Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

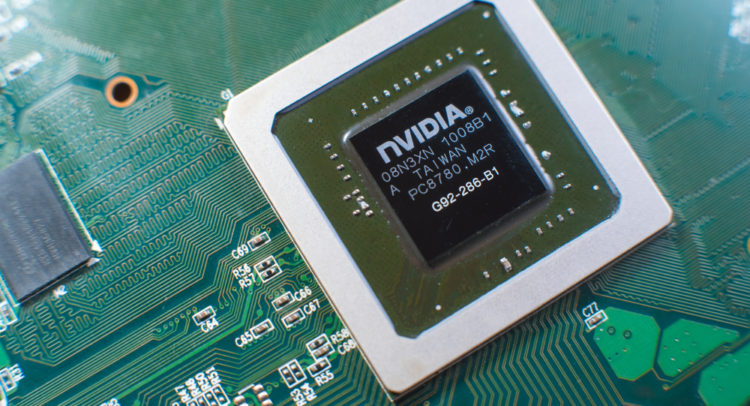

Randolph Co Inc, managed by Carter F. Randolph, recently executed a significant transaction involving Nvidia Corporation ((NVDA)). The hedge fund increased its position by 1,432 shares.

Spark’s Take on NVDA Stock

According to Spark, TipRanks’ AI Analyst, NVDA is a Outperform.

Nvidia’s strong financial performance and positive earnings call highlight its leadership in the semiconductor industry, driven by robust growth in AI and data center segments. Technical indicators suggest a strong bullish trend, although valuation concerns due to a high P/E ratio and overbought signals may pose risks. The strategic focus on AI offsets geopolitical challenges, supporting a positive outlook.

To see Spark’s full report on NVDA stock, click here.

More about Nvidia Corporation

YTD Price Performance: 27.63%

Average Trading Volume: 205,261,389

Current Market Cap: $4165.1B