Shares of Moderna surged 10% on Thursday after it revealed subjects in the Phase 1 study led by the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH), evaluating its COVID-19 vaccine candidate, mRNA-1273, demonstrated durable immunity.

The update from Moderna (MRNA) came in the form of a letter to the editor published in the New England Journal of Medicine, and stated that its COVID-19 vaccine retained high levels of neutralizing antibodies through 119 days following first vaccination (90 days following second vaccination).

“mRNA-1273 produced high levels of binding and neutralizing antibodies that declined slightly over time, as expected, but they remained elevated in all participants three months after the booster vaccination,” Alicia T. Widge M.D. of Vaccine Research Center, NIAID, NIH and other authors wrote. “Although correlates of protection against SARS-CoV-2 infection in humans are not yet established, these results show that despite a slight expected decline in titers of binding and neutralizing antibodies, mRNA-1273 has the potential to provide durable humoral immunity.”

The data was consistent across all of the age cohorts, with the authors noting that no new serious adverse events were witnessed.

Additionally, the biotech reiterated its target of having roughly 20 million doses available in the U.S. by the end of 2020, with it also expecting to have between 100-125 million doses available globally in the first quarter of 2021. Of these, 85-100 million will be available in the U.S. and 15-25 million will be made available outside of the U.S.

Moderna’s update comes on the heels of its November 30 announcement that the primary efficacy analysis of the Phase 3 study evaluating mRNA-1273, which was conducted on 196 cases, confirmed the 94.1% efficacy observed at the first interim analysis. (See Moderna stock analysis on TipRanks)

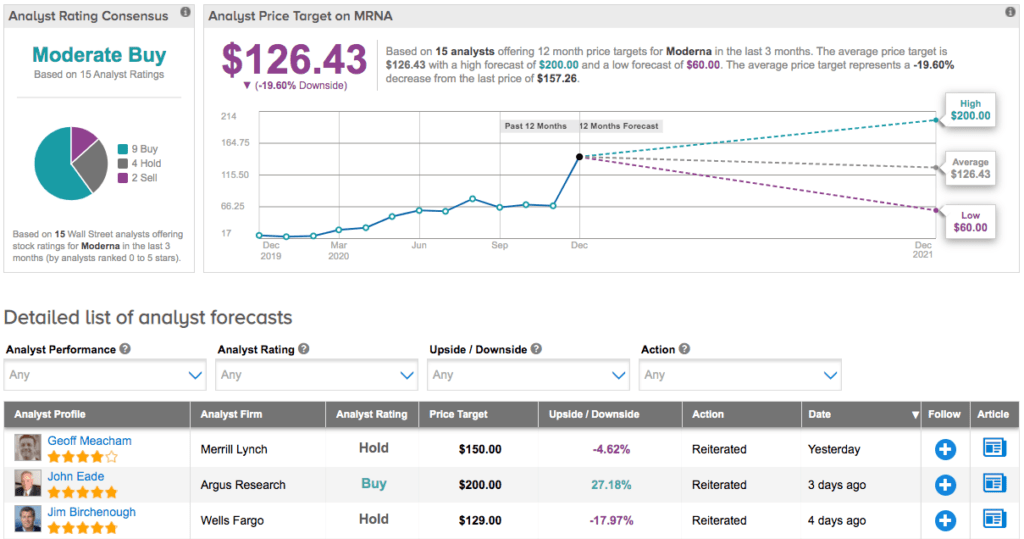

Following the update, BofA Securities analyst Geoff Meacham bumped up the price target from $105 to $150, but reiterated a Hold rating. Explaining his hesitation, the analyst argues that while Moderna’s pipeline is impressive, he has doubts about the long-term sustainability of COVID-19 revenue. Meacham is also unsure about any broad read-through of the COVID-19 program to the rest of its development pipeline.

From other analysts, Moderna has earned a total of 9 recent Buys, 4 Holds and 2 Sells, adding up to a Moderate Buy analyst consensus. As shares have exploded 705% year-to-date, the average price target of $126.43 indicates 20% downside potential.

Related News:

Eli Lilly Inks $812.5M Covid-19 Antibody Supply Deal With US; Street Sees 18% Upside

Merck Cashes In On Moderna Equity Investment As Stock Pops 631% YTD

AdaptHealth Snaps Up AeroCare In $2B Deal; Shares Pop 19%