Poolside, an AI startup backed by Nvidia (NVDA), is teaming up with AI infrastructure firm CoreWeave (CRWV) to build a massive new data center complex in West Texas, known as Project Horizon. The site covers 568 acres and will be developed in eight phases, with each adding 250 megawatts of capacity. Notably, the land belongs to the Mitchell family, who are longtime operators in the state’s oil and gas sector. It also sits near a natural gas hub with strong water and processing infrastructure that could lower costs and make the project more sustainable over the long term.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

As part of the partnership, CoreWeave will supply over 40,000 Nvidia GPUs for AI computing and act as both the lead tenant and operations partner for the first 250 MW phase, with an option to expand capacity by another 500 MW. The complex will also use an existing on-site gas plant built by Occidental Petroleum (OXY) and nearby pipelines, which will allow it to generate its own electricity.

This move is part of the current race to build AI-ready infrastructure. For example, OpenAI (PC:OPAIQ) has been making deals with companies like Advanced Micro Devices (AMD), Broadcom (AVGO), and Nvidia to boost its computing power, while Nscale recently signed a huge deal with Microsoft (MSFT) for 200,000 Nvidia GPUs across the U.S. and Europe. Meanwhile, a group including BlackRock (BLK), Nvidia, Microsoft, and Elon Musk’s xAI (PC:XAIIQ) is reportedly considering a $40 billion takeover of a major global data center operator.

Is CRWV Stock a Good Buy?

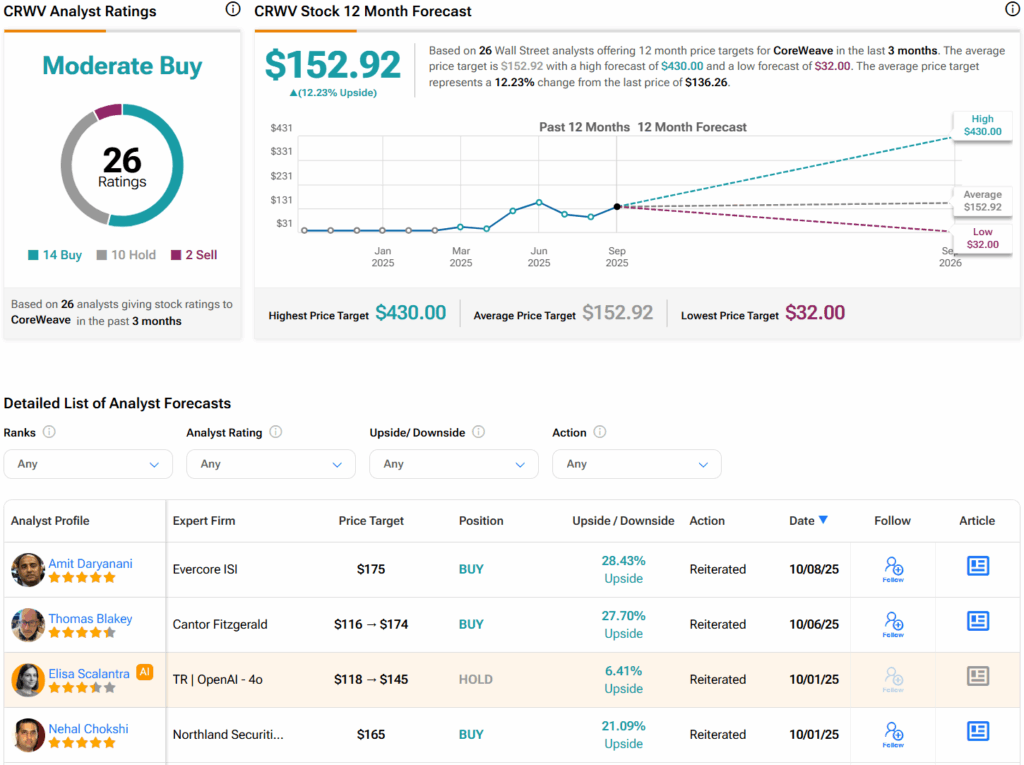

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 14 Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CRWV price target of $152.92 per share implies 12.2% upside potential.