CoreWeave (CRWV) has officially sold all of its shares in Applied Digital (APLD), according to a regulatory filing submitted on June 10. The filing confirms that CoreWeave now holds 0% of APLD’s stock, with no direct or indirect beneficial ownership.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The exit comes as a surprise to investors, given the two companies’ ongoing business relationship. Applied Digital recently announced two major lease agreements with CoreWeave, valued at around $7 billion over 15 years. These deals involve long-term commitments for data center space and remain active despite the stock divestment.

The market reacted quickly. Shares of APLD fell by roughly 11% after the filing became public. Meanwhile, CoreWeave stock is down just over 1% in Friday’s trading.

What Does it Mean for CRWV and APLD

Even though CoreWeave no longer owns shares of APLD, it still holds a warrant issued on May 28. That warrant gives CoreWeave the right to purchase up to 13,062,521 shares at $7.19 each. The filing does not indicate whether any of those warrants have been exercised. As of June 10, CoreWeave is not listed as a beneficial owner, meaning it likely hasn’t acted on the warrant yet.

For APLD shareholders, the news raises short-term uncertainty. A major partner and former investor stepping away could unsettle confidence, even with strong commercial contracts in place. The potential for future dilution from warrant exercises adds another variable for investors to consider. For CoreWeave, the sale could reflect a shift in strategy or capital reallocation. The company remains operationally involved but has temporarily removed its exposure to APLD stock.

Analysts may differ in their interpretation of the move. Some may focus on the $7 billion in lease revenue that could support APLD’s long-term outlook. Others may see the stock sale as a signal of reduced alignment between the two companies.

Investors should watch for updates on the warrants and any changes to the business relationship. As of now, the lease agreements remain a key source of revenue for APLD, while CoreWeave continues to grow its own operations independently. TipRanks readers can follow APLD and CRWV for the latest analyst ratings, price targets, and insider activity to understand better what happens next.

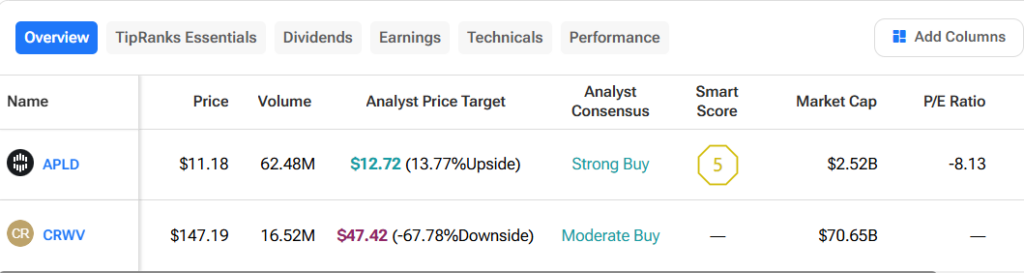

Using Tipranks’ Comparison Tool, we’ve compared the two companies to gain a broader perspective on both stocks: