Constellation Brands (STZ) is set to release its second quarter of Fiscal 2025 financials on October 3. Wall Street analysts expect the company to report earnings of $4.08 per share for Q4, up 10% year-over-year. Also, analysts expect revenues to increase 3.9% from the year-ago figure to $2.95 billion, according to TipRanks’ data.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With a market capitalization of $47.08 billion, STZ is an alcohol company that produces beer, wine, and spirits. The company’s portfolio features premium brands like Corona, Modelo, Robert Mondavi, and SVEDKA Vodka across the U.S., Canada, Mexico, and other international markets.

Factors to Consider Ahead of Q2

Analysts forecast both revenues and earnings to increase in fiscal Q2, signaling optimism for Constellation Brands’s near-term performance. Also, shares of STZ gained 5.3% over the past year and 7.8% year-to-date, reflecting positive market sentiment.

In addition, analysts, according to TipRanks’ Bulls Say, Bears Say tool shown below, believe Constellation Brands’ cost management is a key strength. The company is expected to save more than anticipated, allowing it to invest more in high-return marketing campaigns. Additionally, STZ has raised the midpoint of its FY25 adjusted EPS outlook to $13.70, reflecting confidence in its financial health.

Nevertheless, some challenges still exist. Bears have noted that consumer spending on beer is not as strong as expected. Recently, the company reduced its FY25 beer sales forecast. Additionally, the slow performance of its wines and spirits division is a concern. For this segment, the company expects to incur a non-cash goodwill impairment loss of approximately $1.5 billion to $2.5 billion.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can gauge options traders’ expectations for the stock post-earnings report. Based on a $245 strike price, with call options priced at $13.63 and put options at $0.90, the expected price movement, based on the at-the-money straddle is 3.66%.

Is Constellation Brands a Good Stock to Buy?

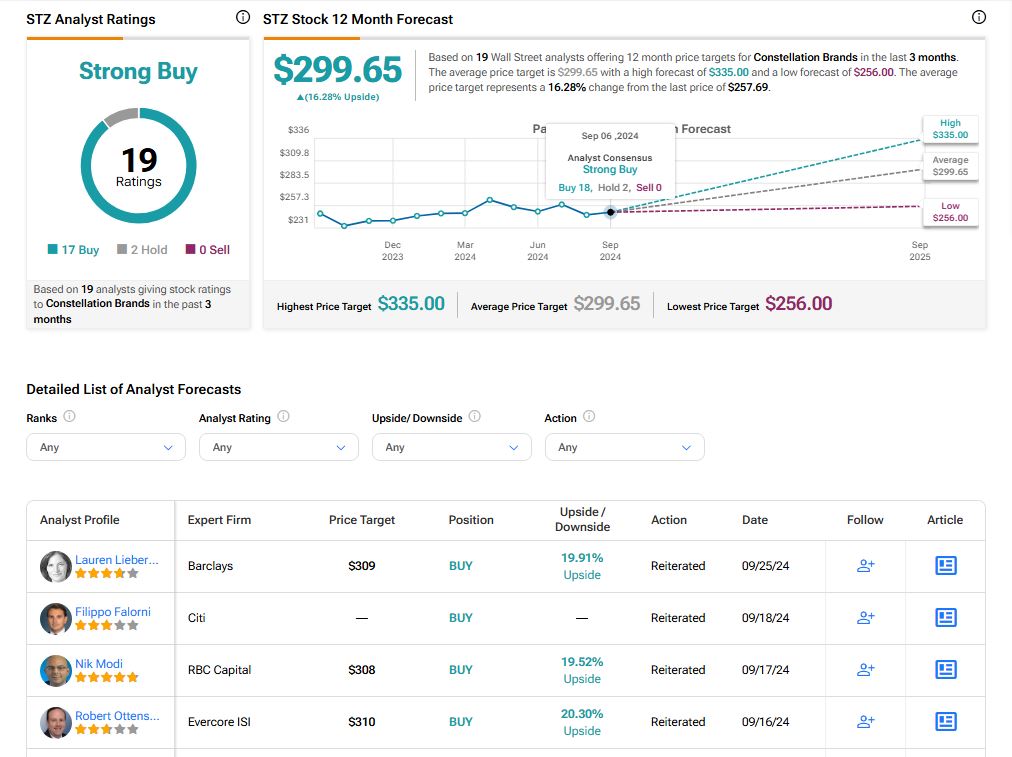

Turning to Wall Street, Constellation Brands has a Strong Buy consensus rating based on 17 Buys and two Holds assigned in the last three months. At $299.65, the average STZ price target implies 16.28% upside potential.