Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

China Sunsine Chemical Holdings Ltd. ( (SG:QES) ) just unveiled an announcement.

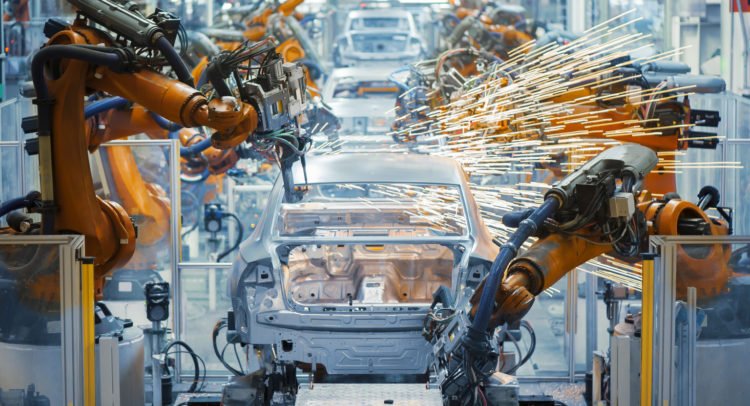

In the first quarter of 2025, China Sunsine Chemical Holdings Ltd. reported a slight increase in sales volume but a marginal decrease in sales revenue due to lower average selling prices, despite a 27% rise in net profit. The company faces intense competition in the Chinese rubber chemicals industry and challenges from global economic uncertainties, yet it remains committed to its strategy of ‘Sales and Production Equilibrium’ and enhancing internal efficiency. The company is also progressing with its capacity expansion plans, with a trial run of its Phase 2 IS project underway, expected to commence commercial production by the end of 2025.

More about China Sunsine Chemical Holdings Ltd.

China Sunsine Chemical Holdings Ltd. operates in the chemical industry, focusing primarily on rubber chemicals. The company is involved in the production and sale of products used in the automotive sector, with a strategic emphasis on flexible pricing and market expansion to maintain competitiveness in a challenging market.

YTD Price Performance: 18.18%

Average Trading Volume: 611,030

Technical Sentiment Signal: Sell

Current Market Cap: S$504.7M

For detailed information about QES stock, go to TipRanks’ Stock Analysis page.