilder Stocks to Buy?

For investors interested in investing in homebuilders, we have rounded up the best stocks that analysts are bullish about using the TipRanks Stock Comparison Tool.