New Jersey-based data center operator CoreWeave (CRWV) did not post the biggest rally of 2025, but it is the most searched-for stock globally in 2025, according to data from Alphabet’s (GOOGL) Google Trends.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

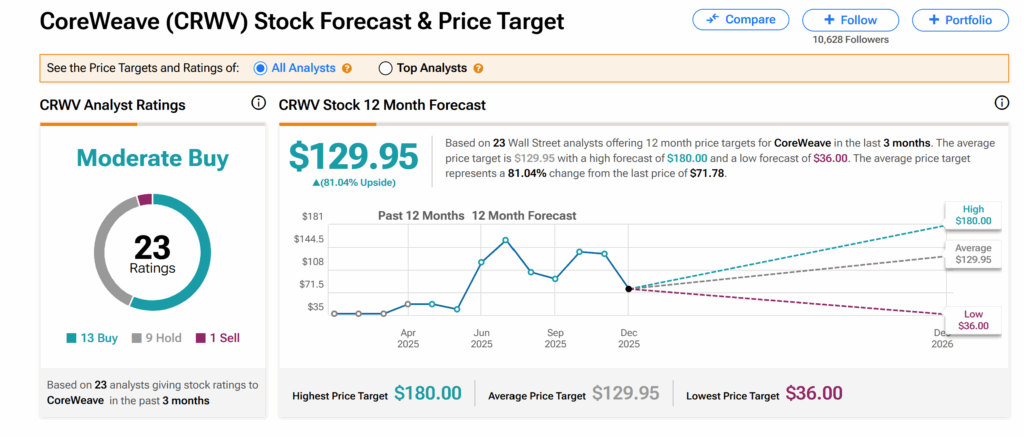

After an almost 100% rally this year, the analyst consensus on Wall Street is that CoreWeave could further surge by 81% in 2026, riding the artificial intelligence momentum. The firm started trading in the U.S. in March in one of the most talked-about IPOs of 2025.

Analysts Back CoreWeave’s AI Growth Story into 2026

On Wall Street, CoreWeave’s shares currently carry a Moderate Buy consensus rating based on 13 Buys, nine Holds, and one Sell issued by 23 analysts over the past three months. This is accompanied by an average CRWV price target of $129.95 that implies 81.04% upside.

Heading into 2026, analysts are generally upbeat about CoreWeave despite various periods of volatility throughout the year. In its Q3 2025 results released last month, CoreWeave more than doubled its revenue to $1.366 billion, thereby shrinking its earnings per share loss by 88% to 22 cents.

While CoreWeave’s softer outlook for its fourth‑quarter earnings results, due in February 2026, has prompted several analysts to trim their price targets, the massive upside expected by analysts over the next 12 months suggests optimism remains strong for the American AI cloud‑capacity provider.

Wall Street Bets on AI Momentum despite Challenges

During the quarter, CoreWeave faced supply challenges and delays in building out power shells — the data center spaces with power and cooling infrastructure — a move that impacted its revenue. However, Citi analyst Tyler Radke believes that the build‑out of CoreWeave’s infrastructure is going as planned heading into the next quarter.

Radke also expects CoreWeave — which secured a $14 billion computing power supply deal with Meta (META) in late September — to continue to enjoy “robust” demand for its cloud and graphics processing unit capacity. While the four-star analyst trimmed his CRWV price target by 30% to $135 per share, the target still implies about 87% upside potential.

In contrast, Roth MKM analyst Rohit Kulkarni has stronger bullish views on CoreWeave, as he pointed to the neocloud company’s “proven scale.” Kulkarni also described the firm as a “top-four market share winner” in the AI cloud market. The analyst’s price target of $110 suggests more than 52% upside.

Looking into 2026, analysts on Wall Street are also bullish on CoreWeave’s AI neocloud competitors, Sydney-based Iren Limited (IREN) and Amsterdam-based Nebius (NBIS).

Should You Buy CoreWeave in 2026?

According to analysts on Wall Street, CoreWeave’s shares are poised for a significant jump of 81.04% in 2026, even as a few analysts see the stock price breaching 100% over the next 12 months.