China Sunsine Chemical Holdings Ltd. (DE:CHMN) has released an update.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

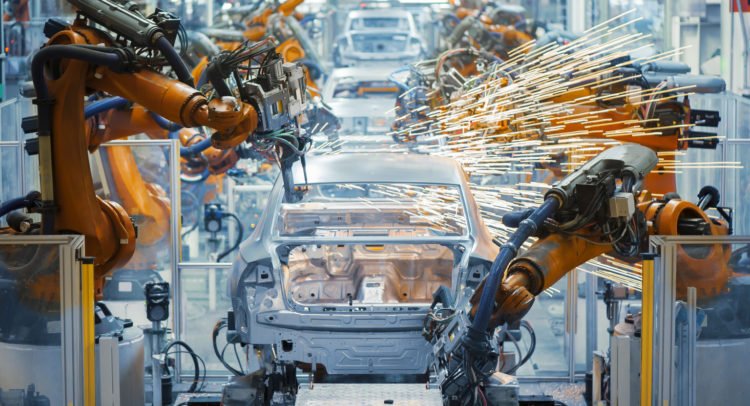

China Sunsine Chemical Holdings Ltd. reported an 8% increase in product sales volume in Q1 2024 compared to Q1 2023, despite a slight decrease in sales revenue due to lower average selling prices driven by reduced raw material costs and a flexible pricing strategy. The company’s gross profit margin improved, and net profit rose to RMB 85 million, amidst a 10.6% increase in China’s automaker sales, with new energy vehicles making up 31.1% of the total. Facing an intensifying competitive landscape and global economic challenges, China Sunsine remains committed to its ‘Sales and Production Equilibrium’ strategy and is confident in its market leadership and profitability for the upcoming year.

For further insights into DE:CHMN stock, check out TipRanks’ Stock Analysis page.