Commercial Metals (CMC) reported stronger-than-expected fiscal Q3 results, significantly topping both earnings and revenue estimates, driven by robust performance across all key geographies.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, despite the beat, shares of the company that engages in the manufacture, recycling, and marketing of steel and metal products dropped 4.9% on June 16.

Q3 Beat

Notably, adjusted earnings of $2.61 per share more than doubled year-over-year and massively beat analysts’ expectations of $1.85 per share. The company reported earnings of $1.04 per share for the prior-year period.

Furthermore, revenues gained 36.2% year-over-year to $2.52 billion and exceeded consensus estimates of $2.32 billion.

CEO’s Comments

Speaking on the recently-completed Tensar acquisition, Commercial Metals CEO, Barbara R. Smith, commented, “Seeing the early results of the teams working together has only further reinforced our confidence in the strategic merits of this transaction and the potential for meaningful commercial synergies. With the onboarding of Tensar, CMC has added a highly attractive new growth platform and is creating a valuable and unique portfolio of solutions for existing and new markets.”

Wall Street’s Take

Following the upbeat results, Credit Suisse analyst Curt Woodworth increased the price target on Commercial Metals Company to $39 from $37 and reiterated a Hold rating.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on three Buys and two Holds. At the time of writing, the average Commercial Metals Company price target was $44.86, which implies 26.54% upside potential to current levels.

Investors Weigh In

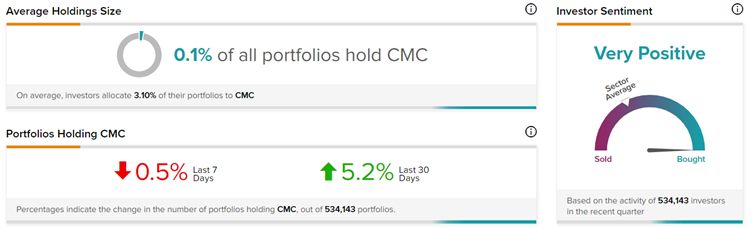

At the time of writing, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Commercial Metals, with 5.2% of investors increasing their exposure to CMC stock over the past 30 days.

Conclusion

Shares of CMC have gained over 17% in the past 12 months, handsomely beating the struggling and loss-making benchmark indices.

CMC’s management remains confident about continuing robust demand for each of CMC’s major product lines, driven by favorable market conditions and backed by historically high levels of contract backlog.

Positive management commentary as well as investor sentiments bode well for the stock in the long run.