A study has noted that COVID-19 vaccines developed by Pfizer Inc. (PFE) and BioNTech SE (BNTX) have shown lower efficacy on the Omicron variant in South Africa. So far, South Africa has administered about 20 million Pfizer doses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Shares of Pfizer hit a new all-time high of $55.95 driven by the acquisition of Arena Pharmaceuticals, and closed the day marginally up at $55.54 on December 14. Meanwhile, BNTX shares closed at $276.77 on December 14.

Omicron Scare in South Africa

The emergence of the Omicron variant was first found in South Africa. According to a real-world study conducted on 211,000 COVID-19 test results, of which 78,000 were infected by Omicron, the vaccine showed only 70% protection against the variant.

The daily number of cases with hospitalizations is increasing in South Africa. Those who had taken two doses of the Pfizer vaccine between November 15 and December 7, had a 70% probability of avoiding hospitalization, lower than 93% showed during the Delta wave infections.

Moreover, a study from Discovery, the largest health insurer in SA, showed that the overall protection against the COVID-19 vaccine had fallen to 33% against the 80% protection shown earlier. However, Discovery also warned that these stats should not be taken as conclusive.

According to senior research fellow in global health at the University of Southampton, Michael Head, there was uncertainty regarding the Omicron variant. He said, “It is important to avoid inferring too much right now from any national scenario. For example, the narrative around South Africa is that Omicron may be much milder, whereas reports out of Denmark broadly suggests the opposite.”

The study also showed that the reinfection risk was higher during the third wave as opposed to the earlier ones. Adults showed 29% lower hospitalization rates, while children showed a 20% higher risk of hospitalization during the fourth wave compared to the first wave last year.

See Analysts’ Top Stocks on TipRanks >>

Analysts’ View

Yesterday, Mizuho Securities analyst Vamil Divan lifted the price target on the stock to $56 (almost fully valued at current levels) from $44, and maintained a Hold rating.

Divan updated the Pfizer model based on the recent announcements regarding the acquisition Arena Pharmaceuticals, Inc. (ARNA), as well as its oral antiviral Paxlovid’s anticipated approval. The analyst surveyed more than 500 individuals to screen their interest in Paxlovid.

Divan estimates sales from Paxlovid of around $24 billion/$16 billion in 2022/2023 and ongoing annual revenue beyond 2024 to be between $1 billion and $3 billion.

Divan said, “We also adjust estimates for Comirnaty and Eliquis, with our model updates increasing our price target to $56. We see room for some further near-term upside around Comirnaty/Paxlovid headlines, but on a fundamental level see Pfizer shares reasonably valued, keeping us Neutral-rated.”

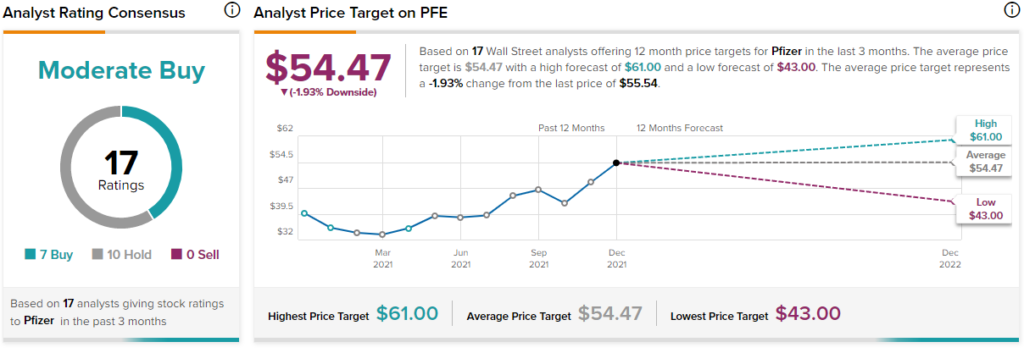

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 10 Holds. The average Pfizer price target of $54.47 implies 1.9% downside potential to current levels. Shares have gained 43.5% over the past year.

Related News:

Meta Platforms Buys Name Rights for Meta

Starbucks China to Probe Expired Ingredients Usage

UBS Found Guilty in French Tax Case; Penalty Slashed to $2B