Concerned shareholder Adam Arviv, through his fund KAOS Capital Ltd., announced Thursday that he intends to nominate five new independent directors at HEXO (TSE: HEXO) (NASDAQ: HEXO).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The goal is to replace the majority of the former incumbent HEXO board members and to redress the disappointing performance of the underperforming company. HEXO is a Canadian cannabis company focused on smoke-free and traditional cannabis products.

Severe Financial Distress

Arviv, who currently owns a roughly 2% stake in HEXO, has fought a battle with the cannabis company’s management over the past few months since the company’s August 2021 acquisition of licensed producer Redecan.

Arviv alleges that former Chairman of the Board, Dr. Michael Munzar, and former CEO, Sebastien St-Louis, deceived the Redecan investor group and destroyed shareholder value by carrying out a number of destructive financings and that the incumbent board, led by current chairman John Bell and director Vincent Chiara, was grossly negligent in approving these transactions.

HEXO’s Share Price Sinks Below a Dollar

As of the date of Arviv’s letter, HEXO common stock was trading at a 52-week low of C$0.58, down from a high of C$14, within one year.

The departure of Mr. St-Louis, which was effective immediately on October 18, 2021, was not enough to halt the steep decline in share value, with HEXO shares having fallen more than 50% since that day.

Arviv will submit the names of five independent candidates to replace the majority of the current members of the board at the next annual and special meeting of shareholders scheduled for March 8, 2022.

Wall Street’s Take

On January 28, Jefferies analyst Own Bennett upgraded HEXO to Hold from Sell and set a C$0.67 price target. This implies 20% downside potential.

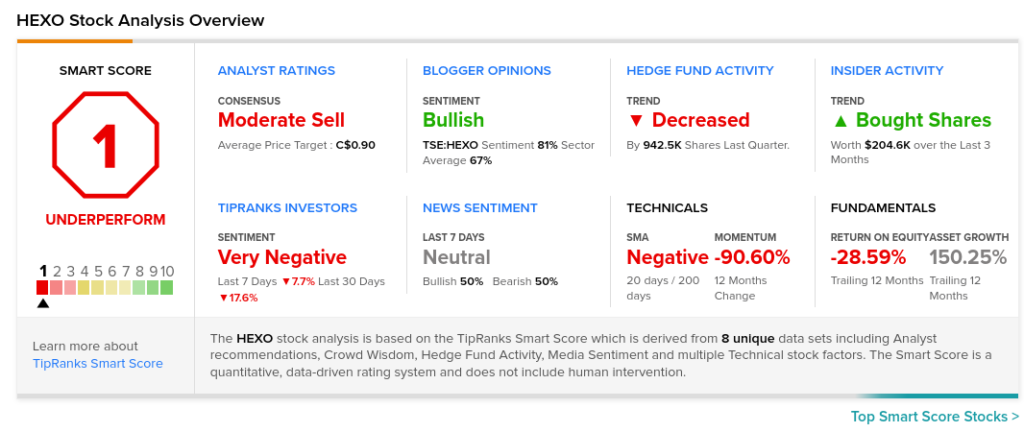

The consensus among analysts is that HEXO is a Moderate Sell based on three Holds and two Sells.

The average HEXO price target of C$0.90 implies 8.5% upside potential to current levels.

TipRanks’ Smart Score Rating

HEXO scores a 1 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to underperform the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

High Tide Revenue Rises 118% in FY 2021

Fire & Flower Closes Pineapple Express Acquisition

Curaleaf Closes Bloom Dispensaries Acquisition