The former chief of Honeywell International (HON), David Cote, is embarking on a new buying spree. His company, CompoSecure (CMPO), plans to buy Husky Technologies, a maker of injection-molding machines, for about $5 billion, including debt. The deal is expected to be announced soon, according to a report by the Wall Street Journal.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cote, together with former Goldman Sachs (GS) banker Tom Knott, controls CompoSecure through their firm Resolute Holdings. The group bought a majority stake in CompoSecure last year to turn it into a platform for larger deals. CompoSecure, known for its metal credit cards, is valued at more than $2 billion.

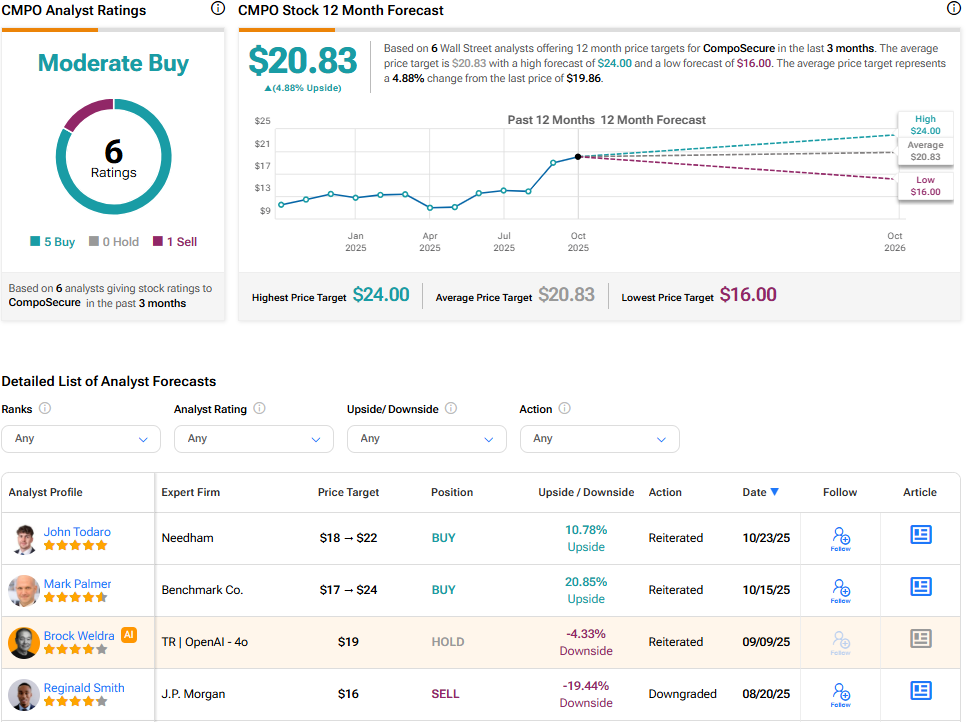

Meanwhile, CMPO shares climbed 1.48% in Friday’s trading, closing at $19.86. The stock is up 56% year-to-date.

How the Deal Is Structured

Husky makes machines that produce plastic parts for packaging, medical products, and consumer goods. The company was founded in 1953 and has changed hands several times. Platinum Equity bought it from Berkshire Partners and Omers Private Equity for about $4 billion in 2018.

The Husky deal will be partly funded through a $2 billion private investment in public equity, or PIPE, priced at $18.50 per CompoSecure share. Cote’s family office already has $1.1 billion invested in CompoSecure and will roll that into the transaction. Platinum Equity, which currently owns Husky, will retain a little under 20% of the new combined company.

Cote’s Bigger Plan

This purchase is expected to be only the start. Cote and Knott aim to buy and merge several industrial firms to form what some call a “new Honeywell.” The idea is to combine mature but profitable companies that were previously backed by private equity firms.

The plan echoes Cote’s history. As Honeywell’s CEO from 2002 to 2017, he led a major turnaround that raised the company’s value and reputation. He later partnered with Goldman Sachs to acquire Vertiv Holdings (VRT), a data center equipment maker now worth more than $70 billion.

With Husky, CompoSecure, and Resolute Holdings, Cote is setting up a structure that mixes public-company access to capital with the focus and speed of private investment. If it works, it could become a new model for industrial roll-ups in the public markets.

Is CompoSecure a Good Stock to Buy?

Turning to the Street’s analyst, CompoSecure boasts a Moderate Buy consensus rating, with an average CMPO stock price target of $20.83. This implies a 4.88% upside from the current price.