Costco Wholesale (COST) stock gained more than 1% in the aftermarket trading session after the warehouse retailer announced impressive sales figures for June. COST’s monthly net sales jumped 8% to $26.44 billion, a major increase from $24.48 billion in June 2024.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The five-week retail period ending July 6 saw comparable sales rise 5.8%, with e-commerce leading the charge, up 11.5% year-over-year.

Excluding the impact of gasoline prices and foreign exchange fluctuations, Costco’s total comparable sales for June were even stronger at 6.2%.

For the first 44 weeks of the fiscal year, Costco’s net sales reached $227.46 billion, an 8% increase compared to the same period last year. This reflects Costco’s continued strength in the retail sector, driven by growth across its various sales channels.

International Markets Lead the Way

It must be noted that Costco’s sales in the international markets outpaced domestic performance. Same-store sales grew 10.9% outside the U.S. and Canada. Canada posted a healthy 6.7% gain, while the U.S. saw a more modest 4.7% increase.

When adjusted for gasoline prices and currency fluctuations, the U.S. market saw a 5.5% comparable sales increase, Canada posted 7.9% growth, and other international markets expanded by 8.2%.

Costco’s June report shows that it can operate value-driven retail stores and grow its online business as well. With strong demand overseas and steady digital sales, COST is well-positioned for growth in the near term.

TipRanks AI Analyst Bullish on COST Stock

According to TipRanks’ A.I., Costco scored 76 out of 100 with an Outperform rating. Costco’s solid financial results and upbeat Q4 earnings call are key factors behind its strong rating. While valuation remains a concern and technical signals are mixed, steady growth in memberships, rising e-commerce sales, and smart global expansion continue to support the company’s long-term potential.

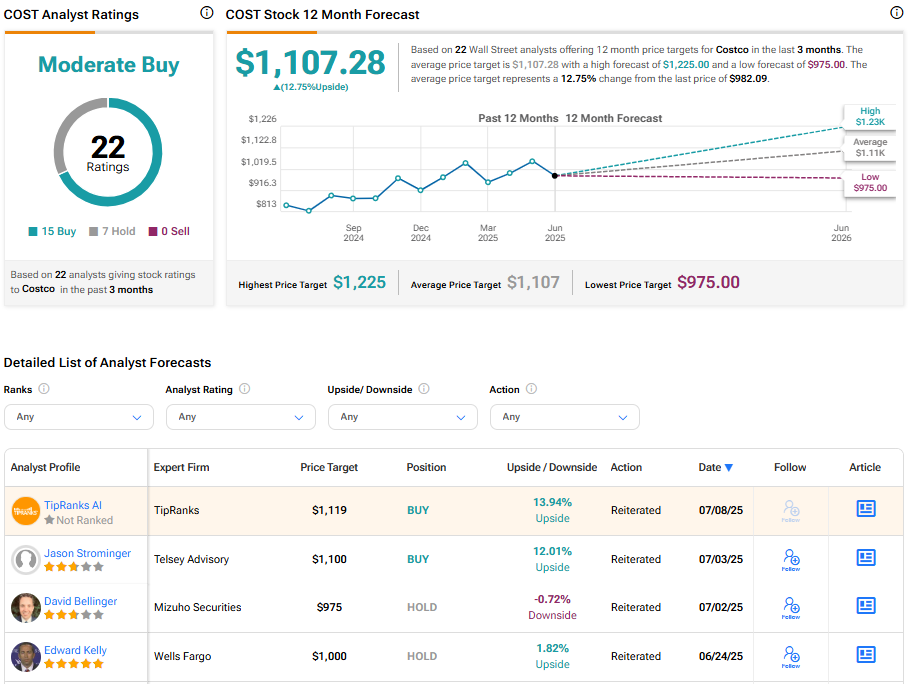

TipRanks’ AI analyst sets a price target of $1,119 for Costco stock, which points to an upside of about 14%.

What Is the Prediction for Costco Stock?

Turning to Wall Street, COST stock has a Moderate Buy consensus rating based on 15 Buys and seven Holds assigned in the last three months. At $1,107.28, the average Costco stock price target implies 12.75% upside potential.