Over the past few months, we have seen a massive rally in precious metals as well as base metals. While copper (CM:HG) prices have moderated over the past week, the red metal still remains nearly 23% higher over the past year. Importantly, the rally in copper may not be over, and there may still be potential for further price increases.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Legroom for Further Price Rise

At present, the copper market is experiencing a supply-demand imbalance, with production falling well short of demand. In fact, leading commodity trader Pierre Andurand predicts copper prices will hover around $40,000 per ton over the next four years, according to the Financial Times. This follows a jump in copper prices from around $7,900 per ton in October to the current level of $10,130 per ton.

This price surge has also led to a nearly 60% rise in Southern Copper (NYSE:SCCO) shares and an 81% jump in Ero Copper (NYSE:ERO) shares over the last six months. The United States Copper Index Fund (NYSE:CPER) ETF is also up by around 23% during this period. These gains seem likely to compound further as the world’s hunger for electrification grows. Copper is required in virtually all of today’s critical undertakings, from EVs and solar energy to data centers.

According to Markets Insider, the worldwide copper supply fell to its lowest level last year, and major producers are racing to ramp up production. Copper production in China is running at a record level. The turnaround plans of Anglo American (GB:AAL) involve parting ways with platinum, diamond, and coal, and focusing on iron ore and copper. Additionally, Grupo Mexico’s mining unit, Asarco, plans to restart its copper smelter in the U.S.

Is Copper Expected to Go Up in Price?

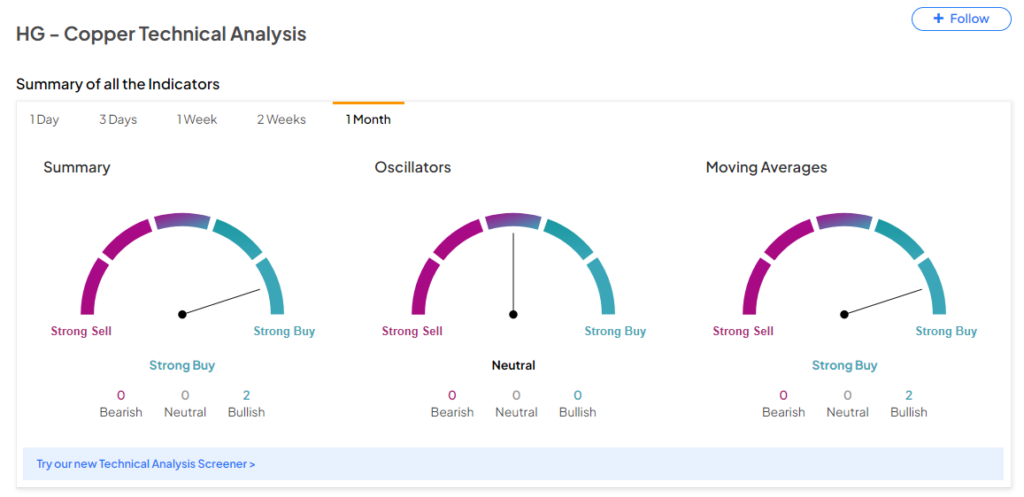

Still, new capacity additions could be some time away, and copper’s price upsurge could continue over the coming months. The TipRanks Technical Analysis tool is also flashing a Strong Buy signal for copper on a monthly timeframe.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure