Shares in payments groups Visa (V) and Mastercard (MA) were lower in value today on concerns that they could both face regulatory action in the U.K. on competition grounds.

Visa was down around 2% and Mastercard off a similar amount on reports that the U.K. payments regulator fears that the “card duopoly’s sharp fee increases” were costing businesses £170 million in extra charges a year.

Nearly 100% of the Market

As reported in the Financial Times, Visa and Mastercard account for an enormous 95% of all debit and credit card payments in the U.K. They have increased the fees they charge merchants by 25% above inflation since 2017, according to the Payment Systems Regulator.

This led to complaints from merchants and retailers and calls for more competition in the market. Indeed the regulator said today that it has “found that there is a lack of competition in the market” and evidence that Visa and Mastercard are therefore able to charge more than they would normally with more rivals breathing down their necks.

Remedies May be Needed

As such the regulator plans to impose what it describes as “remedies” on the card providers. This could include caps on the fees the two companies charge. However, it plans to consult on these remedies before taking any “corrective action.”

According to the FT both Visa and Mastercard moved swiftly to defend their policies. Mastercard said it disagreed with the regulator’s findings and that it underplayed the work it did in innovation and investment into security. Visa said its fees reflected the “immense value” that it provides to financial institutions, merchants and consumers.

However, it is not just the U.K. where they are under pressure. An EU investigation into competition concerns around the two providers is also understood to be in motion.

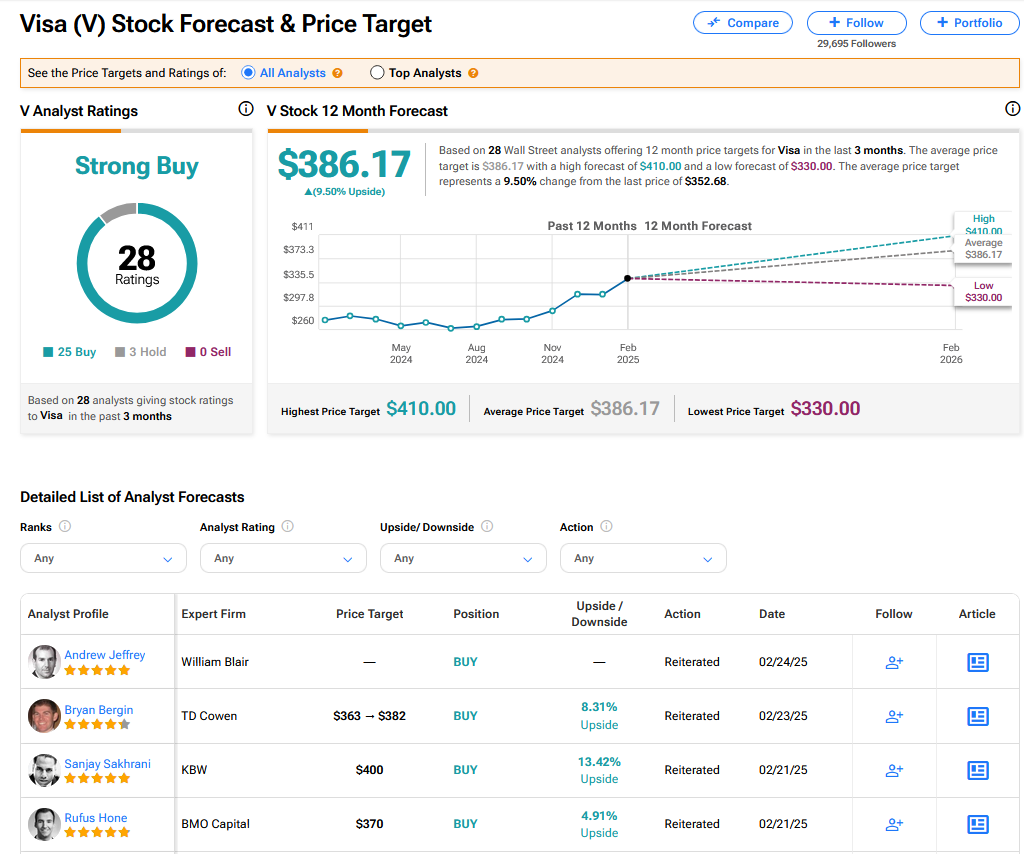

Is V a Good Stock to Buy Now?

On TipRanks, V has a Strong Buy consensus based on 25 Buy and 3 Hold ratings. Its highest price target is $410. V stock’s consensus price target is $386.17 implying an 9.50% upside.