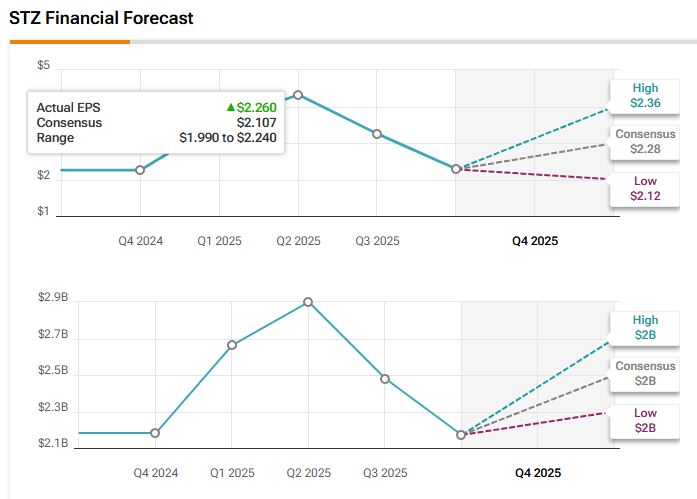

Constellation Brands (STZ) is set to release its fourth quarter of Fiscal 2025 financials on April 9. Wall Street analysts expect the alcohol company to report earnings of $2.28 per share, representing a 0.9% decrease year-over-year. Meanwhile, revenues are expected to decline by 0.5% from the year-ago quarter to $2.13 billion, according to data from the TipRanks Forecast page.

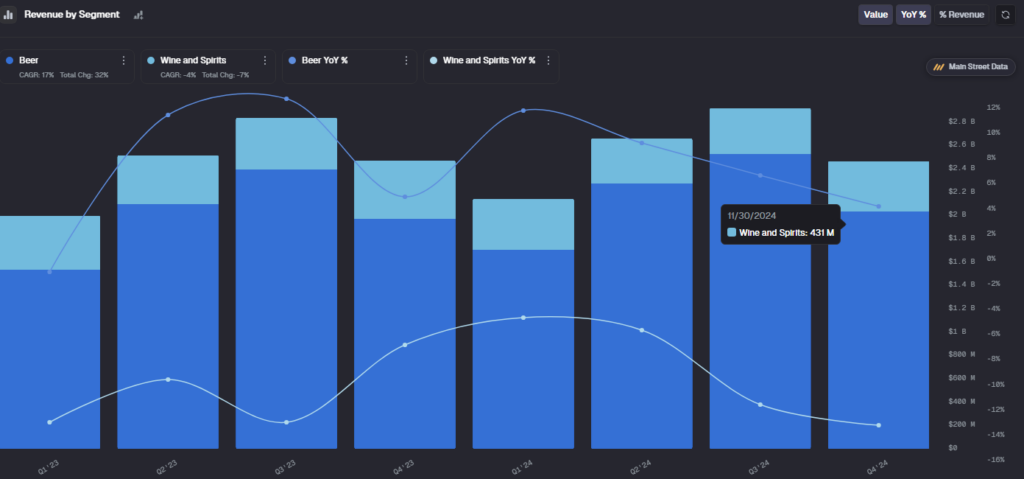

STZ stock has declined over 22% year-to-date, primarily due to rising aluminum tariffs, ongoing weakness in its Wine and Spirits segment, a lowered sales forecast, and a growing trend of consumers cutting back on alcohol consumption. According to Main Street Data, Wine and Spirits segment contributed $431 million in the quarter ended November 30 ,2024, down 1.6% year-over-year.

STZ is an alcohol company that produces beer, wine, and spirits. The company’s portfolio features premium brands like Corona, Modelo, Robert Mondavi, and SVEDKA Vodka across the U.S., Canada, Mexico, and other international markets.

Analysts’ Views Ahead of STZ’s Q4 Earnings

Ahead of Constellation Brands’ Q4 report, UBS analyst Peter Grom pointed out that the company will release results after the market closes on April 9, with a conference call the next morning. This is a change from its usual routine of announcing results and holding the call in the morning. Along with this shift, concerns about tariffs and weaker demand for beer, wine, and spirits have made investors more cautious.

In response to recent market trends, Grom lowered his Q4 EPS estimate slightly from $2.30 to $2.29. Still, he thinks the main focus won’t be on the numbers themselves but on the company’s outlook. While near-term challenges remain, Grom stays positive on the stock over the long run. He believes Constellation Brands can deliver stronger revenue and profit growth than many of its consumer staples peers.

Meanwhile, Bank of America analyst Bryan Spillane kept a Hold rating on Constellation Brands with a $205 price target. He raised his Q4 earnings estimate due to a short-term boost from higher inventory levels ahead of a new tariff. However, he expects this benefit to fade in the first half of FY26. Spillane also pointed to ongoing challenges in beer and wine, leading him to take a cautious view on the stock’s growth potential.

Options Traders Anticipate a 9.36% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.36% move in either direction.

Is Constellation Brands a Good Stock to Buy?

Turning to Wall Street, Constellation Brands has a Moderate Buy consensus rating based on 11 Buys and nine Holds assigned in the last three months. At $221.26, the average STZ price target implies 29.42% upside potential.