Shares in drinks firm Constellation Brands (STZ) staggered lower today on fears that customer demand for beer has fallen flat.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Poor Weather

A new analyst note from Gerald Pascarelli of Needham said the company, known for brands such as Corona Extra and Modelo Especial, has likely experienced a less than merry start to the fiscal year 2026.

Ahead of its Q1 earnings next month, Needham expects beer revenue and operating margin to miss the low end of the full-year guidance and see a potential downside to current Wall Street estimates for the quarter.

“Over the past three months volumes have worsened sequentially, there has been no meaningful improvement in sentiment for the Hispanic consumer, and the weather has been awful in May and early June,” Pascarelli said.

Lost Year

As a result, Needham lowered its fiscal Q1 earnings per share estimate to $3.20 from $3.30, and cut its fiscal year 2026 and 2027 EPS estimates to $12.64 and $13.76 from $12.75 and $13.81, respectively.

According to TipRanks, the group is expected to report earnings per share of $3.37 for the quarter, compared with $3.57 in the same period last year.

Needham maintained its buy rating on the stock but lowered its price target to $195 from $215.

Wells Fargo lowered its price target on Constellation Brands to $196 from $210 and kept an Overweight rating on the shares. It said that beer trends have worsened into 2025 and that it looks like it could be a “lost” year.

Is STZ a Good Stock to Buy Now?

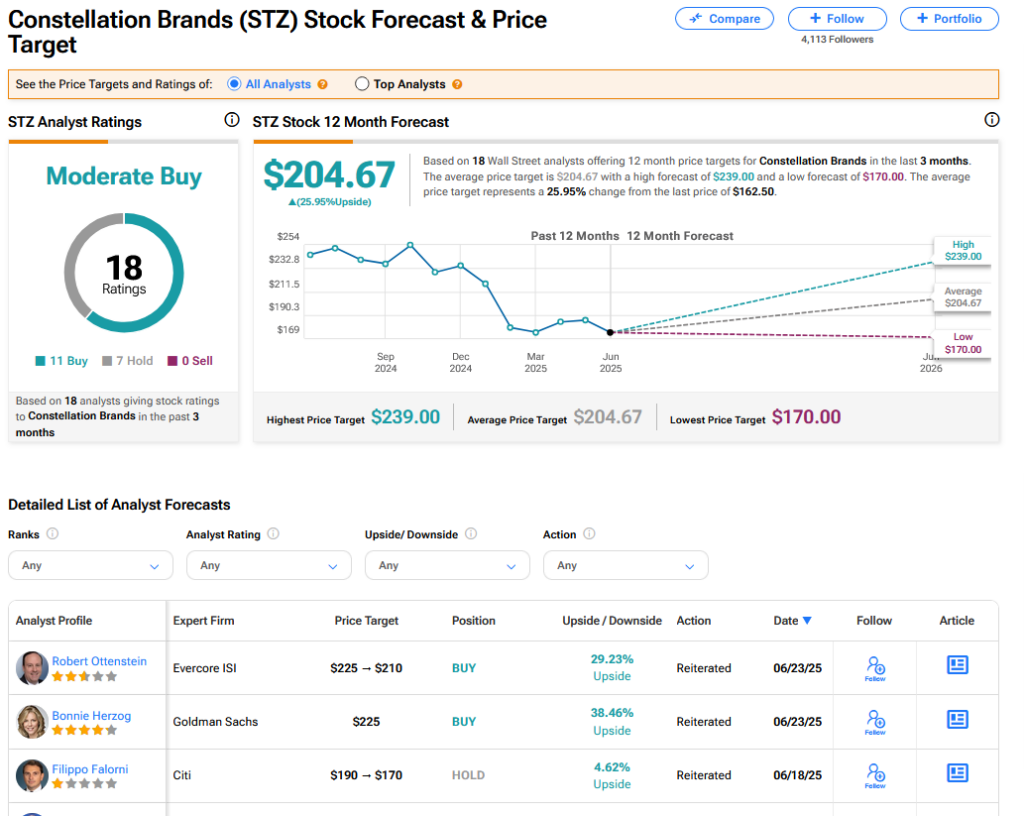

On TipRanks, STZ has a Moderate Buy consensus based on 11 Buy and 7 Hold ratings. Its highest price target is $239. STZ stock’s consensus price target is $204.67 implying a 25.95% upside.