Amazon (AMZN) may be best known for revolutionizing e-commerce. However, it’s the company’s cloud division, Amazon Web Services (AWS), that has quietly become its most powerful growth engine. As cloud adoption surges across industries, AWS continues to deliver robust margins and steady revenue growth, playing a critical role in Amazon’s broader business success.

Key Metrics for Amazon’s AWS

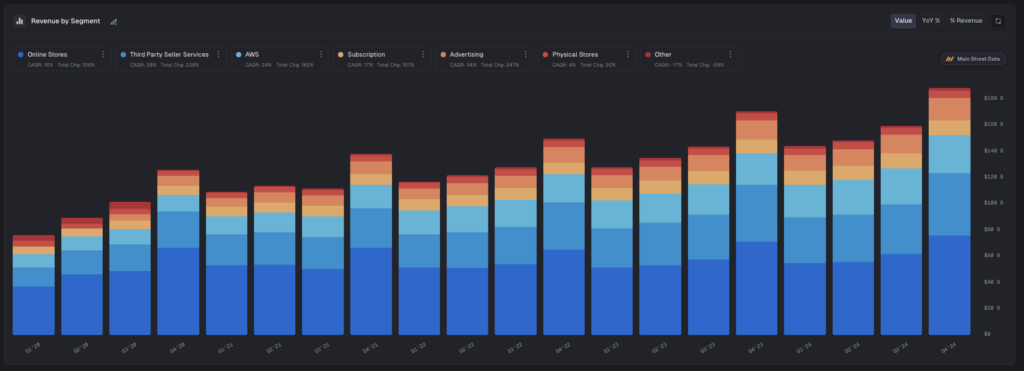

According to Main Street Data, AWS generated revenue of $28.8 billion in Q4 2024, marking a growth of 19% year-over-year. For the full year also, AWS segment sales climbed 19%, reaching a total of $107.6 billion.

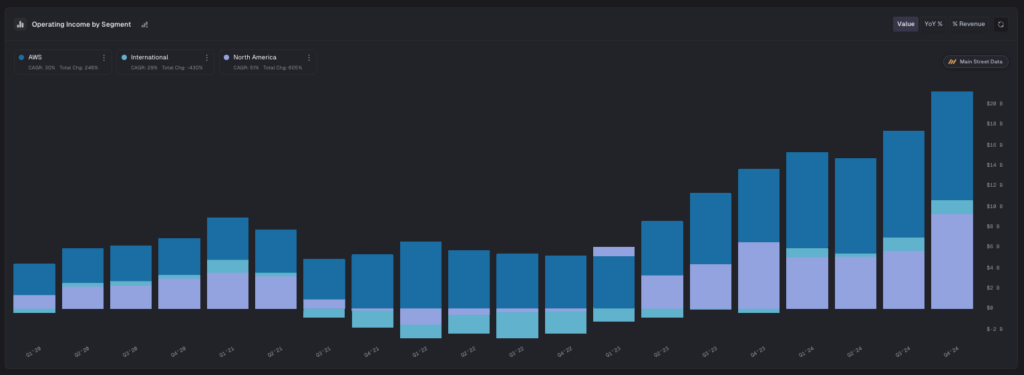

Meanwhile, AWS posted an operating income of $10.6 billion, up from $7.2 billion in Q4 2023.

A standout metric for AWS was its operating margin, which came in at 36.9% in Q4, significantly outperforming Amazon’s North America and International segments. This also marked a jump of over 20% compared to the same period last year.

When it comes to global cloud market share, AWS held onto its long-standing lead in Q4 2024. According to new data from Synergy Research Group, AWS retained its position as the global cloud market leader in Q4 2024, capturing 30% of the $91 billion market. Microsoft (MSFT) followed with a 21% share, while Google (GOOGL) Cloud secured third place with 12%.

Overall, AWS closed Q4 2024 on a strong note, delivering impressive top-line growth, improved profitability, and standout margins. The cloud unit not only led Amazon’s business segments in performance but also underscored its critical role in the company’s overall growth story.

What Lies Ahead for AWS?

Looking ahead, AWS is doubling down on artificial intelligence (AI) and machine learning (ML) to maintain its leadership in the cloud computing market. In 2025, AWS is investing heavily in the development of its proprietary Trainium 2 chips and the ambitious Project Rainier. Notably, Project Rainier is an ultracluster AI supercomputer that could become one of the largest AI supercomputers globally by 2025. It will support Anthropic, an Amazon-backed AI startup, and aims to challenge Nvidia’s (NVDA) dominance in AI model training.

Overall, Amazon plans to allocate $100 billion in capital expenditures for 2025, with the majority focused on AI advancements for AWS.

Is Amazon a Buy or Sell Right Now?

Given AWS’s strong performance, it’s no surprise that analysts are mostly optimistic about Amazon’s stock. However, in the short term, there is some caution largely influenced by weakened consumer demand amid ongoing macroeconomic challenges.

According to TipRanks, AMZN stock carries a Strong Buy rating from analysts based on 45 Buys and one Hold assigned in the last three months. At $251.8, Amazon’s share price forecast implies an upside of 52% from current levels.