CoreWeave’s (CRWV) stock traded nearly 7% higher on Monday afternoon after the data center operator greeted investors with the news of its $6.3 billion deal with chipmaking giant Nvidia (NVDA). However, Kerrisdale, a New York-based investment firm, thinks there is nothing much to rejoice over.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a newly released report, the hedge fund manager noted that it has taken a short position in CRWV stock, describing CoreWeave as “the poster child for the AI infrastructure bubble.” According to Kerrisdale, CoreWeave is a “debt-fueled” graphics processing units (GPU) rental business that has “no moat” but is “dressed up as innovation.”

The company, therefore, downgraded CRWV stock by 90% from its current price, believing that a fair value for the shares is $10. CoreWeave’s shares traded at around $120 as of 1 p.m. EDT on Monday.

What Does CoreWeave Do?

CoreWeave runs data centers built specifically to deliver GPU-powered cloud computing services that are designed for AI, machine learning, and other high-performance workloads.

The company also rents out GPUs and specialized hardware and GPU infrastructure to companies such as OpenAI and Microsoft (MSFT). However, Microsoft recently refused to renew its contract with CoreWeave, opting instead for a $20 billion deal with its rival Nebius (NBIS).

Furthermore, despite recently exceeding $1 billion in revenue for the first time during its recent Q2 2025, CoreWeave suffered $131 million in adjusted net loss. This was attributed to higher interest payments on debt taken to expand the company’s GPU and data center infrastructure to keep up with the surging demand for AI infrastructure.

Kerrisdale Says CoreWeave “Rests More on Hype”

Kerrisdale’s sharp downward revision trails a sell-off frenzy that has hit CoreWeave following the expiration of its IPO lock-up period, which has raised concern among retail investors. Yet, CoreWeave’s stock has soared by more than 200% to over $119 since it went public in late March. Also, the shares have rallied by more than 31% over the last five days alone.

Kerrisdale believes that “the latest surge rests more on hype, not substance,” as CoreWeave’s business model “revolves entirely around leasing discounted GPU access to a handful of large customers”.

“This structure has fueled rapid expansion but leaves CoreWeave dangerously exposed to customer concentration, weak pricing power, and eroding relevance as hyperscalers scale their own infrastructure,” Kerrisdale wrote in the report.

Deutsche Bank Sees “Positive Factors Coming Together”

On the contrary, Deutsche Bank’s (DB) Brad Zelnick placed a Catalyst Call: Buy rating on CRWV stock, suggesting it as a short-term investment idea. Zelnick pegged his argument on the “almost insatiable” demand for AI infrastructure.

The analyst also sees “positive factors coming together” to push up CoreWeave’s revenue in the next quarter or two. Furthermore, he believes that the demand for AI infrastructure will continue to surpass supply in the short-to-medium-term horizon.

Moreover, he pointed out that some of CoreWeave’s data center infrastructure remains unleased to customers, and they are expected to become operational over the next year to a year and a half.

Can You Buy Stock in CoreWeave?

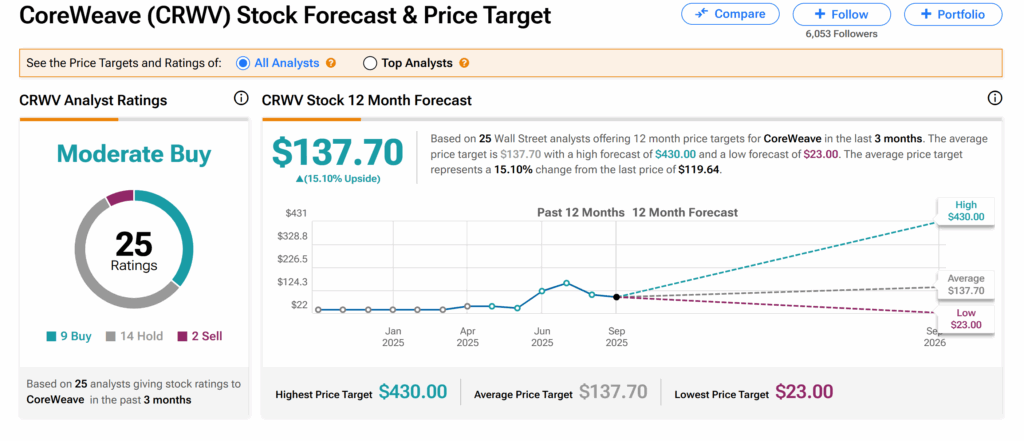

On Wall Street, CoreWeave’s shares currently hold a Moderate Buy consensus rating based on nine Buys, 14 Holds, and two Sells assigned by 25 Wall Street analysts over the past three months. The average CRWV price target is $137.70, which suggests a 15% growth potential from its current level.